INP-WealthPk

Shams ul Nisa

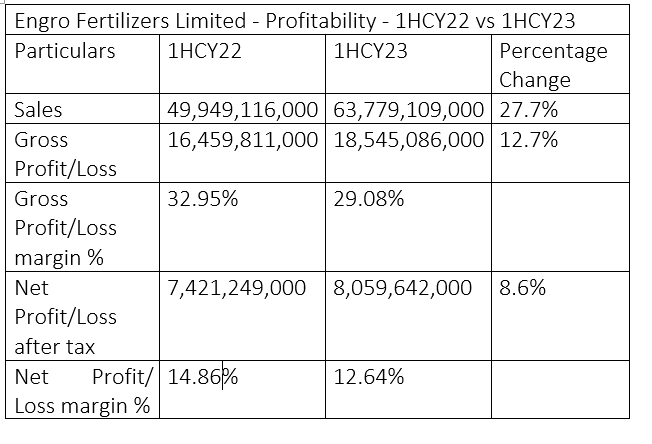

Engro Fertilizers Limited (EFERT) posted 27.7% growth in sales in the first half of the ongoing calendar year 2023 compared to the corresponding period of the previous year, WealthPK reports. In 1HCY23, the company posted revenue of Rs63.7 billion compared to Rs49.9 billion in 1HCY22. The company’s gross profit increased to Rs18.5 billion in 1HCY23 from Rs16.4 billion in 1HCY22, thus posting growth of 12.7%. The gross profit ratio in 1HCY23 stood at 29.08% compared to 32.95% in 1HCY22.

Likewise, EFERT’s net profit increased 8.6% to Rs8.05 billion in 1HCY23 from Rs7.4 billion in 1HCY22. The net ratio stood at 12.64% in 1HCY23 compared to 14.86% in 1HCY22. Earnings per share (EPS) increased to Rs6.04 from Rs5.56 in 1HCY22.

1QCY23 compared with 1QCY22

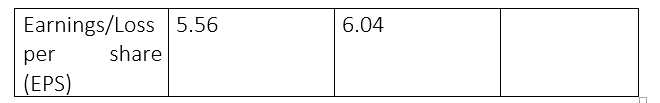

In the first quarter of 2023, sales stood at Rs33.3 billion compared to Rs24.3 billion in 1QCY22, recording a growth of 37%. Similarly, the company posted 26% growth in gross profit, which jumped to Rs8.58 billion in 1QCY23 from Rs6.8 billion in 1QCY22.

The net profit stood at Rs5.52 billion compared to Rs4.7 billion in 1QCY22, thus achieving growth of 17% in 1QCY23.

EPS stood at Rs4.13 in 1QCY23 compared to Rs3.53 in the same period of the previous year.

2QCY22 compared with 2QCY23

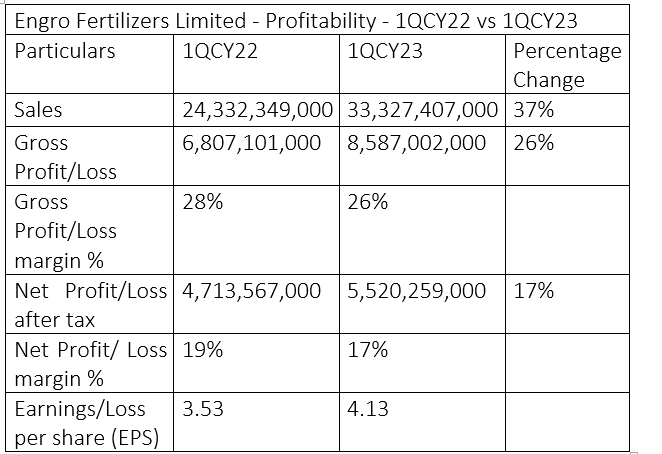

In 2QCY23, the company’s sales increased to Rs30.4 billion from Rs25.6 billion in 2QCY22, posting a 19% growth. The gross profit inched up to Rs9.9 billion in 2QCY23 from Rs9.6 billion in 2QCY22, thus achieving a paltry growth of 3% and a gross profit ratio of 33% on the total sales. The net profit, however, slightly dipped to Rs2.5 billion in 2QCY23 from Rs2.7 billion in 2QCY22, showing negative growth of 6%. The company recorded net profit ratio of 8% during this quarter. Similarly, the EPS stood at Rs1.9 in 2QCY23 compared to Rs2.03 in 2QCY22.

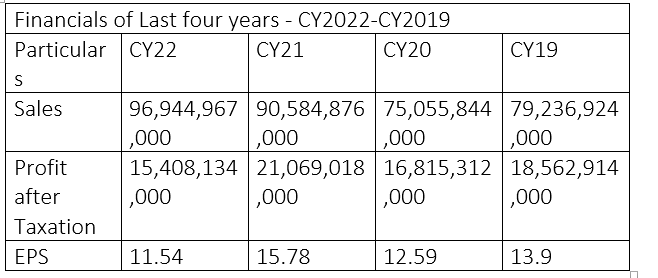

Analysis of last four year financials

The company’s sales have kept increasing since 2019. In CY19, sales stood at Rs79.2 billion, which grew to Rs96.9 billion in CY22. However, the net profit experienced uneven patterns over the years. The profit stood at Rs18.5 billion, Rs16.8 billion, Rs21 billion and Rs15.4 billion in CY19, CY20, CY21 and CY22, respectively. The highest profit was recorded in CY21 at Rs21.1 billion. EPS was recorded at Rs13.9, Rs12.59, Rs15.78 and Rs11.54 in CY19, CY20, CY21 and CY22, respectively.

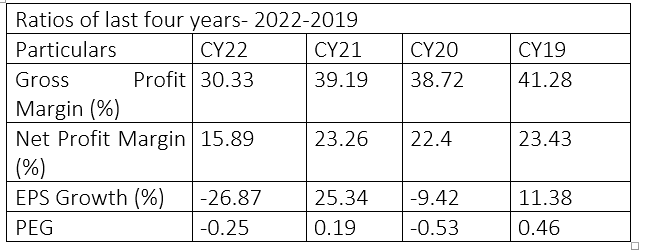

Ratio analysis of last four years

In the last four years. the gross profit margin was recorded the highest in CY19 at 41.28%, and the lowest in CY22 at 30.33%. Similarly, the net profit margin was the highest at 23.43% in CY19 and the lowest in CY22 at 15.89%. The highest EPS growth of 25.34% was recorded in CY21, and the lowest growth of -26.87 was noted in CY22. The price/earnings to growth ratio (PEG) was recorded -0.25, 0.19, -0.53 and 0.46 in CY22, CY21, CY20 and CY19, respectively.

Company profile

Engro Fertilizers Limited is a public company incorporated in Pakistan on June 29, 2009, as a wholly owned subsidiary of Engro Corporation Limited (the holding company). The company is involved in the manufacturing, purchasing and marketing of fertilisers, seeds and pesticides and providing logistics services. The company is divided into five business units: e-logistics, speciality fertilizer business, crop science division, and urea and phosphates. The firm sells a variety of product lines under the brand names Engro Urea, Engro Ammonium Sulphate, Engro DAP, Engro NP, Engro Envy, Engro Zarkhez, Engro MOP and Zingro.

Credit: INP-WealthPk