INP-WealthPk

Qudsia Bano

The stock market is growing and its attitude is improving despite the fact that the economy is currently in a downturn for a number of reasons, including political and economic ones, said Hamza Anwar, Equity Manager at Zahid Latif Khan Securities. He argues in an exclusive interview with WealthPK that the most important economic element at the present is the local currency’s current depreciation against the dollar and the economy is immediately impacted by these exchange rate swings.

Given the economic condition of Pakistan, what do you think is the sentiment of the market?

Hamza Anwar: As we can see, the economy is currently experiencing a downturn, but despite this, the stock market is rising and its mood is improving for a variety of reasons, including political and economic ones. When it comes to economic factors, the dollar's depreciation against the rupee at the moment is the key one. Although the market sentiment went on negative recently when the country faced the disastrous floods and one-third of the country drowned and the market aggressively behaved and started moving in 1000-2000 points, but then again after the devaluation of the dollar against the rupees, the market sentiment started moving positively.

Investor confidence is another aspect of the market's agitated state. The greater the level of investor trust we achieve, the greater the number of inflows created, and the better the market sentiment becomes. The reduction in the current account deficit is the final contributor to the upbeat market sentiment since it means that our imports are now a little lower and our exports are slightly higher. Rumors are a significant factor in market mood as they have the potential to both positively and negatively affect both the currency and stock markets.

2. As we can see things getting intense in interbank, what are the reasons behind fluctuations in the exchange rate and how it affects the industry?

Hamza Anwar: When exporters ask banks to open Letters of Credit (LCs) against their security, the banks open the LC on a 20%–25% margin, allowing the exporter to export the goods and pay the amount. This is how exchange rate changes are mostly caused. The dollar has risen in recent days as a result of banks beginning to open LCs upon full payment and request additional exchange rates from exporters due to the currency's erratic movements and overnight risk and importers have borne the loss here.

Therefore, the economy is immediately impacted by these exchange rate swings. Another reason is that a country's exchange rate is also impacted when its foreign reserves decrease. Even in free markets, the same situation of speculative activity can be seen. Governments have historically stepped in to stop domestic currencies from falling in value. For instance, the state bank will sell its dollars to maintain the rate if the exchange rate is significantly higher.

3. By doing the financial analysis of the companies, we realized revenues are on decreasing trend in the half-yearly reports of most of the companies. What is the reason behind it?

Hamza Anwar: The major reason for decreasing the revenues or the profits of the company is the recently imposed super taxes by the government on the companies and large-scale industries. However, specific industry revenues and profits decreased, e.g., import-based companies, foods, fertilizers, and cement. Another reason for decreasing trends in these financials was the political turmoil because they could not perform sales on higher volumes due to the decrease in purchasing power of the general public.

Another reason is the floods, where the major production units stopped working and revenues went on declining. However, some of the industries like pharmaceutical, IT, and Oil performed exceptionally well even during the flood and Covid19 pandemic. Despite all these major factors, overall if we see the stock market scenario, there was an immense growth in the revenues and the profits of the companies listed on the Pakistan Stock Exchange.

4. In July 2022, Pakistan's foreign direct investment rose by 58.90 USD million. How increase in FDI can improve the GDP?

Hamza Anwar: Foreign direct investment/Inflows are directly related to our Gross Domestic Product (GDP). The major issues in managing the FDI are the priorities of policymakers and the government what the main sector where they want to utilize this inflow from foreign investors, e.g., what projects they want to start, whether it will be utilized on infrastructure development or the health sector, or education, etc.

FDI can only be effective to increase the GDP if we utilize it on micro levels, like investing in manufacturing industries, export-oriented sectors, and production sectors where we can generate maximum revenues and profits. Government policy should be well crafted and structured to increase the GDP through FDI.

5. What steps you have taken to improve the earnings per share of your company in the last two years?

Hamza Anwar: The nature of Zahid Latif Securities is that we are a corporate brokerage house / Intermediary, and our core department is Trading we generate revenues by providing a platform to investors and traders and we charge a nominal amount of 0.08% against brokerage services. Yes, our revenues increased in the last two years and the major reason was that the market performed really well during that period.

The post-Covid scenario was very good for the market and it gained the interest of the investors and this is how our revenues increased. We also developed our social media handles according to domestic needs and improved inbound marketing at all possible channels including educational and financial institutes.

Another major reason was that investors were generating good profits from the stock exchange so other people also showed interest and visited us to open their accounts and invested with us. We also digitized our system of applications so that the out of the reach clients can also contact us and apply for a Unique Identification Number (UIN) and this is how our revenues increased.

6. What measures can we take to improve the economic condition of the country?

Hamza Anwar: We can improve the economic condition of the country by focusing on the following aspects;

- Maintaining a corruption-free society

- Import bill should be reduced

- Export-oriented industry should be promoted and should provide ease of doing business.

- Should focus on long-term economic policies which relate to political stability.

- Best utilization of monetary loans from IMF and other sources.

- Focusing on profit generation strategies so that we could be able to pay back the loans.

- There should be some strict rules on the imports of Luxury items.

- Made-in-Pakistan products should be promoted.

- De Regulation ( Should be given tax relieves)

- Should focus on health and infrastructure development.

- Income taxes should be reduced.

- Government should take initiative to educate the general public about financial literacy.

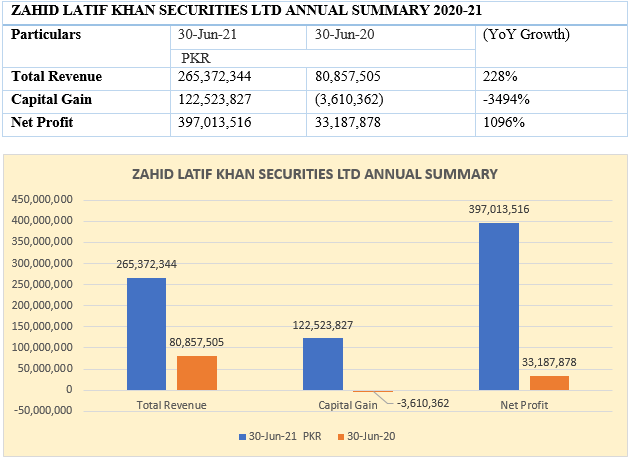

Zahid Latif Khan Securities – Financial Performance

Zahid Latif Khan Securities Limited’s revenue climbed 228% to Rs 265.3 million in FY2021 compared with Rs 80.85 million in the corresponding period of last year.

Similarly, the capital gain of the company registered an increase of 3494% during the FY21 and stood at Rs122.5 million as against a capital loss of Rs 3.6 million in the corresponding period the previous year.

The company posted a net profit of Rs 397 million in FY21 compared to a profit of Rs 33.2 million in the corresponding period last year, showing a massive growth of 1096% year-on-year, reports WealthPK.

About Company

The Pakistan Stock Exchange's leading and innovative provider of premium brokerage and financial services is Zahid Latif Khan Securities (Pvt.) Ltd. It is famous for providing valued business and retail clients with services of the highest caliber. Zahid Latif Khan Securities (Pvt.) Ltd, a skilled brokerage firm founded in 1999, has established a vast network of branches all over the nation.

In order to establish its success, the company joined Pakistan Mercantile Exchange as an active broker in 2010 to give traders access to and the chance to transact in commodities. As part of its ongoing efforts to inform and instruct investors about commodity trading at the Pakistan Mercantile Exchange, ZLK also holds regular investor awareness events. It provides its clients with expert trading support and keeps them informed about its technical and fundamental analysis and research for the equity and commodity markets.

Credit : Independent News Pakistan-WealthPk