INP-WealthPk

Ayesha Mudassar

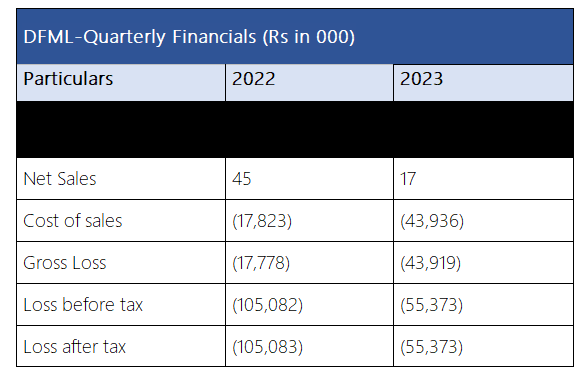

Dewan Farooque Motors Limited (DFML) posted a loss-after-tax (LAT) of Rs55.3 million during the first quarter of 2023 ending September 30, compared with a loss of Rs105 million in the corresponding quarter of last year, WealthPK reports. As per the company’s annual report, DFML sustained a gross loss of Rs43.9 million during 1QFY24 as compared to a gross loss of Rs17.7 million in 1QFY23. Likewise, the loss-before-tax plunged by 47% in the period under review.

A notable year-on-year decline of 62% is observed in revenue. The automobile assembler posted a loss per share of Rs1.73 for the quarter ending June 30, 2023. The company suffered financial losses owing to the unabsorbed overhead costs and other expenses.

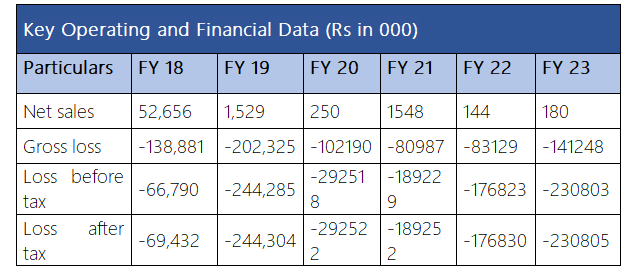

Six years at a glance

Among all the years under consideration, the company has been witnessing decline in net sales except in 2021. The highest-ever net sales of Rs52 million were reported in 2018. The loss-after-tax increased until 2020 and then marginally fluctuated in the subsequent years. Furthermore, the gross loss and loss-before-tax (LBT) have been fluctuating over six years. In the last six years (2018-2023), the firm posted the highest gross loss in FY19.

Company profile

Dewan Farooque Motors Limited was incorporated in Pakistan as a public limited company on December 28, 1998. The company is engaged in the assembling, progressive manufacturing, and sale of vehicles in Pakistan.

Industry overview

With the development of the domestic engineering base, the automobile sector provides import substitution for local consumption. The industry employs more than 500,000 people directly and indirectly and makes a sizable contribution to the national exchequer. During the period, the industry experienced a reduction of 40% with total units sold at 20,983 as compared to the previous period’s units of 35,002. The decline is attributed to steep currency devaluation, rising car prices, and stringent auto financing conditions. The aforementioned factors have driven car prices out of reach for millions.

Furthermore, the potential buyers are experiencing unprecedented late delivery times and unavailability of desired car variants due to disruption in supplies. Moreover, the increased tax burden has further constrained the sector’s growth potential. The automobile sector expects an industry-friendly operating environment to overcome the prevailing challenges.

Credit: INP-WealthPk