INP-WealthPk

Shams ul Nisa

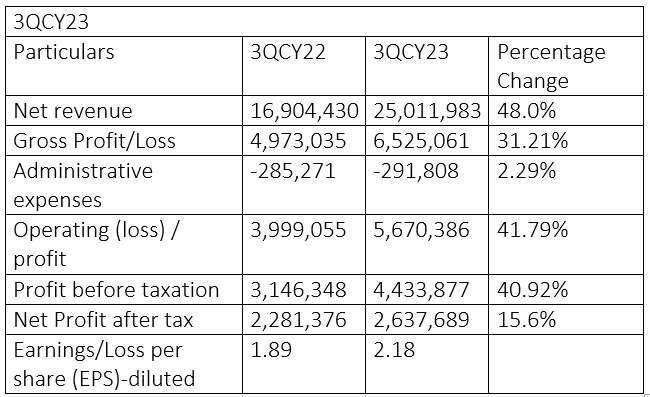

Engro Polymer & Chemicals Limited (EPCL) achieved net revenue of Rs25.01 million in the third quarter (July-September) of the ongoing calendar year 2023 (3QCY23) compared to Rs16.9 million recorded in the same period last year, thus posting a hefty increase of 48%. This was because of an increase in sales volume. The profit-after-tax expanded by 15.6% to Rs2.6 million in 3QCY23 despite unstable financial circumstances, sharply rising oil and fuel prices, soaring inflation, and volatile currency rates.

On the expense side, EPCL's administrative expenses expanded slightly by 2.29% to Rs291,808 in 3QCY23 compared to Rs285,271 in 3QCY22. The primary operations of the firm are the production and commercialisation of poly vinyl chloride, vinyl chloride monomer and caustic soda. Additionally, the company provides Engro Fertilizers Limited with excess electricity generated from its power plants.

![]()

Operating profit stood at Rs5.67 million in 3QCY23, 41.79% higher than Rs3.99 million in the same period last year. Profit-before-taxation climbed to Rs4.43 million in 3QCY23 from Rs3.14 million in 3QCY22, constituting a significant growth of 40.92%. Diluted earnings per share were recorded at Rs2.18 in 3QCY23 compared to Rs1.89 in the same period last year.

Nine-month analysis

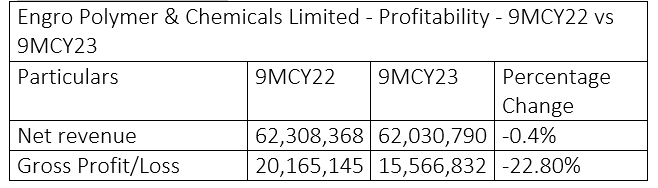

At the end of 9MCY23, the company's net revenue reduced marginally by 0.4% to Rs62.03 million. Gross profit stood at Rs15.56 million in 9MCY23 compared to Rs20.16 million in 9MCY22, posting a decline of 22.80%. Whereas, administrative expenses expanded by 13.44% in 9MCY23. Additionally, the operating profit plummeted by 20.59% and profit-before-tax went down by 35.43% in 9MCY23. The net profitability contracted to Rs5.47 million in 9MCY23 compared to Rs9.34 million in 9MCY22, depicting a decline of 41.4%. Diluted earnings per share reduced to Rs4.53 in 9MCY23 from Rs7.73 in the same period last year.

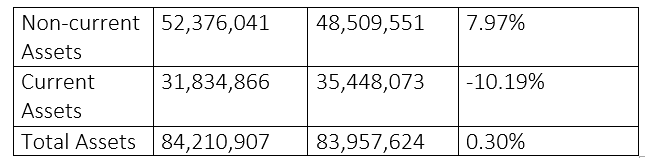

Assets analysis

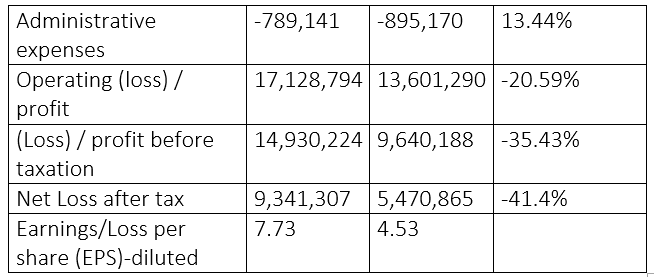

The company's non-current assets increased by 7.97% between December 2022 and September 2023 from Rs48.509 million to R52.37 million. This shows that the business has made investments in long-term assets, including real estate, machinery, and intangible assets. However, given that current assets saw a notable reduction of 10.19%, a considerable change was evident. A decrease in short-term assets, such as trade receivables and short-term investments, is indicated by this dip. As a consequence, the total assets grew marginally by 0.30% from Rs83.957 million in December 2022 to Rs84.21 million in September 2023.

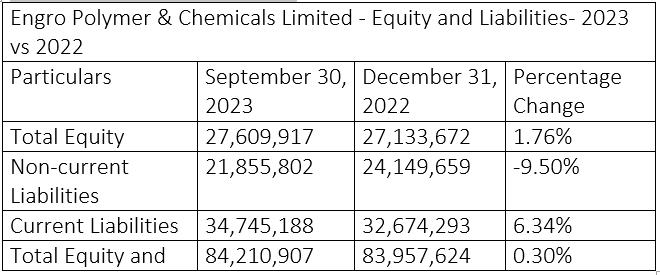

Equity and liabilities analysis

![]()

The company's total equity increased by 1.76% from Rs27.13 million in December 2022 to Rs27.6 million in September 2016. Non-current liabilities, on the other hand, dropped by 9.50% from Rs24.14 million to Rs21.85 million in September 2023. Conversely, the company's current liabilities climbed significantly, rising from Rs32.67 million in December 2022 to Rs34.74 million in September 2023, or 6.34%, as a result of higher financial commitments to fund working capital. As a result, the total equity and liabilities increased by 0.30%.

Credit: INP-WealthPk