INP-WealthPk

Moaaz Manzoor

Pakistan’s economic outlook has demonstrated a dramatic turnaround, as the State Bank of Pakistan Governor’s report for 2023-2024 highlights a 13-year low in the current account deficit, driven by record remittances, strong export growth, and stabilizing fiscal policies, reports WealthPK.

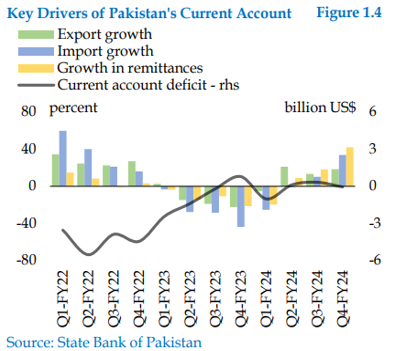

In the Fiscal Year 2023-24 (FY24), the CAD slashed by an impressive 79%, dropping from $3.275 billion in FY23 to just $681 million in FY24. This significant reduction underscores the country’s robust economic progress.

Source: https://www.sbp.org.pk/reports/annual/GovAR/pdf/2024/Gov-AR.pdf

This achievement is primarily attributed to robust remittance flows, increased export revenues, and stabilized fiscal policies. Remittances grew by 11%, reaching a record $30.3 billion, while export earnings, especially in food commodities like rice, surged by 11.5% to $31.1 billion due to favorable market conditions and India’s export restrictions. The technology sector also played a significant role, with service exports reaching $7.8 billion, contributing to the positive balance.

Source: https://www.sbp.org.pk/reports/annual/Gov-AR/pdf/2024/Gov-AR.pdf

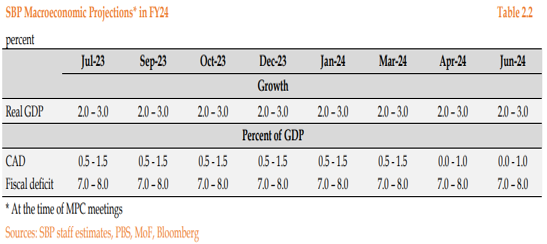

The report underscored that policy measures like maintaining a high 22% interest rate and introducing foreign exchange reforms supported this turnaround by fostering exchange rate stability and curbing inflation. The Pakistani rupee (PKR) held steady, aided by the $3 billion IMF Stand-By Arrangement (SBA) and subsequent multilateral and bilateral inflows that increased the foreign exchange reserves. These stabilizing factors improved investor confidence and helped manage inflation in the second half of FY24, marking a shift towards a more balanced economy. Agriculture’s strong performance also boosted economic resilience, as record wheat and rice harvests reduced import dependency and bolstered the GDP growth. Imports grew marginally by 0.9%, with energy imports contracting by nearly 20% due to the lower global energy prices, counterbalancing a 12% rise in non-energy imports.

This maintained the trade balance, underscoring the effectiveness of targeted fiscal and monetary policies, lowering the public debt-to-GDP ratio, and easing external account pressures. Despite these gains, challenges persist. A primary income deficit of over $1 billion has emerged as the SBP addresses a backlog in repatriating profits and dividends. However, this is countered by continued remittance growth and rising exports, providing a buffer against external financial pressures. Analysts view this fiscal performance, as outlined in the State Bank of Pakistan Governor’s Annual Report 2023-2024, as a testament to the resilience built through careful policy choices and international partnerships, positioning Pakistan well to tackle future global economic challenges. The PKR’s stability has slowed inflation, supported by policies like the Extended Fund Facility (EFF) and FX market reforms in collaboration with the IMF.

These improvements and formalization of remittance inflows through reduced kerb premiums and revamped exchange channels have bolstered Pakistan’s reserves and enhanced external stability. Significantly, remittances and export gains offset minimal import growth, indicating Pakistan’s potential for sustained economic stability. Pakistan’s efforts to boost remittances and diversify exports, particularly in the tech and agricultural sectors, showcase the possibility of sustainable economic growth. Yet, maintaining this positive trajectory will require continued focus on structural reforms in technology and agriculture to further strengthen resilience to external shocks. Looking ahead, Pakistan’s economic momentum suggests that its fiscal stability and improved trade balance could offer more robust defenses against the vulnerabilities traditionally impacting its financial health, provided the current policies remain robust and adaptable to the changing international dynamics.

Credit: INP-WealthPk