INP-WealthPk

Hifsa Raja

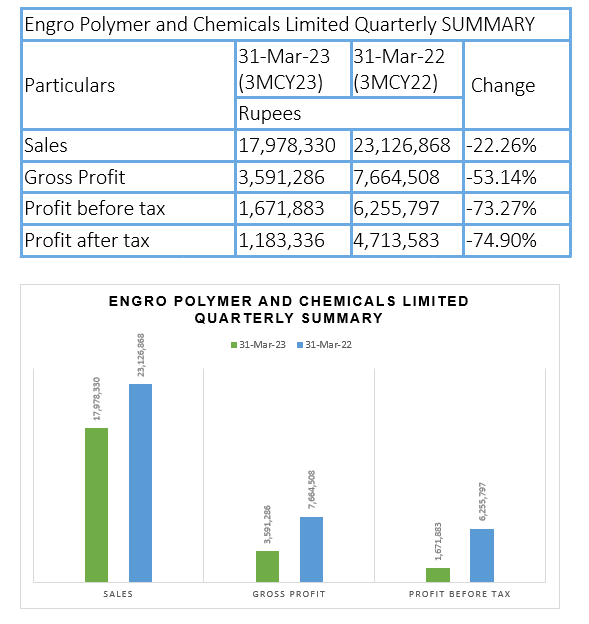

Engro Polymer and Chemicals Limited’s sales revenue decreased 22% to Rs17 million in the first three months of the calendar year 2023 (3MCY23) from Rs23 million over the corresponding period of the previous year, reports WealthPK. Similarly, the company’s gross profit decreased 53% to Rs3.5 million in 3MCY23 from Rs7.6 million in 3MCY22. The profit-before-taxation also plunged 73% to Rs1.6 million in 3MCY23 from Rs6.2 million in 3MCY22.

Likewise, the profit-after-taxation also declined 74% to Rs1.18 million in 3MCY23 from a post-tax profit of Rs4.71 million in 3MCY22. Overall, Engro Polymer and Chemicals faced challenges in terms of sales growth and gross profit, which is a cause for concern for the company. Additionally, the decline in post-tax profit indicates a need for the company to take proactive measures to enhance its financial performance and strategic approach. Addressing these issues will be crucial for the company's future success and sustainability.

2022 summary

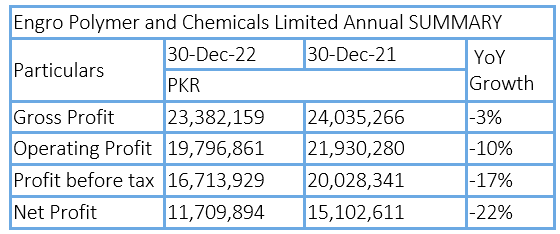

Engro Polymer and Chemicals gross profit decreased 3% to Rs23 million in calendar year 2022 from Rs24 million in the previous year. This shows that despite several difficulties, the business managed to control its expenditures and retain sales to some extent.

Similarly, the company’s operating profit decreased by 10% to Rs19 million in CY22 from Rs21 million in CY21. This shows the business was unable to increase income from its activities while reducing costs. The profit-before-taxation declined 17% to Rs16 million in CY22 from a profit-before-tax of Rs20 million in CY21. The profit-after-taxation also plunged 22% to Rs11.7 million in CY22 from a post-tax profit of Rs15.1 million in CY21.

Industry comparison

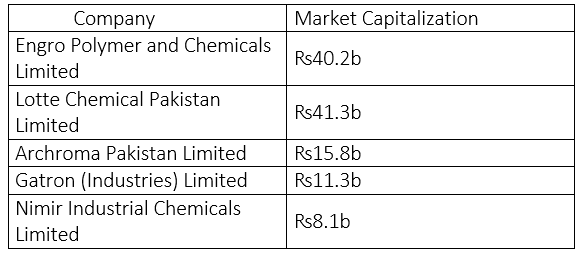

Engro Polymer and Chemicals Limited’s competitors include Lotte Chemical Pakistan Limited, Archroma Pakistan Limited, Gatron (Industries) Limited and Nimir Industrial Chemicals Limited.

Engro Polymer and Chemicals Limited has a market capitalisation of ₨40.2 billion, which is the second-highest among its competitors. Lotte Chemical Pakistan Limited has the highest market capitalisation of ₨41.2 billion and Nimir Industrial Chemicals Limited has the lowest capitalisation of Rs8.1 billion.

About the company

Engro Polymer and Chemicals Limited was incorporated in Pakistan in 1997 under the now repealed Companies Ordinance, 1984. The company is a subsidiary of Engro Corporation Limited, which is a subsidiary of Dawood Hercules Corporation Limited. The company’s principal activity is to manufacture, market and sell Poly Vinyl Chloride (PVC), Vinyl Chloride Monomer (VCM), caustic soda and other related chemicals. It also supplies the surplus power generated from its power plants to Engro Fertilizers Limited.

Credit: Independent News Pakistan-WealthPk