INP-WealthPk

Shams ul Nisa

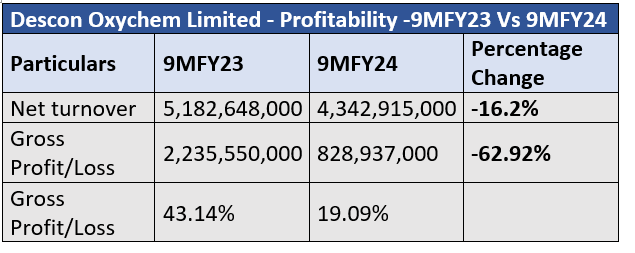

Chemical maker Descon Oxychem Limited delivered sluggish results, with revenue down by 16.2%, gross sales by 62.92%, and net profit by 70.3% in the first nine months of the ongoing fiscal year (9MFY24) as compared to the corresponding period of FY23, reports WealthPK. High re-gasified liquefied natural gas costs, high packing material costs, steep slide in product prices, and dumping of products by international players into the Pakistani market notably caused this gloomy performance. Gross and net margins shrank to 19.09% and 8.90% in 9MFY24 from 43.14% and 25.10% in the same period last year. Similarly, operating profit plummeted to Rs680.8 million, 64.14% lower than Rs1.89 billion in 9MFY23. Likewise, profit-before-tax marked a decline of 64.86% to Rs660.12 million in 9MCY24.

As per the financial report, the company's recent exports helped slightly offset the decline in H2O2 pricing caused by foreign players dumping their products and the slump in the textile sector. This has enhanced the company's capacity to put volumes overseas despite obstacles. The government's emphasis on developing an energy supply mix and the improved economic conditions will allow the corporation to anticipate short-term improvements in sales and profitability. At the end of nine months of FY24, the earnings per share contracted to Rs2.21 from Rs7.43 in 9MFY23.

Quarterly analysis

![]()

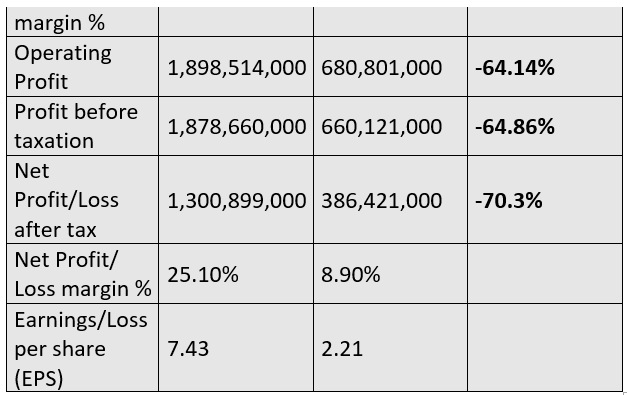

The third quarter of FY24 followed similar declining financials, with net turnover sliding to Rs1.44 billion from Rs1.69 billion in 3QFY23, representing a 15.1% contraction. Furthermore, operating and net profits shrank by 56.27% and 58.9%, respectively, to Rs195.06 million and Rs120.47 million in 3QFY24. Earnings per share stood lower at Rs0.69 in 3QFY24 against Rs1.67 in 3QFY23.

Profitability ratios analysis

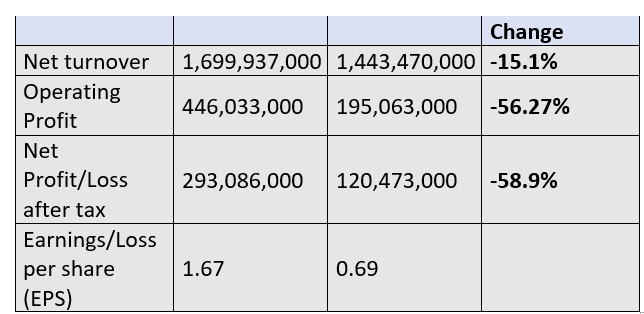

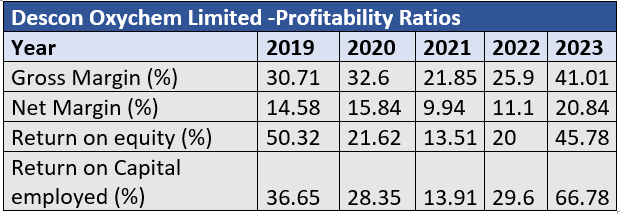

The gross margin for Descon Oxychem Limited has grown consistently over the last five years, starting from 2019, with a single dip of 21.85% in 2021. The overall growth indicates favorable progress of the company through increased sales and lower expenses. The gross margin climbed by 33.54% from 30.71% in 2019 to 41.01% in 2023.

Likewise, the net margin ballooned by around 42.94% from 14.58% in 2019 to a maximum of 20.84% in 2023. The company recorded a minimum net margin of 9.94% in 2021. The return on equity decreased from 50.32% in 2019 to 45.78% in 2023. This implies the company wasn't making enough profit from the shareholders' investment. The return on capital employed fell gradually from 36.65% in 2019 to the lowest of 13.91% in 2021, but expanded in later years, reaching 66.78% in 2023.

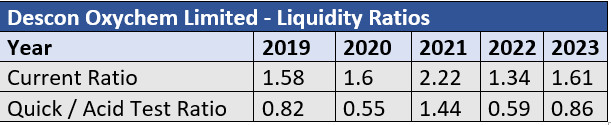

Liquidity ratios analysis

The current ratio, which evaluates the extent to which a company's current assets may be used to pay down its short-term liabilities, stayed over 1.2 in the past five years, showing Descon Oxychem had enough cash to cover its current liabilities. The company witnessed a maximum current ratio of 2.22 in 2021. In contrast, except for 2021, the quick ratio stayed below 1, indicating fewer liquid assets to pay the company's debts.

Future outlook

The company faces financial challenges due to global inflation and a slowdown in the textile sector. It is, however, working on strategies to meet these challenges by focusing on the textile, food and mining sectors. The goal of the company is to become the lowest-cost producer and dominant player in the region through manufacturing excellence and international market development programs. Apart from meeting the current market needs, the company's primary focus is creating new market sectors domestically and internationally.

Company profile

It was incorporated as a private limited company in 2004 and converted into a public limited company in 2008. It is principally engaged in the manufacturing, procurement and sale of hydrogen peroxide and allied products.

Credit: INP-WealthPk