INP-WealthPk

Shams ul Nisa

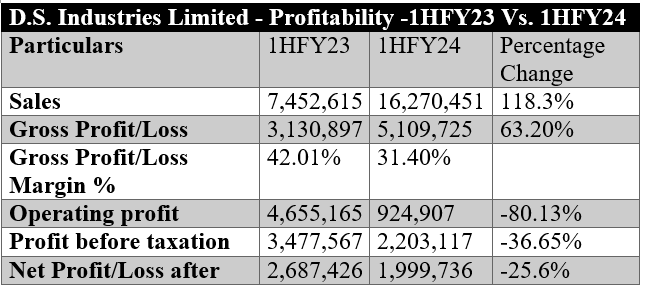

DS Industries Limited – the manufacturer of yarn – recorded robust sales of Rs16.27 million in the first half of the ongoing fiscal year (1HFY24), marking an impressive year-over-year growth of 118.3%. However, the company’s net profit declined 24.6% to Rs1.99 million from Rs2.68 million in the same period last year, according to WealthPK. The company attributed the decline in profitability to unfavourable economic conditions such as high inflation and increased energy costs. The company announced a gross profit of Rs5.10 million in 1HFY24, up 63.20% from the same period of FY23. However, the company’s gross profit margin plunged to 31.40% in 1HFY24 from 42.01% in 1HFY23 due to increased costs of sales.

The operating profit declined 80.13% and the profit-before-tax by 36.65% in 1HFY24. The net profit decreased 25.6%, thus plunging profit margin to 12.29% in 1HFY24 from 36.06% in 1HFY23. As a result, earnings per share dropped to Rs0.02 in 1HFY24 from Rs0.03 in the same period last year.

Quarterly Analysis

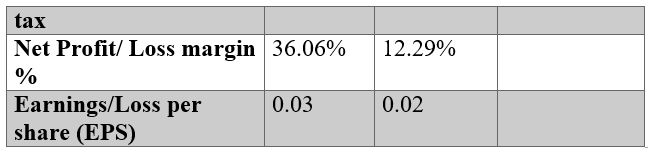

Sales in the second quarter (October-December) of FY24 contracted marginally by 3.2% to Rs6.49 million from Rs6.71 million in 2QFY23. The gross profit inched down by 4.32% and the operating profit by a substantial 88.93%. As a result, the profit-before-tax slipped to Rs1.4 million in 2QFY24 from Rs2.43 million in 2QFY23, representing a decrease of 39.38%. At the end of the second quarter of FY24, the net profit stood at Rs1.39 million, lower by 24.9% than Rs1.86 million in 2QFY23. The EPS remained unchanged at Rs0.02 in 2QFY24.

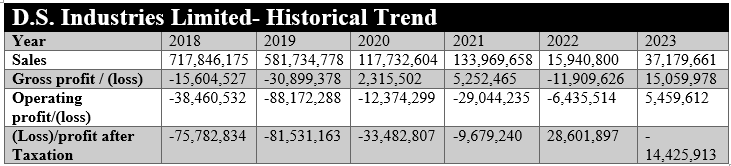

Historical trend

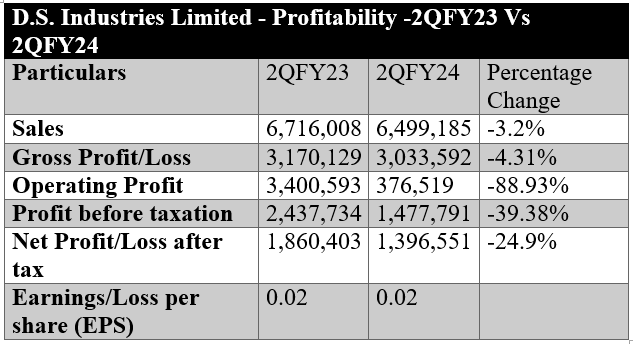

The company’s sales declined from Rs717.8 million in 2018 to Rs117.7 million in 2020, but rose marginally to Rs133.9 million in 2021. However, the sales plunged to Rs15.9 million in 2022 before increasing to Rs37.17 million in 2023.

The company suffered gross losses in 2018, 2019 and 2022. However, the company managed to earn gross profits in 2020, 2021 and 2023.

The company continued to suffer operating losses from 2018 to 2022, before recovering in 2023 with an operating profit of Rs5.45 million. Barring 2022, when the company posted a net profit of Rs28.6 million, it sustained losses in all the other years.

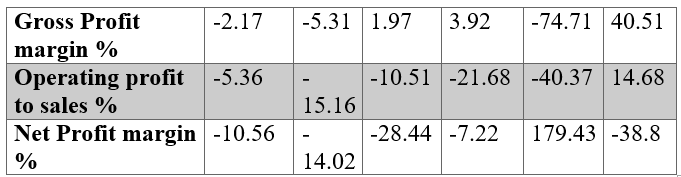

Profitability ratios

Over the period from 2018 to 2023, DS Industries witnessed negative gross margins in 2018, 2019 and 2022. It posted the highest gross profit margin in 2023 at 40.51%. It also registered negative operating margins from 2018 to 2022, but scored positive operating margin in 2023. This reflects the company’s costs of goods exceeded the revenue generated from sales, coupled with a hike in non-operating costs, lower sales and financial challenges.

![]()

The firm managed to earn net profit margin only in 2022.

Future outlook

Unfavourable economic conditions punctuated by rising inflation, monetary tightening and rising energy costs have caused uncertainty among many firms. The rising inflation, if not controlled, could further depress the country’s economic growth. The government needs to adopt long-term plans to boost confidence in the businesses. Continuation of the IMF programmme, return of political stability, support of friendly nations, and continued implementation of measures aimed at stabilising the economy will have far-reaching effect on the country’s outlook.

Company profile

DS Industries Limited was established in Pakistan as a private limited company and was later converted into a public limited company. Its principal activity is manufacturing and selling yarn.

INPCredit: INP-WealthPk