INP-WealthPk

Shams ul Nisa

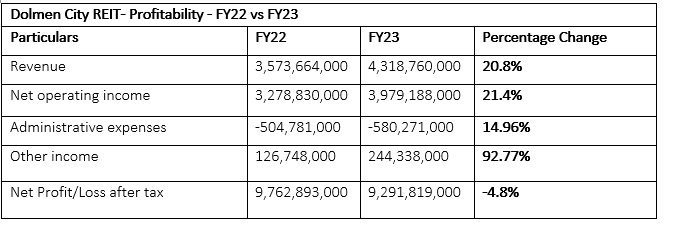

Dolmen City REIT saw its revenue increase by 20.8% to Rs4.3 billion during the financial year ending on June 30, 2023, from Rs3.57 billion in the previous fiscal (FY22). However, the company has had its net profit and earnings per share drop despite an increase in revenue and net operating income. The real estate investment company's net profit reduced by 4.8% to Rs9.29 billion in FY23 from Rs9.76 billion in FY22.

The company's net operating income clocked in at Rs3.97 billion in FY23, representing an increase of 21.4% from Rs3.27 billion in FY22. The administrative expenses rose by 14.96% to Rs580.27 million in FY23. The company's other income improved from Rs126.7 million in FY22 to Rs244.3 million in FY23, indicating a hike of 92.77%. During FY23, earnings per share fell slightly to Rs4.18 from Rs4.39 in FY22.

![]()

Assets Analysis

Dolmen City REIT reported an increase in its non-current assets by 8.32% in 2023, which grew to Rs68.04 billion from Rs62.8 billion registered in 2022. The company's current assets improved 12.52% to Rs2.24 billion in 2023 from Rs1.99 billion in 2022. As a result, the total assets climbed by 8.45%. This shows the company expanded its operations. It registered Rs70.29 billion in total assets at the end of 2023 against Rs64.81 billion in 2022.

![]()

Cash flow analysis

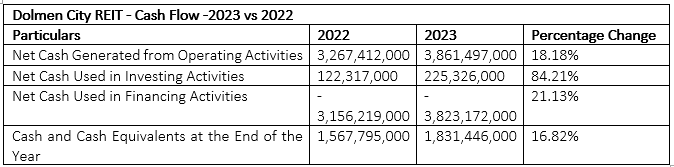

Dolmen City REIT posted an 18.18% rise in net cash generated from operating activities to Rs3.86 billion in 2023 compared to Rs3.26 billion registered in 2022. The investment company generated cash of Rs122.3 million from investing activities at the end of 2022, and in 2023, the company was able to generate net cash of Rs225.32 million, showing a growth of 84.21%.

However, the company used net cash of Rs3.82 million and Rs3.156 million in financing activities in 2023 and 2022, respectively, indicating a rise of 21.13%. The company registered a growth of 16.82% in cash and cash equivalents at the end of the year to Rs1.83 billion in 2023 from Rs1.56 billion in 2022.

Liquidity ratios analysis

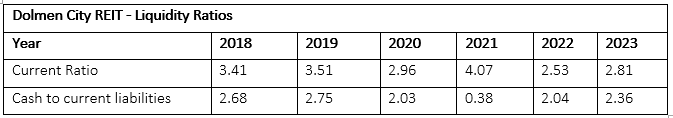

The current ratio evaluates how well a business can pay its short-term debts with its current assets. Dolmen City's current ratio has stayed above 1 from 2018 to 2023, indicating a reduced risk of covering the liabilities. The current ratio reached its maximum of 4.07 in 2021 and minimum of 2.53 in 2022. Similarly, the company's ability to pay its current liabilities with cash from its core operations is gauged by the cash-to-current liabilities ratio.

The investment company's cash-to-current liability ratio remained above 2 except in 2021, which indicates a steady state of liquidity. However, the cash-to-current liability ratio stood at 0.38 in 2021, indicating the company had less cash on hand to pay short-term obligations.

Credit: INP-WealthPk