INP-WealthPk

Ayesha Mudassar

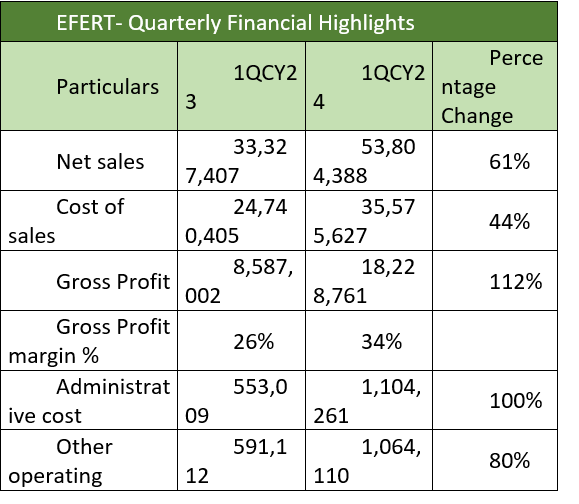

The net sales of Engro Fertilizers Limited (EFERT) grew by 61%, gross profit by 112%, and net profit by 59% in the first quarter (January-March) of the ongoing calendar year 2024 compared to the corresponding period of the last calendar, WealthPK reports. In 1QCY24, the company made net sales of Rs53.8 billion and gross profit of Rs18.2 billion. The net profit stood at Rs8.7 billion compared to Rs5.5 billion in the corresponding period last year, resulting in the earnings per share (EPS) of Rs6.59 versus Rs4.13 in the same period of the previous year.

(Amounts in thousands except for earnings per share)

Going by the unconsolidated results, the company’s cost of sales rose by 44% year-on-year (YoY) to Rs35.5 billion compared to Rs24.7 billion in 1QCY23. On the expense side, the company saw a rise in administrative costs by 100% YoY and other expenses by 80% YoY to clock in at Rs 1.1 billion and Rs1.06 billion, respectively, during the period. The company’s finance cost contracted by 65% YoY and stood at Rs158.3 million compared to Rs457 million in 1QCY23. On the tax front, the company paid a significantly larger tax worth Rs5.01 billion against the Rs1.7 billion paid in the corresponding period of last year, a rise of 188% YoY.

Sectoral financials- 1QCY24

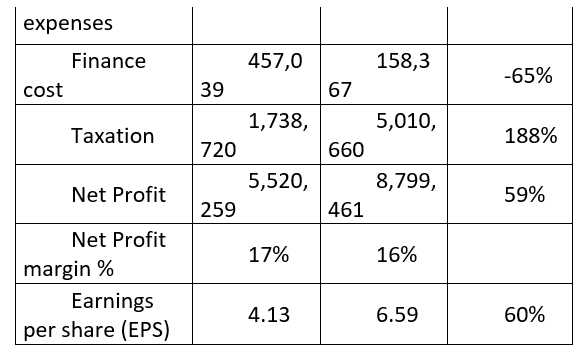

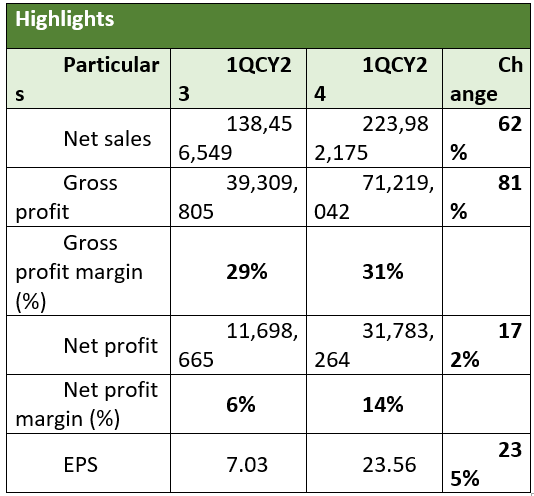

Pakistan's fertilizer companies jointly posted an 81% increase in gross profit, and 172% growth in net profit during 1QCY24 compared to the corresponding period of 2023. In 1QCY24, listed fertilizer firms collectively earned a gross profit of Rs71.2 billion and a net profit of Rs31.7 billion, rising by 31% and 14%, respectively. The substantial growth is primarily driven by higher production and sales volume of urea and diammonium phosphate (DAP) fertilizers.

![]()

(Amounts in thousands except for earnings per share)

As per the results available with WealthPK, the fertilizer sector’s net sales jumped to Rs223.9 billion in 1QCY24 from Rs138.4 billion in the same period of CY23, representing an increase of 62%. The fertilizer sector includes Engro Fertilizers Limited (EFERT), Fauji Fertilizers Company Limited (FFC), Fatima Fertilizer Company Limited (FATIMA), and Fauji Fertilizer Bin Qasim Limited (FFBL). EFERT with a market capitalisation of Rs211.1 billion leads its peers followed by FFC with a market cap of Rs177.7 billion. FATIMA and FFBL are the third and fourth placed with market caps of Rs103.1 billion and Rs42.7 billion, respectively.

Company profile

Engro Fertilizers Limited is a public company incorporated in Pakistan on June 29, 2009, as a wholly owned subsidiary of Engro Corporation Limited. The company is engaged in the manufacturing, purchasing, and marketing of fertilizers, seeds, and pesticides and offering logistics services. Engro Fertilizers is listed on the Pakistan Stock Exchange under the symbol "EFERT".

Near-term outlook

The fertilizer industry remains pivotal to the sustainable agricultural growth of the nation. The company continues to work closely with the industry and the government of Pakistan to ensure uninterrupted production of urea. To address the decline in gas pressure, EFERT and other fertilizer producers have agreed with Mari Petroleum Company Limited (MPCL) to invest in Pressure Enhancement Facilities (PEF) at MPCL's delivery node. The project is expected to have a significant capital outlay and will ensure sustained gas supplies to fertilizer manufacturers.

Credit: INP-WealthPk