INP-WealthPk

Shams ul Nisa

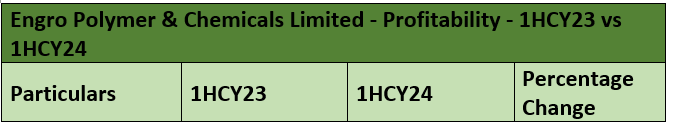

Engro Polymer & Chemicals Limited (EPCL) posted a net loss of Rs1.2 billion in the first half of 2024 (1HCY24), registering a formidable decline of 144.6% compared to a net profit of Rs2.8 billion over the same period of CY23.

The company’s revenue dropped 7.1% to Rs34.38 billion in 1HCY24 from Rs37.02 billion in 1HCY23, reports WealthPK. The company attributed this decline to lower volumetric sales and decreasing global Poly Vinyl Chloride (PVC) prices. The PVC pricing was affected by weak market fundamentals, including demand, increased monomer prices, and higher energy costs. Additionally, the prolonged winter season and early monsoon season further stifled the demand. As a result, the gross profit also plunged 73.42% in 1HCY24, indicating significant cost pressures. Ethylene prices remained muted due to slower demand and supply improvement during the period under review.

Increased administrative expenses further strained the operating performance by 25.45%, leading to a steep decline of 80.84% in operating profit. Furthermore, the company incurred a loss-before-tax of Rs2.3 billion in 1HCY24 compared to a profit-before-tax of Rs4.9 billion in 1HCY23 due to lower core delta and volumetric sales. Likewise, the net losses led to the company suffering a loss per share of Rs1.61 in 1HCY24 compared to earnings per share of Rs2.34 in 1HCY23, indicating a significant erosion of shareholder value.

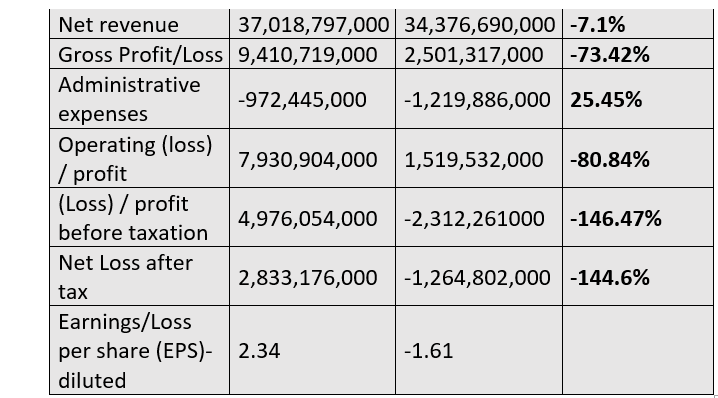

Profitability ratios (2019-23)

The company’s gross profit margin reached a peak of 34.33% in 2021, indicating effective cost management and pricing strategies. However, the decreases in 2022 and 2023 suggest challenges in maintaining these margins, possibly due to rising raw material costs, increased competition or market pressures.

Likewise, the net profit margin followed a similar pattern, reaching a high of 21.51% in 2021 before declining to 10.99% in 2023. It stood at 14.24% in 2022 and 10.99% in 2023.

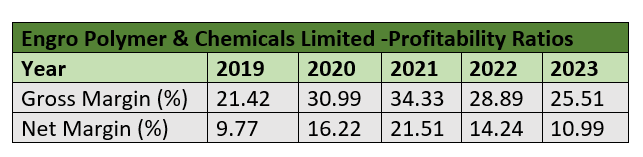

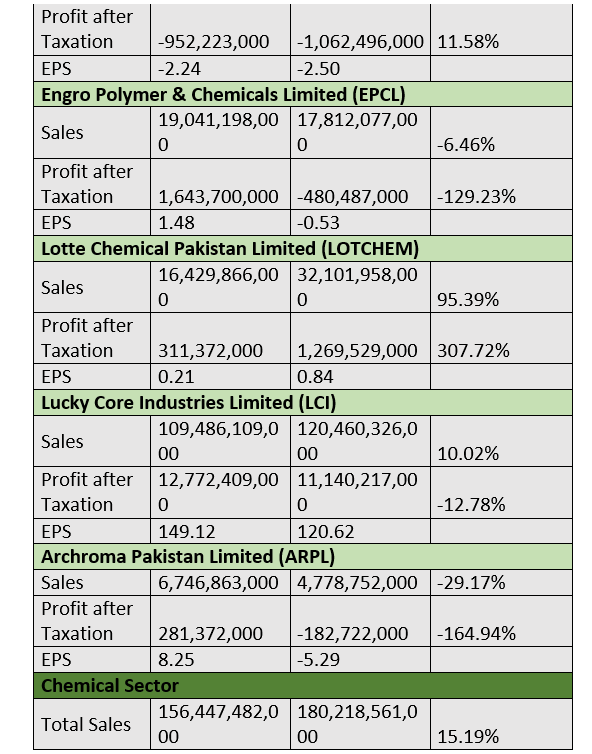

Chemical sector

The chemical sector posted a 15.19% increase in total sales during the March-June period of 2024, but the net profit declined by 23.99% as compared to the same period of 2023. This disparity highlights challenges in converting sales growth into profits, possibly due to rising costs, increased competition, and operational inefficiencies.

![]()

Among the companies analysed, Lotte Chemical Pakistan Limited emerged as the highest performer during this period, with a remarkable 95.39% increase in sales and a substantial profit increase of 307.72%. This performance demonstrates the company’s ability to effectively manage operations and capitalise on market demand, positioning it as a leader in profitability within the sector. On the other hand, EPCL faced significant challenges, with a 6.46% decrease in sales and a substantial net loss of 129.23%. Similarly, Archroma Pakistan Limited also struggled with a 29.17% decrease in sales and a huge loss-after-taxation of 164.9% during the period under review.

Future outlook

EPCL expects prices of its major segments, PVC and ethylene, to stay volatile due to dampened demand. The company’s key focus areas for the coming quarters include ensuring safe operations, completing projects within timelines and navigating the challenging economic situation.

Company profile

EPCL is a subsidiary of Engro Corporation Limited. Its primary operations are to produce and distribute caustic soda, vinyl chloride monomer and polyvinyl chloride.

Credit: INP-WealthPk