INP-WealthPk

Arooj Zulfiqar

Pakistan's economy is witnessing sustained recovery in the ongoing fiscal year, with the first four months showing better-than-expected improvements. Key factors contributing to this recovery include receding inflation, a significant increase in remittances and IT exports, and stability in external and fiscal sectors.

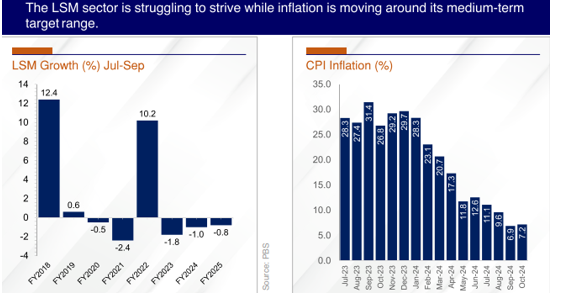

Additionally, a downward trend in interest rates has bolstered economic confidence. This recovery across all sectors is expected to support the achievement of the targeted economic outlook in the coming quarters. According to the data released by the Ministry of Finance in its monthly outlook for November, the large-scale manufacturing (LSM) sector demonstrated resilience despite challenges, with a marginal decline of 0.8% during the first quarter of FY25 compared to a contraction of 1.0% in the same period last year. Month-on-month, the sector registered modest growth of 0.5% in September 2024, although year-on-year contraction stood at 1.9%.

The report highlights that the auto industry led the recovery, with a surge of 21.2% in production and 21.8% in sales during the Jul-Oct period of FY25. Key segments such as cars (51.0%), trucks and buses (80.2%), and jeeps and pick-ups (55.1%) witnessed substantial increases, while tractor production declined by 54.2%. Cement dispatches presented mixed results, with overall dispatches decreasing by 7.9% in the first four months of FY25. However, export dispatches surged by 30.7%, reaching 3.2 million tonnes. CPI inflation has been on a downward trajectory, reaching single digits during the first four months of FY25 at 8.7%, compared to 28.5% in the same period last year. October 2024 saw year-on-year inflation of 7.2%, significantly lower than the 26.8% recorded in October 2023.

Key contributors to inflation included perishable food items, housing, and utilities, while non-perishable food items and transport costs declined. The fiscal sector demonstrated stability through prudent fiscal consolidation. Federal revenues grew by 186% to Rs4,019 billion during the first quarter of FY25, driven by the surplus profit of the State Bank of Pakistan and an increase in tax and non-tax revenues. Total expenditures grew slightly by 1.8%, with a decline in mark-up expenditures. The fiscal balance posted a surplus of Rs1,896 billion, while the primary balance recorded a surplus of Rs3,202 billion. The FBR’s net tax collection increased by 25.3% to Rs3,442.6 billion during the first four months of FY25.

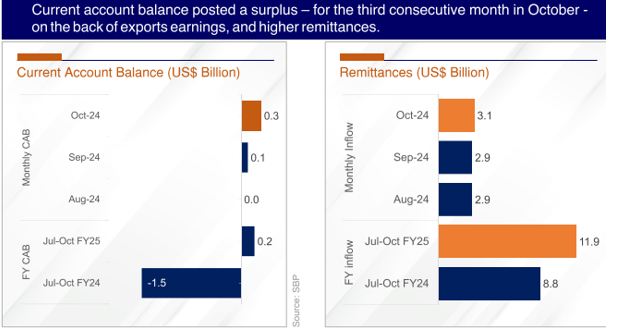

The external account position improved significantly, with the current account recording a surplus of $218 million during the first four months of FY25, compared to a deficit of $1,528 million last year. Goods exports increased by 8.7% to $10.5 billion, driven by strong growth in commodities like rice, sugar, and textiles. Imports also rose by 13%, leading to a goods trade deficit of $8.3 billion. IT exports grew by 34.9%, while workers' remittances increased by 34.7% to $11.9 billion. Foreign direct investment rose by 32.3% to $904 million, with China contributing the largest share.

Pakistan’s total foreign exchange reserves reached $16.0 billion as of November 8, 2024. Monetary policy decisions have signalled stability and boosted business confidence. The policy rate was reduced by 250 basis points to 15%, reflecting the faster-than-expected decline in inflation. The stock market remained bullish, with the KSE-100 index gaining 7,853 points in October 2024, closing at 88,967 points, and market capitalisation increasing by Rs917 billion. Social safety net spending has been enhanced, with the allocation for the Benazir Income Support Programme increasing by 27% to Rs593 billion for FY25.

Interest-free loans amounting to Rs4.8 billion were disbursed during the first four months, while employment registrations for overseas jobs also rose, with 77,316 workers registered in October 2024 alone. Pakistan's sustained economic recovery is marked by resilience across various sectors, fiscal prudence, and external sector improvements. These positive developments suggest the potential for achieving targeted economic growth in the coming quarters, with continued reforms and investments driving further stability.

Credit: INP-WealthPk