INP-WealthPk

Shams ul Nisa

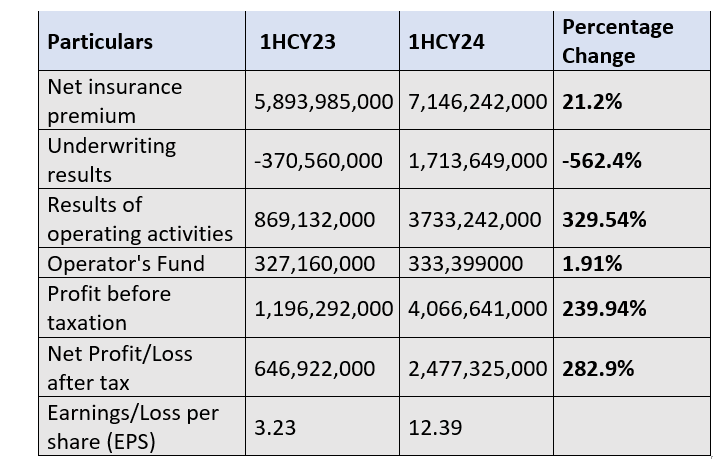

EFU General Insurance Limited’s net profit soared by 282.9% to Rs2.48 billion during the first half of the ongoing calendar year 2024 from Rs646.92 million over the corresponding period of 2023, indicating a strong bottom-line performance, reports WealthPK.

Additionally, the company’s net insurance premium increased 21.2% in 1HCY24, indicating a strong market share and ability to attract new business. Furthermore, its underwriting results showed an exponential jump of 562.4%, from negative underwriting results of Rs370.5 million in 1HCY23 to positive results of Rs1.71 billion in 1HCY24, indicating effective management of underwriting processes. Likewise, the company’s operating activities spiked by 329.54% in 1HCY24, indicating improved operational efficiency and cost management. A slight increase of 1.91% was witnessed in operating funds during the period.

![]()

The profit-before-tax expanded by 239.94%, from Rs1.20 billion in 1HCY23 to Rs4.07 billion in 1HCY24, indicating robust performance in generating profits from core operations. Thus, the earnings per share (EPS) also improved significantly, from Rs3.23 in 1HCY23 to Rs12.39 in 1HCY24, indicating the company's ability to enhance shareholder value.

Insurance sector analysis

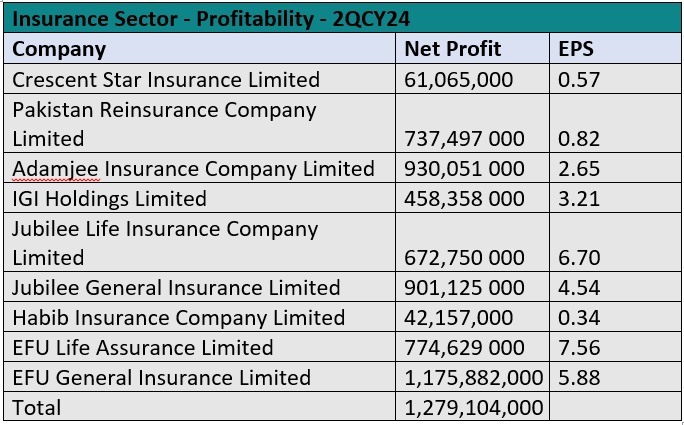

The insurance sector's net profit reached Rs1.28 billion in the second quarter of the ongoing year (2QCY24), indicating a healthy overall performance. EFU General Insurance was the highest performer in the sector, with a net profit of Rs1.18 billion and an EPS of Rs5.88. This indicates effective underwriting and operational efficiency, positioning the company as a leader within the sector. Jubilee General Insurance Limited also performed well, with a net profit of Rs901.13 million and an EPS of Rs4.54. EFU Life Assurance Limited followed closely with a net profit of Rs774.63 million and an impressive EPS of Rs7.56. Adamjee Insurance Company Limited reported a net profit of Rs930.05 million with an EPS of Rs2.65, indicating potential room for improvement in shareholder returns.

Jubilee Life Insurance Company Limited and IGI Holdings Limited also demonstrated strong profitability with net profits of Rs672.75 million and Rs458.36 million. The companies reported an EPS of Rs6.70 and Rs3.21, respectively. Crescent Star Insurance Limited and Habib Insurance Company Limited showed weaker performance with net profits of Rs61.07 million and Rs42.16 million during 2QCY24.

EFU General Insurance financials

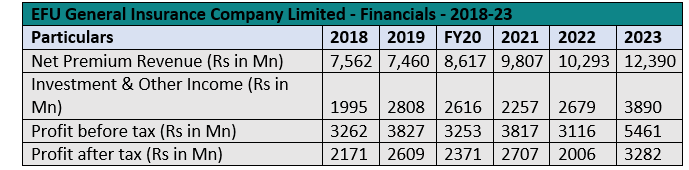

EFU General Insurance has experienced consistent growth in net premium revenue, which improved from Rs7.56 billion in 2018 to Rs12.39 billion in 2023. Likewise, investment and other income also increased from Rs1.99 billion in 2018 to Rs3.89 billion in 2023, indicating the firm’s effective investment strategies and diversification of income sources.

The company’s profit-before-tax showed volatility, peaking at Rs3.82 billion in 2019 and fluctuating in subsequent years, before reaching Rs5.46 billion in 2023. The significant rebound in 2023 suggests improved operational efficiency and cost management, leading to enhanced profitability. The profit-after-tax showed a positive trend, increasing from Rs2.17 billion in 2018 to Rs3.28 billion in 2023, indicating the company's resilience and ability to recover from challenging periods.

Future outlook

Pakistan has achieved some sort of economic stability and is now set to put the economy on a growth trajectory. The likely finalisation of a deal with IMF for a long-term lending programme will help strengthen the country’s external sector and open up avenues for foreign funding sources in the long-term.

Company profile

EFU General Insurance was established as a public limited company on September 2, 1932. The company specialises in non-life insurance, including fire and property, marine, motor, and various other types.

Credit: INP-WealthPk