INP-WealthPk

Ayesha Mudassar

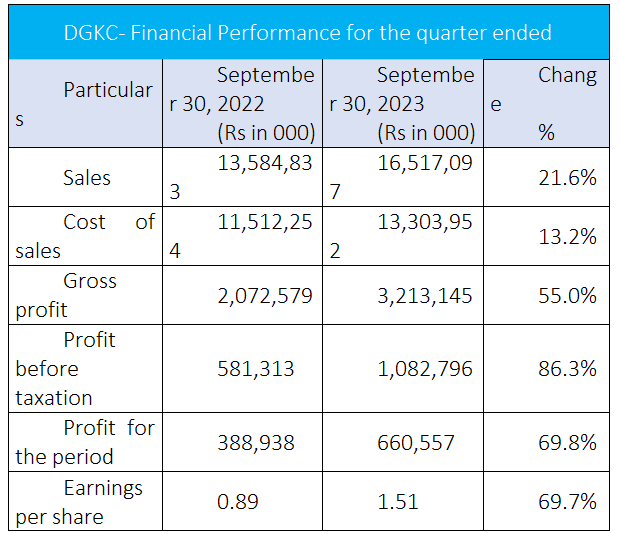

DG Khan Cement Company Limited (DGKC) witnessed a significant improvement in its financial performance during the first quarter of the ongoing fiscal year (1QFY24) as it posted a net profit of Rs660 million against profit of Rs388 million in 1QFY23, WealthPK reports.

The company earned a gross profit of Rs3.2 billion during 1QFY24 as compared to a gross profit of Rs2.07 billion in 1QFY23. Moreover, the cement company reported an increase in profit-before-tax during the quarter under review. DGKC observed an increase in revenue, amounting to Rs16.5 billion, representing a 21.6% increment from the preceding year’s first quarter. However, the cost of sales also surged by 13.2% in the period under review. Furthermore, the cement company posted an earnings per share (EPS) of Rs1.51 in 1QFY24 as compared to EPS of Rs0.89 in 1QFY23.

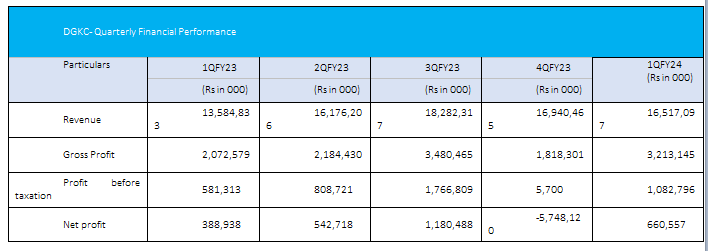

Quarterly analysis

Quarterly results witnessed a growth trajectory except for 4QFY23 where net profit was massively hit by high taxation due to the enactment of a super tax from 4% to 10% and the lapse of tax credits. Sales of this quarter also slowed down due to lower demand. Gross profit also declined due to a lower base of sales and high per-unit fixed costs. Moreover, the finance costs kept increasing quarter-on-quarter in line with the hike in policy rate.

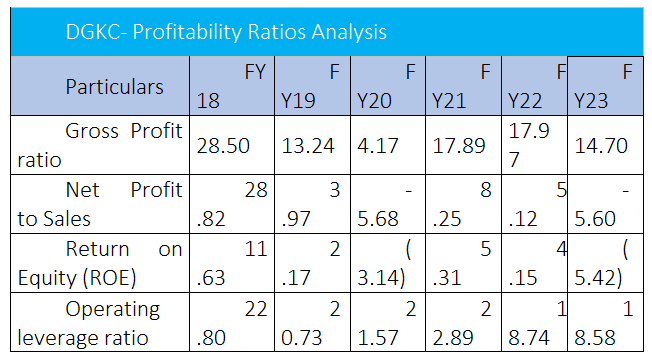

Analysis of profitability ratios

The gross profit ratio has shown a declining trend in the last three years. The plant’s under-utilisation led to a high cost per unit, causing a decline in GP. However, the company shifted to different avenues to manage cost per unit but could not hedge fully against the inflationary pressure on the cost side. The same trend is witnessed in the net profit to sales ratio. In FY23, the ratio turned negative due to high taxation expenses.

Furthermore, the net equity declined in FY23 due to net loss and a decline in the share price of major investments due to macroeconomic factors and stock market performance. The operating leverage ratio declined, indicating a gradually decreasing trend of fixed costs in the overall cost base. For FY23, there is a slight increase in the ratio due to less production and sales, and lower variable costs leading to a high ratio of fixed costs in the overall cost base.

Principal business activities

DG Khan Cement is a public limited company incorporated in Pakistan on September 27, 1978. It is listed on the Pakistan Stock Exchange. The company is primarily engaged in the production and sale of clinker and cement with more than 1,900+ employees. As of June 30, 2023, its total market capitalisation was about Rs22 billion.

Credit: INP-WealthPk