INP-WealthPk

Hifsa Raja

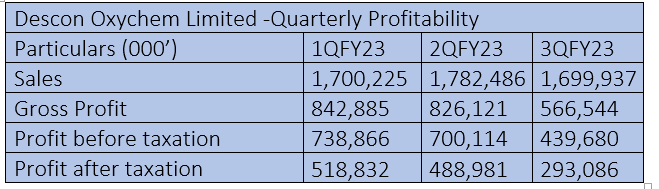

Descon Oxychem Limited’s adeptness in maintaining sales and profits amid changing market conditions has helped the company fortify its position among competitors in the chemical manufacturing sector. In the first quarter (July-Sept) of FY23, the chemical maker posted sales of Rs1.7 billion. It came with gross profit of Rs842 million and net profit of Rs518 million on the total sales.

In the second quarter (Oct-Dec), the company posted income of Rs1.78 billion, and gross profit of Rs826 million and net profit of Rs488 million on the total sales. In the third quarter (Jan-March), the firm posted income of Rs1.6 billion and gross income of Rs566 million. It posted a net profit of Rs293 million. In a market characterised by volatility and unpredictability, Descon Oxychem has demonstrated an exceptional capacity to maneuver through challenges. The consistent focus on optimising sales and profitability highlights the company's commitment to sound financial management practices.

Performance in FY22

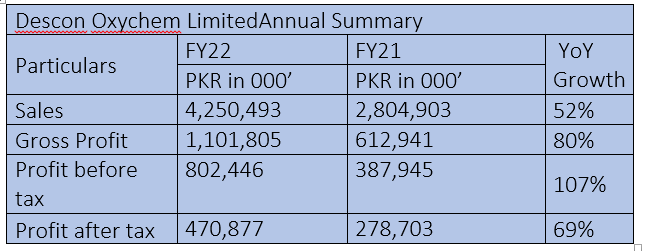

In the fiscal year 2021-22, the company reported an increase in net sales, which reached Rs4.2 billion against Rs2.8 billion in FY21, indicating a healthy growth of 52%. The gross profit jumped 80% to Rs1.1 billion in FY22 from the previous year's Rs612 million.

The company’s profit-before-tax also soared 107% to Rs802 million in FY22 from the previous year's Rs387 million. Moreover, the company’s profit-after-tax increased 69% to Rs470 million in FY22 from Rs278 million in FY21.

Earnings per share

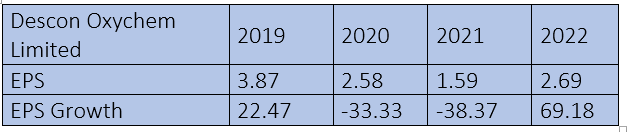

The earnings per share of the company remained robust from 2019 to 2022, achieving a high of Rs3.87 in 2019 and a low of Rs1.59 in 2021. The EPS growth was negative in 2020 and 2021, but relatively healthy in 2019 and quite remarkable in 2022.

The healthy EPS demonstrates the company's ability to adapt to changing market conditions and capitalise on opportunities. While the years 2020 and 2021 posed challenges as far as the EPS growth is concerned, the substantial growth in EPS in 2022 signals a promising trajectory for Descon Oxychem as it continues to navigate the business landscape with determination and strategic acumen.

Ratio analysis

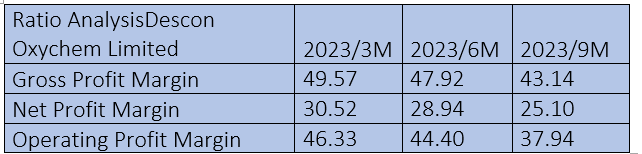

Descon Oxychem Limited's gross profit margin reveals a steady trend across the three quarters of FY23. It started at a robust 49.57% in the first quarter of FY23, indicating the company’s ability to generate profit after accounting for production costs. Despite a marginal decline in gross profit margin to 47.92% in the second quarter and a more pronounced dip to 43.14% in the third quarter, the margin remained relatively strong. This trend suggests the company's cost control measures are effective, but the downward trajectory could warrant attention to maintaining profitability amidst changing market conditions.

The net profit margin mirrors a consistent pattern. It began at an impressive 30.52% in the first quarter, signifying efficient expense management and strong revenue generation. The trend continued, though with a slight dip, with 28.94% in the second quarter and 25.10% in the third quarter. While the net profit margin showcases the company's profitability, the gradual decrease underscores the need to balance revenue growth with cost efficiency to sustain healthy margins. Descon Oxychem Limited's operating profit margin demonstrated a similar trend. The company posted a robust 46.33% in the first quarter, showcasing its ability to generate profit from core operations.

The trend continued with 44.40% margin in the second quarter and 37.94% in the third quarter, albeit with some declines. The decline suggests potential challenges in optimising operational costs, making it vital for the company to evaluate strategies that can enhance operational efficiency. The consistent decline across gross, net and operating profit margins over the three quarters of FY23 implies that Descon Oxychem Limited may be facing cost-related challenges or changes in the competitive landscape. This emphasises the importance of assessing the company's cost structure, pricing strategies and operational efficiency measures.

Industry comparison

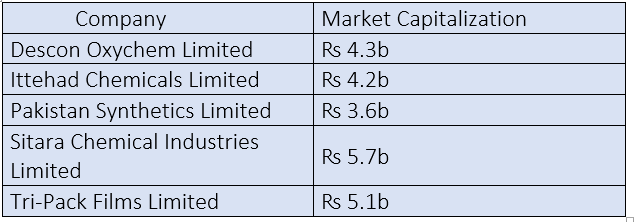

Descon Oxychem Limited’s competitors include Ittehad Chemicals Limited, Pakistan Synthetics Limited, Sitara Chemical Industries Limited and Tri-Pack Films Limited.

Descon Oxychem has a market capitalisation of ₨4.3 billion. Sitara Chemical Industries Limited has the highest market value of ₨5.7 billion and Pakistan Synthetics Limited has the lowest market value of ₨3.6 billion.

About the company

Descon Oxychem Limited is engaged in the manufacturing, procurement and sale of hydrogen peroxide and allied products. The company's products include hydrogen peroxide (H2O2), sanidol and careOx 35. The careOx 35 is specially formulated as a drinking water system cleaner and disinfectant in poultry and dairy farms. It is also used to kill all pathogenic bacteria and viruses. The company's applications include chemical pulp, mechanical pulp, paper recycling, textile and specialty bleaching. The textile application is categorised into textile animal fibers, textile artificial fibers or regenerated cellulose, textiles-dye oxidation and textiles-synthetic fibers. The company has distributors in the Sindh and Punjab provinces, besides distribution network in India and Sri Lanka.

Credit: INP-WealthPk