INP-WealthPk

Qudsia Bano

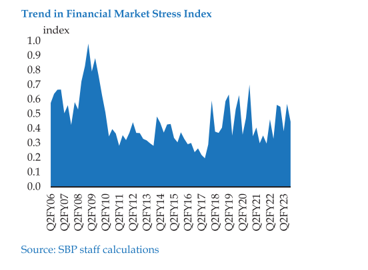

In a year marked by economic uncertainties and global challenges, domestic financial markets in the fiscal year ended June 30, 2023 (FY23) presented a complex picture of resilience and volatility. While the money and equity markets showcased lower volatility compared to the preceding year, the foreign exchange (FX) market grappled with heightened stress. The policy measures implemented in FY22 to mitigate emerging risks played a pivotal role in transforming the current account deficit into a surplus in the second half of FY23.

However, challenges persisted with mounting debt repayments and diminished external inflows, placing sustained pressure on the external account. Inflationary pressures intensified throughout the fiscal year, contributing to the highest volatility in the exchange rate since 2001. As a result, the Pakistani rupee depreciated 28.4% against the US dollar.

The State Bank of Pakistan (SBP) responded to rising inflationary pressures by raising the policy rate by 825 basis points in FY23, with the overnight rate being adjusted in tandem. The government's robust demand for bank credit necessitated Open Market Operations (OMO) injections, although the average size remained relatively low compared to the previous year. Despite challenges, the financial markets demonstrated overall smooth functionality. The equity market, however, experienced lackluster performance, grappling with elevated inflation, a depreciating currency, and uncertainties surrounding the political situation and the revival of the International Monetary Fund (IMF) programme. In the face of these obstacles, financial institutions exhibited commendable resilience, navigating fluctuations in market conditions and sustaining operational smoothness throughout the fiscal year.

As the nation moves forward, the financial landscape remains dynamic, adapting to a blend of challenges and positive indicators, exemplifying the intricate balance that characterised FY23. Talking to WealthPK, Shahid Javed, a senior economist at SBP, offered valuable insights into the intricacies of the FY23 financial markets. "The FY23 financial markets told a tale of resilience and adaptability amidst a challenging economic environment. While the money and equity markets displayed commendable stability, the persistent stress in the FX market reflected the delicate balancing act required to sustain economic equilibrium. The transformation of the current account deficit into a surplus is undoubtedly a positive outcome of strategic policy measures; however, the sustained pressure on the external account demands careful consideration for long-term stability."

He further emphasised the significance of inflationary pressures and the subsequent 28.4% depreciation of the rupee against the dollar. "The foreign exchange volatility observed in FY23, reaching levels unseen since 2001, underscores the need for proactive measures to counter inflationary forces and stabilise the currency. The SBP's decision to raise the policy rate and manage overnight rates reflects a commitment to addressing economic challenges head-on, and the financial institutions' resilience is commendable in navigating these turbulent waters." The SBP economist acknowledged the mixed trends in FY23, urging a continued focus on strategic policies to enhance stability. "As we move forward, a proactive approach to economic challenges will be crucial, and maintaining a delicate balance between addressing inflation, stabilising the currency, and fostering investor confidence will be key to charting a resilient course for the future."

Credit: INP-WealthPk