INP-WealthPk

Ayesha Mudassar

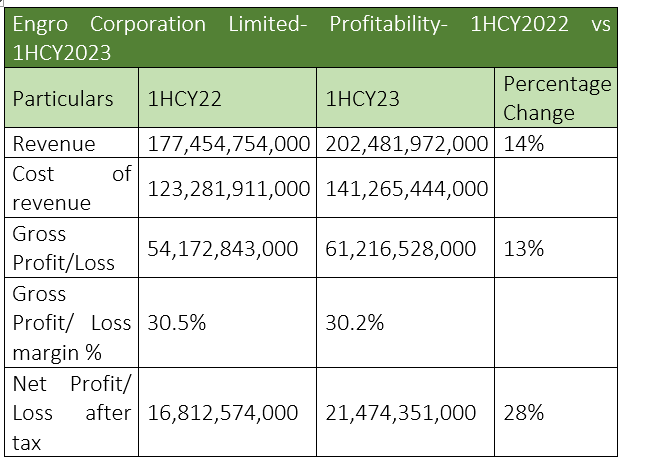

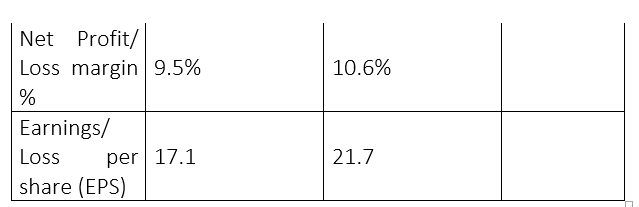

Revenues of Engro Corporation Limited (ENGRO) grew by 14%, gross profit by 13%, and net profit by 28% in the first half (January-June) of the ongoing calendar year 2023 (1HCY23) compared to the corresponding period of the previous year, WealthPK reports. As per the Consolidated Interim Statement, the company posted revenue of Rs202.4 billion and gross profit of Rs61.2 billion in 1HCY23. The net profit stood at Rs21.4 billion compared to Rs16.8 billion in the corresponding period last year, resulting in an earnings per share (EPS) of Rs21.7 versus Rs17.1 in the same period last year.

Gross margins in 1HCY23 settled at 30.2% compared to 30.5% in 1HCY22, indicating that the company’s cost of revenue increased relative to its sales. The net profit margin increased from 9.5% in 1HCY22 to 10.6% in 1HCY23, which portrays that the company managed to control its expenses more effectively, leading to a higher margin of profit.

Quarterly analysis

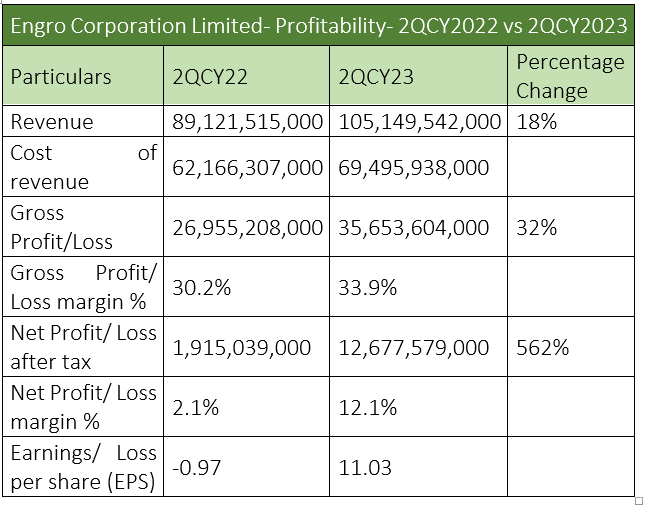

In comparison to the second quarter of 2022, Engro Corporation increased its revenues from Rs89.1 billion to Rs105.1 billion in 2QCY23, representing a change of 18%. The gross profit of Rs26.9 billion in 2QCY22 increased by 32% in 2QCY23. The company reported a net profit of Rs1.9 billion and Rs12.6 billion, respectively, in 2QCY22 and 2QCY23, which represents a significant improvement in profitability, with a percentage change of 562%. EPS in 2QCY22 was -Rs0.97, demonstrating a loss per share. However, in 2QCY23, the EPS improved significantly to Rs11.03, showing that the company generated a profit per share during this period.

Company profile

Registered on the Pakistan Stock Exchange (PSX) with the symbol “ENGRO”, the company is one of Pakistan’s largest conglomerates with a business portfolio spanning across four verticals, including food & agriculture, energy & related infrastructure, petrochemicals, and telecommunication infrastructure. The company anticipates significant challenges arising from political dynamics, inflationary pressures, and currency fluctuations. However, the Engro Corporation is determined to work closely with the relevant authorities to overcome these challenges to ensure the expansion of business operations across the four key verticals.

Historical performance

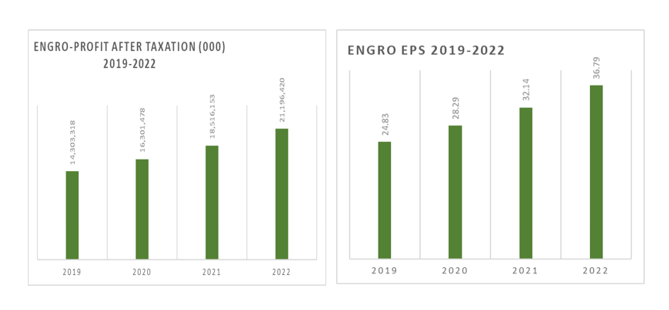

Historical analysis of ENGRO shows that in the last four years, its profit-after-tax (PAT) has kept increasing. The company posted the highest PAT in 2022 at Rs21.2 billion. ENGRO posted a PAT of Rs14.3 billion in 2019, Rs16.3 billion in 2020 and Rs18.5 billion in 2021. Furthermore, ENGRO posted the highest four-year EPS of Rs36.7 in CY22.

Credit: INP-WealthPk