INP-WealthPk

Shams ul Nisa

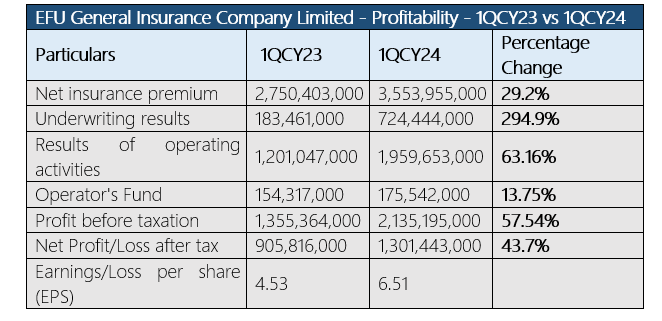

EFU General Insurance Company Limited posted a strong performance during the first quarter of the calendar year 2024 with a growth of 29.2% in net insurance premium and 43.7% in net profit compared to 1QCY23, reports WealthPK. The company earned a total net insurance premium of Rs3.55 billion in 1QCY24 by expanding its customer base and policy premiums. Efficient cost management and increased revenue during this period resulted in a total net profit of Rs1.30 billion compared to Rs905.8 million in the same period last year.

The underwriting results skyrocketed 294.9% to Rs724.4 million in 1QCY24, indicating highly profitable underwriting activities and improved risk management. The operating activities surged by 63.16%, clocking in at Rs1.9 billion against Rs1.2 billion in 1QCY23. The company managed to earn Rs175.5 million from window takaful operations (operator’s fund) during the review period.

At the end of 1QCY24, the insurance company registered a profit before taxation of Rs2.13 billion, 57.54% higher than Rs1.35 billion in 1QCY23. The first quarter exhibits strong financial performance, pointing at increased demand for insurance services and products of the company. The earnings per share improved to Rs6.51 in 1QCY24 compared to Rs4.53 in 1QCY23, showing increased profit on outstanding shares of common stocks.

Insurance sector – net profit

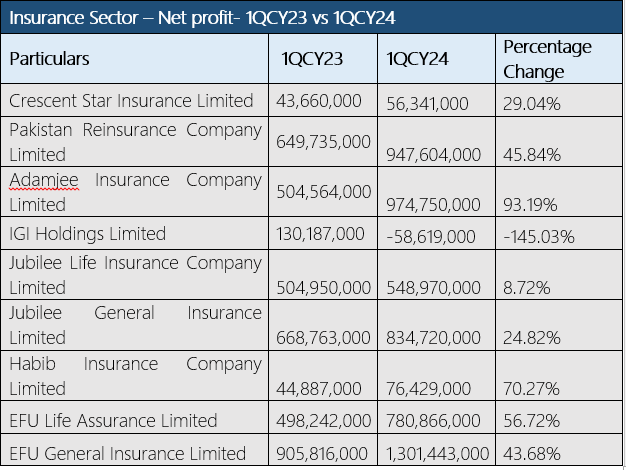

During the first quarter, the insurance sector displayed a mixed performance across the companies. Among the companies, Adamjee Insurance Company Limited stood out as the highly profitable company during the 1QCY24, with a massive growth of 93.19% in net profit. Habib Insurance Company Limited (HICL) earned a net profit of Rs76.4 million in the first quarter of 2024. With a growth of 70.27% in net profit over Rs44.8 million in the 1QCY23, HICL was the second highest profit earner from January 2024 to March 2024.

EFU Life Assurance Limited marked its name as the third profitable company in the sector, with its net profit surging 56.72% to Rs780.8 million in 1QCY24. In contrast, IGI Holdings Limited suffered a net loss of Rs58.61 million, representing a substantial decline of 145.03%. In absolute terms, EFU General Insurance Limited posted the highest net profit of Rs1.30 billion in 1QFY24, with a significant growth of 43.68% over the same period last year.

Historical trend of EFU General Insurance Company Limited

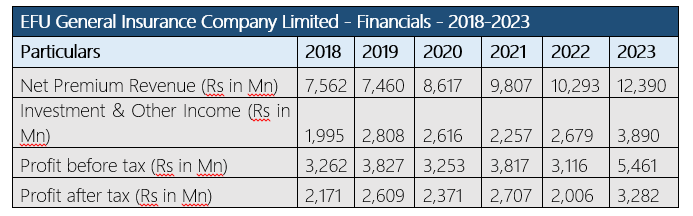

The EFU General Insurance Company’s net premium revenue demonstrates a persistent growth over the years, with an overall hike of 63.85% from Rs7.5 billion in 2018 to Rs12.39 billion in 2023. This implies the company has enhanced its customer base by acquiring a strong market position and effective policies. However, a slight decrease of around 1.35% was experienced by the company to Rs7.46 billion in 2019.

The company’s investment income, including rental income, profit on deposits, and other income, has fluctuated over time, with an overall surge of 94.99% from Rs1.99 billion in 2018 to the highest of Rs3.89 billion in 2023. The Investment and Other Income declined twice in 2020 and 2021 by 6.84% and 13.72% respectively. With only two dips to Rs3.25 billion in 2020 and Rs3.11 billion in 2022, the insurance company’s profit before tax followed an upward trajectory to Rs5.46 billion in 2023. Similarly, the net profit ballooned to Rs3.28 billion in 2023, 51.17% higher than Rs2.17 billion in 2018. The overall performance remained steady and stable, indicating better operational efficiency, effective cost management, and strong investment strategies by the company.

Company profile

EFU General Insurance Limited is Pakistan’s largest and oldest general insurance company established in 1932. The company is engaged in non-life insurance business comprising fire, engineering, marine, aviation, motor, and other services. EFU is the top insurer for Chinese infrastructure projects (CPEC).

Credit: INP-WealthPk