INP-WealthPk

Ayesha Mudassar

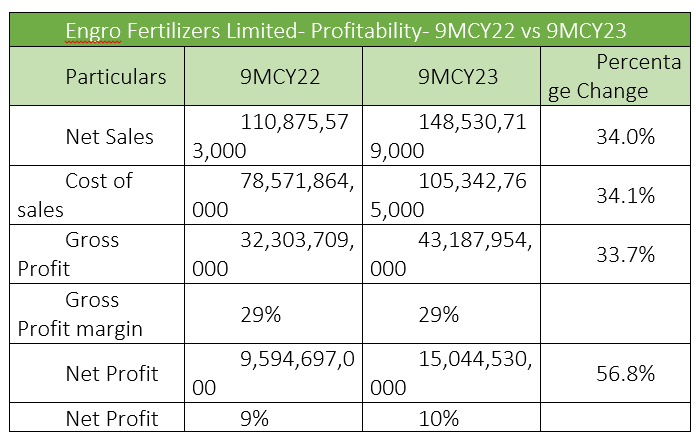

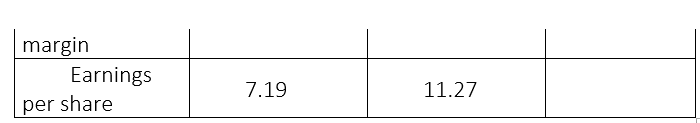

The sales of Engro Fertilizers Limited (EFERT) grew by 34%, gross profit by 33.7%, and net profit by 56.8%, respectively, in the first nine months (January-September) of the ongoing calendar year 2023 (9MCY23) compared to the corresponding period of the previous year, WealthPK reports. In 9MCY23, the company achieved net sales of Rs148.5 billion and gross profit of Rs43.1 billion. The net profit stood at Rs15.04 billion compared to Rs9.5 billion in the corresponding period last year, resulting in the earnings per share (EPS) of Rs11.27 versus Rs7.19 in the same period last year.

Quarterly analysis

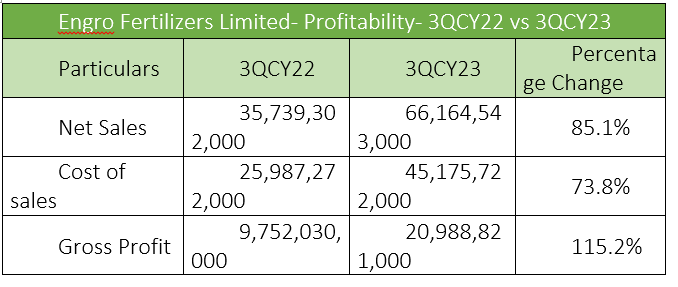

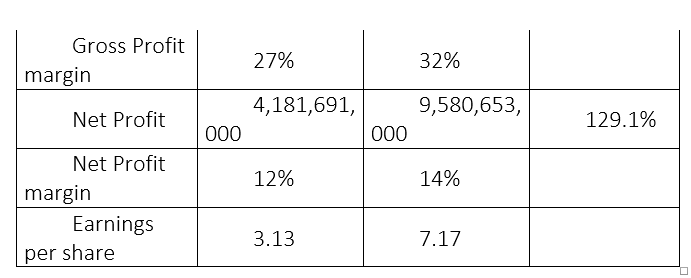

In comparison to the third quarter of 2022, Engro Fertilizers increased its revenues from Rs35.7 billion to Rs66.1 billion in 3QCY23, up 85.1%. The gross profit of Rs9.7 billion recorded in 3QCY22 jumped by 115.2% in 3QCY23. The company reported a net profit of Rs9.5 billion in 3QCY23, increasing by a whopping 129.1%. Gross profit margins in 3QCY23 settled at 32% compared to 27% previously, indicating that the company's cost of goods sold increased relative to its sales. The net profit margin increased from 12% in 3QCY22 to 14% in 3QCY23, which portrays that the company managed to control its expenses more effectively, leading to a higher margin of profit.

Company profile

Engro Fertilizers is a public company incorporated in Pakistan on June 29, 2009 as a wholly-owned subsidiary of Engro Corporation Limited. The company is engaged in the manufacturing, purchasing and marketing of fertilizers, seeds, and pesticides, and is also offering logistics services. Engro Fertilizers is listed on the Pakistan Stock Exchange under the symbol "EFERT". It is the second-largest company registered in the fertilizer sector, with a market capitalisation of Rs148.1 billion. The company anticipates significant challenges arising from political dynamics, inflationary pressures and currency fluctuations. However, Engro Fertilisers is determined to work closely with the industry and the government of Pakistan to overcome these challenges to ensure the uninterrupted production of urea and the long-term food security of the country.

EFERT- historical performance

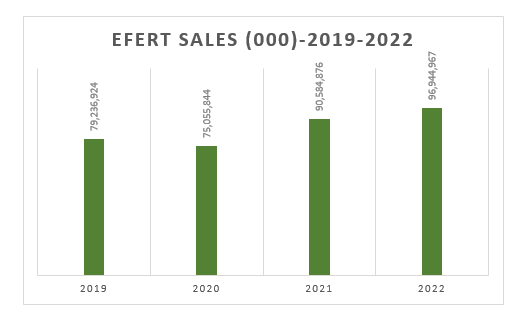

Historical analysis of EFERT sales shows that in the last four years, the company posted the highest revenues in 2022. The company had a single dip in sales in 2020. From sales of Rs79.2 billion in CY19, the company's revenue declined to Rs75 billion in CY20. However, EFERT posted Rs90.5 billion in sales in CY21 and Rs96 billion in CY22.

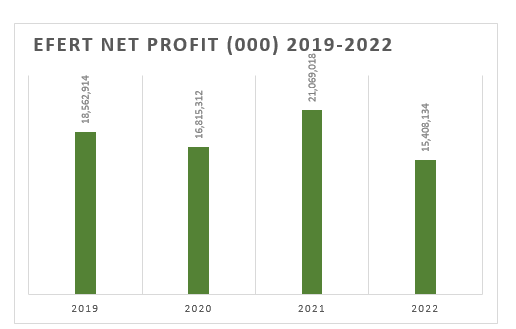

Concerning net profit, the fertilizer maker's historical performance fluctuated over the years. In the span of the last four years (2019-2022), the firm posted the highest net profit of Rs21 billion in 2021. The company posted a net profit of Rs18.5 billion in 2019, but experienced a dip in 2020 and settled at Rs16 billion. In 2021, EFERT posted a net profit of Rs21 billion, which dropped to Rs15.4 billion in 2022.

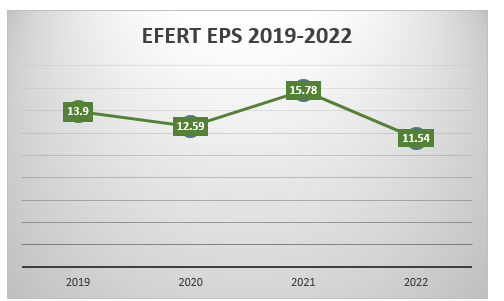

EFERT posted the highest four-year EPS in CY21. However, the company had two dips in EPS in CY20 and CY22.

Credit: INP-WealthPk