INP-WealthPk

Jawad Ahmed

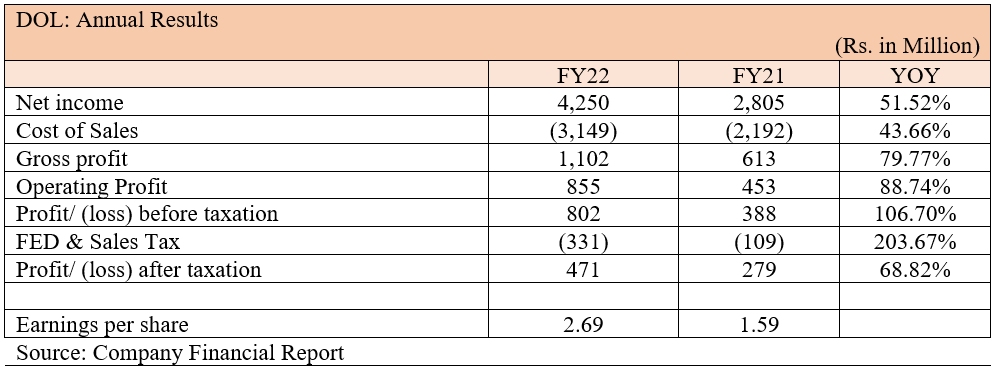

Descon Oxychem Limited posted revenues of Rs4.25 billion in the fiscal year 2021-22, up by 51.5% from Rs2.80 billion in the previous year, according to WealthPK. The company's main activities include the production, acquisition and marketing of hydrogen peroxide and related items.

The company's top-line increased significantly in FY22, with a gross profit of Rs1.1 billion, up from Rs613 million in the previous year, representing a gain of 43.6%. The net profitability of the company increased by 68.8% from Rs279 million in FY21 to Rs471 million in FY22, which caused the earnings per share (EPS) to increase to Rs2.69 from Rs1.59 the previous year.

Historical financial performance

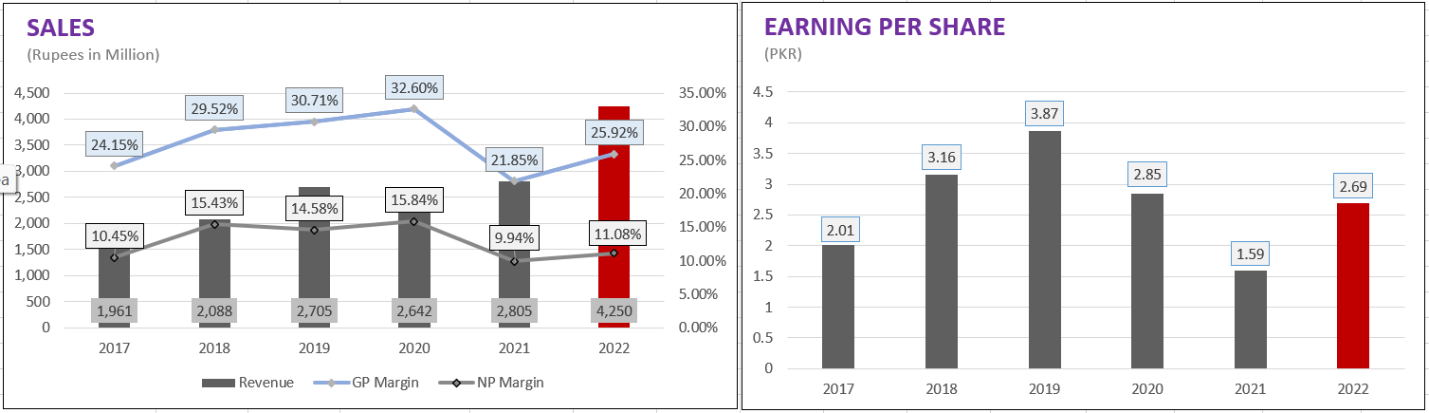

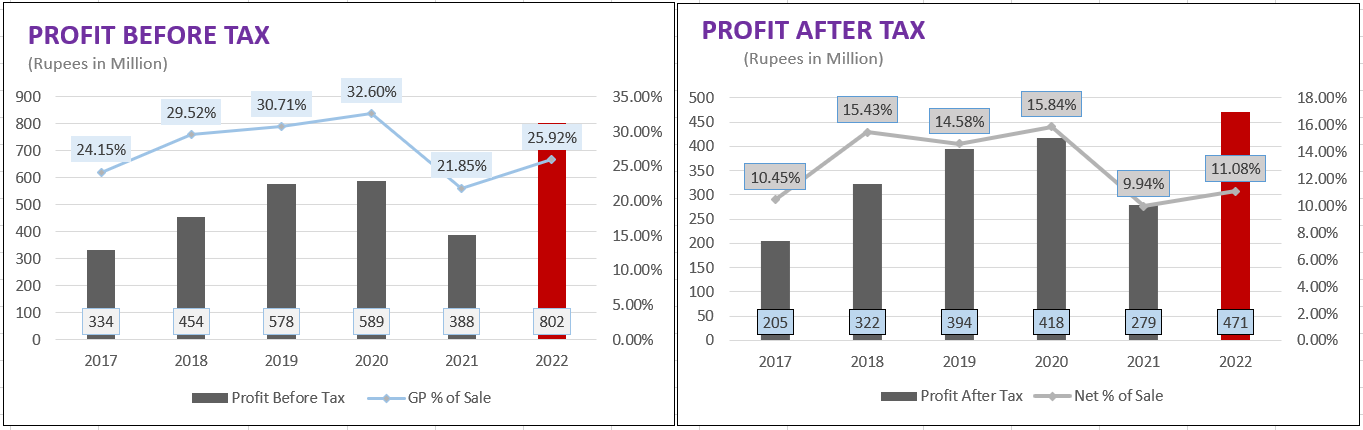

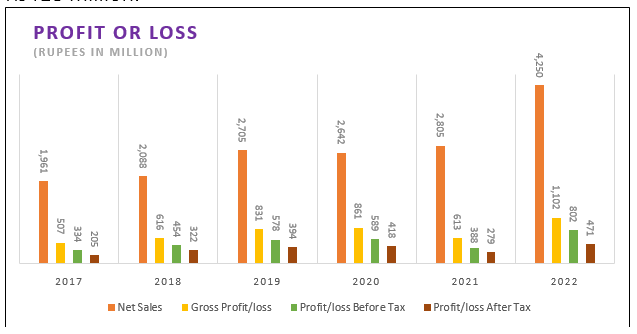

In 2019, sales for the business totalled Rs2.7 billion, a 29.6% increase over Rs2 billion the year before. The gross profit of the company for the year 2019 increased by 35% from Rs616 million to Rs831 million, and the profit-after-tax registered an increase of 22.4% to Rs394 million compared to a net profit of Rs322 million in 2018. The company's profits caused the EPS to climb from Rs3.16 in 2018 to Rs3.87 in 2019.

In 2020, due to the Covid-19 pandemic and the challenging economic situation, the company’s sales marginally dropped 2.3% to Rs2.6 billion from Rs2.7 billion the previous year. However, the company managed to increase the gross profit to Rs861 million from Rs831 million previously. After tax deductions, the company registered a net profit of Rs418 million in 2020 compared to Rs394 million the year before, showing a growth of 6.1%.

In 2021, the topline of the company slightly rose to Rs2.8 billion from Rs2.6 billion the previous year, due to increased sales volume. The cross profit went down to Rs613 million from Rs861 million the previous year primarily due to increase in depreciation expense, increased utility prices and shutdown expense. The net profit also decreased to 279 million from the earlier Rs418 million.

Recent results and future outlook

The company’s revenue growth has continued to rise in FY22. Value-wise, the topline reached an all-time high of Rs4.25 billion. That resulted in an increasing purchasing power with the return of commercial activity in the post-Covid-19 period. According to the financial report, the company is perfectly matched with the high growth/export-focused textile sector, which is in accordance with the government's aim to enhance exports. The company wants to continue investing in improvement and data-driven decision-making to maintain its best-in-class position in safety, production efficiency and market intelligence.

Credit: Independent News Pakistan-WealthPk