INP-WealthPk

Muhammad Asad Tahir Bhawana

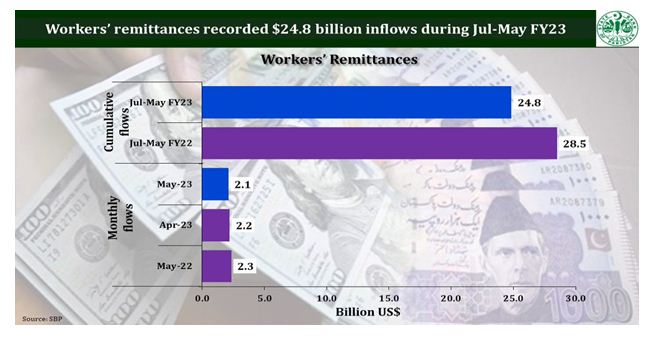

A significant decline in workers’ remittances during the last fiscal year has dealt a blow to the economy, prompting Pakistan to seek financial assistance from the International Monetary Fund (IMF) to help tackle the balance of payment crisis. According to the country's central bank, remittances sent home by Pakistani expatriates fell to $27 billion during the fiscal year 2022-23, in contrast to $31.3 billion in the previous year. Remittances for June 2023 experienced a notable slump, amounting to $2.2 billion compared to $2.8 billion in the same month of FY22. The primary sources of these remittances were Saudi Arabia, the United Kingdom, the United Arab Emirates, and the United States.

It is worth noting that as of the previous year, Pakistan ranked as the sixth-largest recipient of remittances globally, trailing behind India, Mexico, China, the Philippines and Egypt. The decline in remittances has added to the challenges facing Pakistan's economy. This predicament arises from a combination of factors, including financial mismanagement over the years, a global energy crisis, and devastating flooding. Consequently, the government has been compelled to adopt stringent economic measures enforced by the IMF as part of its loan assistance. Though Pakistan managed to secure $3 billion short-term financial package from the IMF in July 2023, the government had to make significant adjustments to its 2023-24 budget and raised its benchmark interest rate to record 22%.

Furthermore, the IMF has stipulated that Pakistan must raise more than Rs385 billion ($1.41 billion) through new taxation measures to achieve fiscal stability. Regrettably, these measures have contributed to an unprecedented surge in inflation, reaching 38% year-on-year in May 2023, making it the highest inflation rate in Asia. Talking to WealthPK,Dr Mahmood Khalid, a research economist, said that Pakistan needed to come up with innovative ways and provide convenience to overseas Pakistanis through different programmes such as the Roshan Digital Account to attract more remittances.

Credit: INP-WealthPk