INP-WealthPk

Qudsia Bano

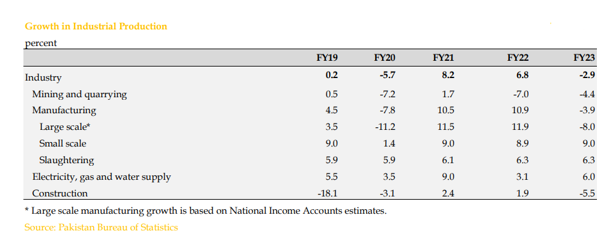

Pakistan's industrial sector shrank by 2.9% in the fiscal year ending on June 30, 2023, showing a significant divergence from the strong growth of 8.2% and 6.8% reported in FY21 and FY22, respectively. As the main engine of industrial activity, the manufacturing sector suffered the most from this economic downturn, declining by 3.9% in FY23. This steep decrease is a substantial reversal from the outstanding 10.9% growth observed the year before. The decline in Large Scale Manufacturing (LSM) output, which was a result of both supply chain disruptions and weaker demand, was the main cause of this recession.

Floods and restrictions on foreign exchange made these problems worse. Concurrently, the construction sector, which showed modest expansion in the previous two years, posted a significant 5.5% decrease in FY23. Construction activity was limited by a number of problems, such as rising labour and material costs, increasing borrowing costs, and a slowdown in development spending.

The industry's problems were exacerbated by external factors like floods, a general slowdown in the economy, political unpredictability, the expiration of amnesty programmes, and restrictions on new disbursements in subsidised lending schemes. The consequences of the poor results in building and manufacturing extended to the mining and quarrying industries. Mining and quarrying, which make up 9% of the industrial sector, shrank by 4.4% in FY23. However, this was less than the 7% decline the year before. The main cause of the decrease was a decline in the production of important minerals, such as natural gas, gypsum, sulfur, and crude oil. The sector's Gross Fixed Capital Formation (GFCF), which fell by 23.5% in FY23, old mining equipment, and the damage that heavy rains and flooding caused to road infrastructure were some of the factors that led to the fall in mining and quarrying activities.

The value addition by power, gas, and water delivery increased by 6% during FY23, despite a dramatic slowdown in the production of gas and electricity. The primary cause of this increase was the power subsidies, which are included in the gross value addition. The reduction in energy generation can be ascribed to several factors, including a downturn in economic activity, a hike in electricity tariffs that has decreased demand, and difficulties of certain power plants in importing coal. Talking to WealthPK, Dr Javed, a senior economist at the Ministry of Planning, Development and Special Initiatives, said the industrial contraction during FY23 signals a concerning shift in economic dynamics. “The manufacturing sector's 3.9% decline highlights the vulnerability of this critical component.” He stressed that the policymakers should adopt a comprehensive strategy to enhance supply chain resilience, stimulate domestic demand, and address the sector's susceptibility to external shocks like floods and foreign exchange constraints.

Javed said that simultaneously, the 5.5% contraction in the construction industry raises red flags about the broader economic landscape. “Rising input costs, a slowdown in development spending, and external factors such as floods and political uncertainty have contributed to this decline.” He emphasised that a targeted approach was needed to streamline bureaucratic processes, encourage investment, and provide a conducive environment for sustainable growth. “Addressing both immediate challenges and long-term structural issues will be pivotal in revitalising these key sectors and steering Pakistan's industrial landscape toward a more robust and resilient future.”

Credit: INP-WealthPk