INP-WealthPk

Fakiha Tariq

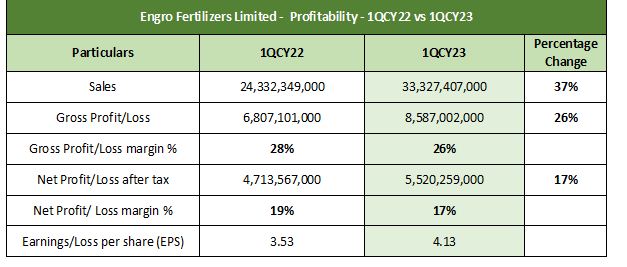

Sales of Engro Fertilizers Limited (EFERT)grew by 37%, gross profit by 26% and net profit by 17% in the first quarter (January-March) of the ongoing calendar year 2023 compared to the corresponding period of the previous year, WealthPK reports. In 1QCY23, the company postedrevenue of Rs33 billion and gross profit of Rs8.58 billion, thus coming up with agross profit ratio of 26%. The net profit stood at Rs5.52 billion and net profit ratio at 17% in 1QCY23. Earnings per share (EPS) stood at Rs4.13.

In comparison to the first quarter of 2022, Engro Fertilizers increased its revenues by 37% from Rs24 billion to Rs33 billion in 1QCY23. Likewise, the gross profit of Rs6.8 billion in 1QCY22 jumped by 26% in 1QCY23.The net profit stood at Rs4.71 billion in 1QCY22. EPS also increased from Rs3.53in 1QCY22 to Rs4.13 in 1QCY23. Engro Fertilizers is listed on the Pakistan Stock Exchange under the symbol of “EFERT”. It is the second-largest company registered in the fertilizer sector, with amarket capitalisation of Rs109.6 billion.

EFERT–Historical performance

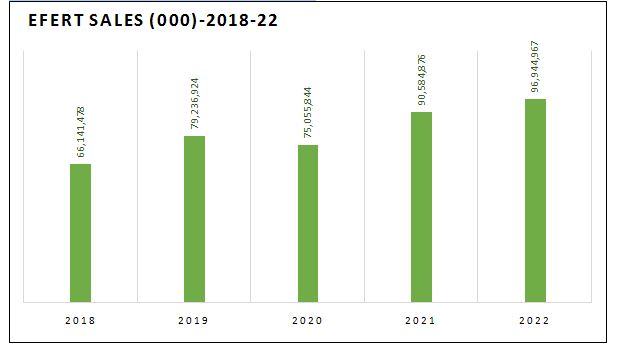

Historical analysis of EFERT sales shows that in the lastfive years, the company posted the highest annual revenues in 2022. The company had a single dip in sales in 2020. From sales of Rs66 billion inCY18, EFERT grew revenues to Rs79 billion in CY19. The company’s revenue declined to Rs75 billion in CY20. However, EFERT posted Rs90 billion sales in CY21 and Rs96 billion in CY22.

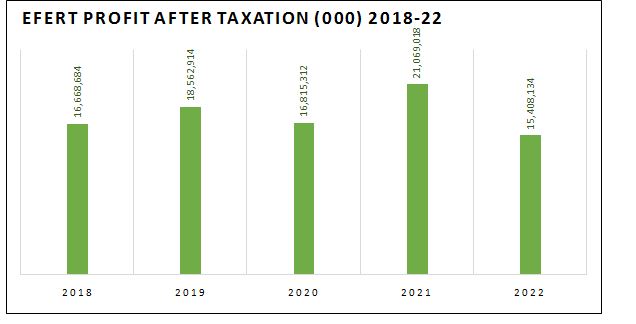

In terms of net profit, the fertilizer maker’s historical performance fluctuated over the years. Over the last five years (2018-2022), the firm posted the highest net profit of Rs21 billion in 2021.

The company posted a net profit of Rs16 billion in 2018 and further jacked it up to Rs18 billion in 2019. Net profit experienced a dip in 2020 and settled at Rs16 billion. In 2021, EFERT posted anet profit of Rs21 billion, which dropped to Rs15 billion in 2022.

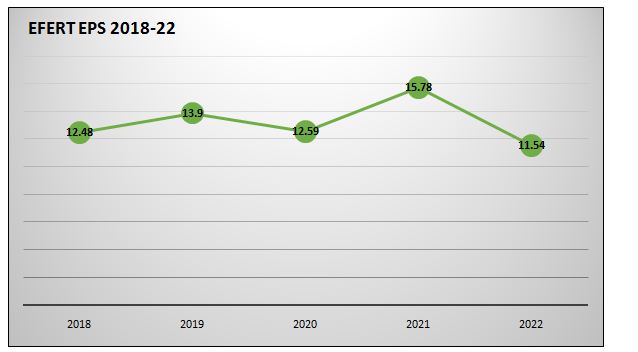

EFERT posted the highest five-year EPS in CY21. However, the company had two dips in EPS in CY18 and CY22.

Credit: INP-WealthPk