INP-WealthPk

Shams ul Nisa

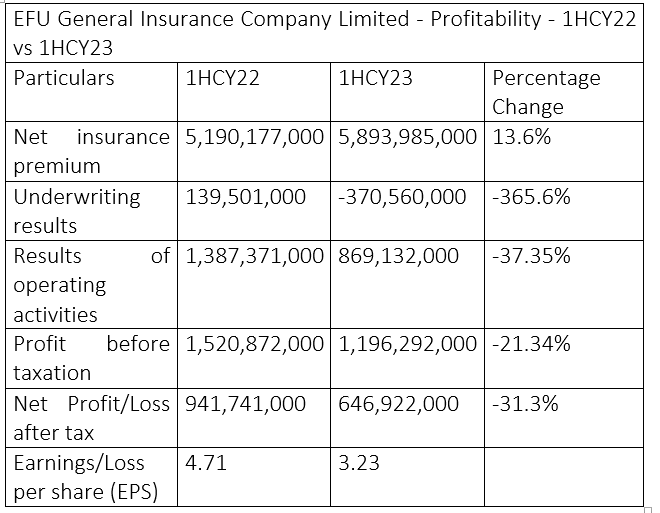

EFU General Insurance Company Limited’s net insurance premium grew by 13.6% to Rs5.89 billion in first half of the ongoing calendar year 2023 from Rs5.19 billion over the corresponding period of last year. This increase indicates the company generated high premium income during 1HCY23 because of increase in demand for its products and services.

In contrast, the insurance company’s underwriting results declined drastically by 365.6% to negative value of Rs370.5 million in 1HCY23, compared to positive value of Rs139.5 million in 1HCY22. This reflects the insurance company’s revenue was not enough to cover the loss from underwriting activities during the period. Likewise, the results of operating activities fell by 37.35% to Rs869 million in 1HCY23 from Rs1.38 billion in 1HCY22. This decline can be attributed to the rise in the operating expenses during the period under consideration.

As a result of decline in underwriting results and increased operating expenses, the insurance company’s profit-before-tax shrank to Rs1.19 billion in 1HCY23 from Rs1.52 billion in 1HCY22, representing a decrease of 21.34%. The company’s net profitability witnessed a considerable decline of 31.3% to Rs646.9 million in 1HCY23 from Rs941.7 million in 1HCY22. The company’s earnings per share (EPS) fell to Rs3.23 in 1HCY23 from Rs4.71 in 1HCY22, reflecting lower per-share profitability.

2QCY23 compared with 2QCY22

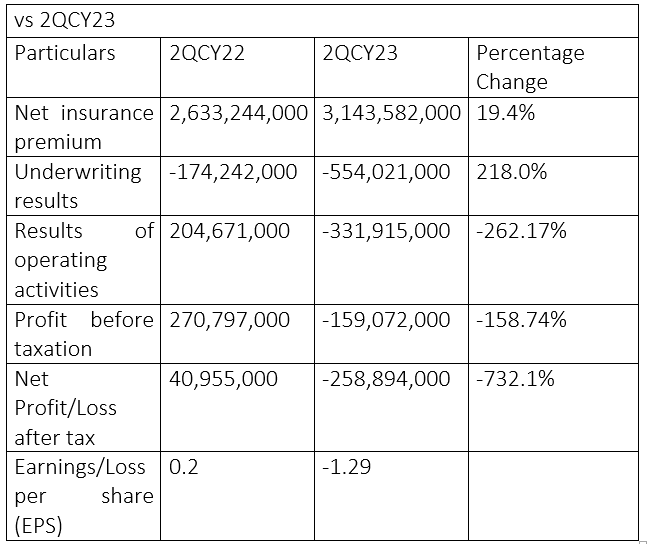

The insurance company witnessed considerable changes in financial performance during the second quarter of calendar year 2023 compared to the same period last year. During 2QCY23, the company’s net insurance premium rose to Rs3.14 billion from Rs2.63 billion in 2QCY22, representing a significant growth of 19.4%.

![]()

The underwriting results increased to negative value of Rs554.02 million during the second quarter of CY23 from negative value of Rs174.2 million over the corresponding period of CY22, posting a negative growth of 218%. Similarly, the company’s results of operating activities fell substantially from Rs204.6 million in 2QCY22 to negative value of Rs331.9 million in 2QCY23, reflecting a decline of 262.17%. In 2QCY23, the company sustained loss-before-tax of Rs159.07 million compared to profit-before-tax of Rs270.79 million in 2QCY22, reflecting a decline of 158.74%.

Likewise, the insurance company suffered a significant 732.1% decline in profitability as it sustained net loss of Rs258.89 million in 2QCY23 compared to net profit of Rs40.9 million in 2QCY22. This shows that the company faced severe financial challenges during 2QCY23. The company sustained decline in EPS from Rs0.2 in 2QCY22 to negative Rs1.29 in 2QCY23.

Analysis of last four years

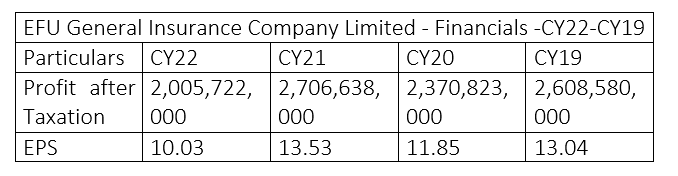

EFU Insurance Company’s profitability shows a fluctuating trend over the years from CY19 to CY22. The highest profitability of Rs2.70 billion was recorded in CY21, followed by Rs2.60 billion in CY19. The lowest profitability of Rs2 billion was observed in CY22 followed by Rs2.37 billion in CY20.

EPS followed a similar trend as the highest of Rs13.53 was recorded in CY21 and the lowest of Rs10.03 in CY22. In CY20, the company recorded EPS of Rs11.85 and Rs13.04 in CY19.

Analysis of ratios in last four years

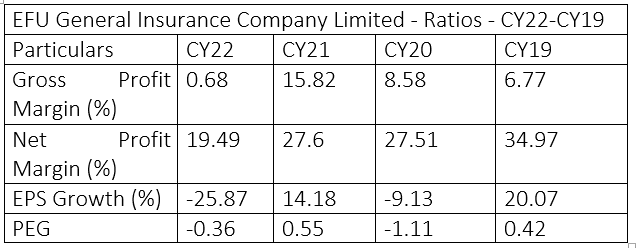

The company’s gross profit margin stood at 15.82% in CY21, which was the highest, followed by 8.58% in CY20. In CY19 and CY22, the gross profit margin was recorded substantially lower, with values of 6.77% and 0.68%, respectively. The lowest value in CY22 reflects the company experienced higher operating costs during the period. The company’s net profit margin exhibited a stable trend over the period, with the highest value of 34.97% recorded in CY19 and the lowest of 19.49% in CY22.

The EPS growth stood at 20.07% in CY19, but declined to negative 9.13% in CY20. In CY21, the EPS growth improved to 14.18%, but again decreased to negative 25.87% in CY22. PEG followed a similar pattern, with values of 0.42%, -1.11%, 0.55% and -0.36% in CY19, CY20, CY21 and CY22, respectively.

Company profile

EFU General Insurance Limited is Pakistan’s largest and oldest general insurance company established in 1932. It offers Takaful coverage as well as fire, engineering, marine, aviation, motor, and other services. EFU is the top insurer for Chinese infrastructure projects under CPEC.

Credit: INP-WealthPk