INP-WealthPk

Shams ul Nisa

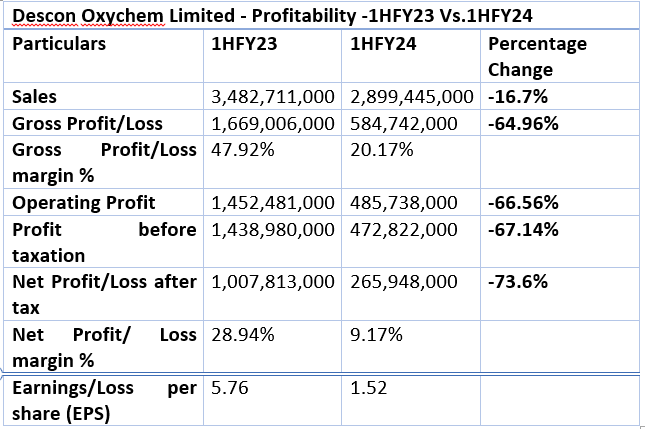

The sales and net profitability of Descon Oxychem Limited (DOL) – a leading supplier of hydrogen peroxide in Pakistan – decreased by 16.7% and 73.6%, respectively, during the first half of the ongoing fiscal year (1HFY24) compared to the corresponding period of FY23. The company also recorded a huge decline of 64.96% in its gross profit, which plunged to Rs584.7 million from Rs1.66 billion in 1HFY23. The company attributed this decline to reduction in volumes, high RLNG costs coupled with a sharp decline in prices and the dumping of goods into the Pakistani market by foreign competitors.

The company's gross profit margin contracted to 20.17% in 1HFY24 from 47.92% in 1HFY23, marking a challenging period for the hydrogen peroxide supplier. The company’s operating profit and profit-before-tax dropped significantly by 66.56% and 67.14%, respectively. The net profit margin reduced substantially to 9.17% in 1HFY24 from 28.94% in 1HFY23. Thus, in 1HFY24, the earnings per share (EPS) also plunged to Rs1.52 from Rs5.76 in the same period last year.

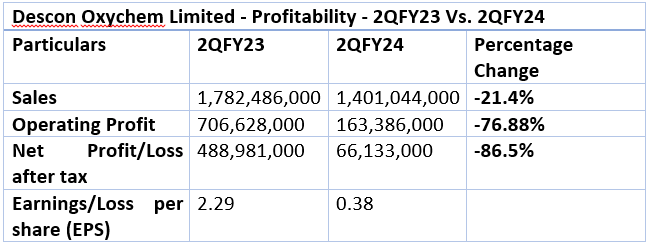

Quarterly analysis

The quarterly analysis provides a similar trend, with sales and operating profit plunging by 21.4% and 76.88%, respectively, in the 2QFY24 compared to the same period in FY23. Similarly, the chemical maker’s net profit nosedived to Rs66.13 million, indicating a decline of 86.5% from Rs488.9 million in 2QFY23. The EPS contracted from Rs2.29 in 2QFY23 to Rs0.38 in 2QFY24.

Historical trend

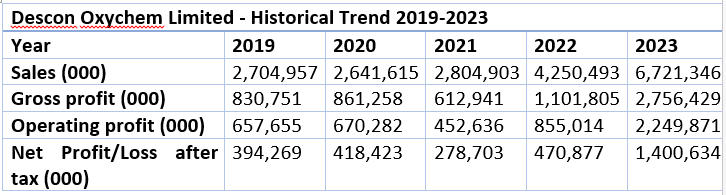

DOL’s sales climbed from Rs2.7 billion in 2019 to Rs6.7 billion in 2023, with a small decline in 2020. The gross profit increased from Rs830.7 million in 2019 to the peak of Rs2.756 billion in 2023. The company witnessed a decline in its gross profit in 2021.

The operating profit showed the similar pattern, barring a decline in 2021. The operating profit increased from Rs657.65 million in 2019 to Rs670.28 million in 2020 before falling to Rs452.6 million in 2021. It rose again to Rs855.014 million and Rs2.249 billion, respectively, in 2022 and 2023. This considerable increase was the outcome of the company's improved operational actions during the time. Similarly, the company's net profit kept increasing, barring 2021, and peaked in 2023 at Rs1.4 billion.

Profitability ratios analysis

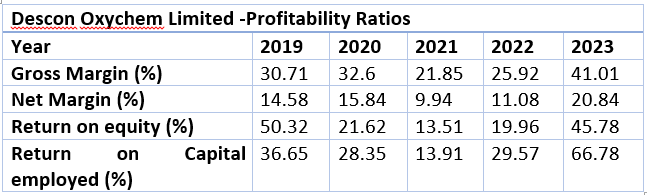

DOL’s gross profit margin grew from 30.71% in 2019 to 41.01% in 2023, with a dip of 21.85% in 2021. The company's increased sales, lower expenses and more efficient manufacturing were responsible for this improvement in gross profit margin.

The net profit margin recorded a maximum of 20.84% in 2023, and a minimum of 9.94% in 2021, whereas the return on equity remained volatile during the last five years, falling from 50.32% in 2019 to 45.78% in 2023. However, the company's return on capital employed significantly increased from 36.65% in 2019 to 66.78% in 2023.

Liquidity ratios analysis

The current ratio evaluates the extent to which the company's current assets may be used to pay down its short-term liabilities. The fact that DOL's current ratio stayed over 1.2 shows that it had enough cash on hand to cover its current liabilities. In 2021, the company recorded greatest current ratio of 2.22 and the lowest of 1.34 in 2022.

![]()

![]()

In contrast, the quick ratio stayed below 1 in 2019, 2020, 2022 and 2023. In 2019, the company posted a quick ratio of 0.82, indicating that it could use its assets to pay back 82% of its obligation. However, in 2021, the company witnessed the highest ratio of 1.44, showcasing sufficient liquid assets to pay its debts.

Future outlook

The company faces challenges due to price reductions and cost increases caused by global supply chain disruptions and slowdown in the textile sector. The company is, however, continuously working on developing new markets and integrating organic growth into the textile, food and mining segments. Furthermore, the company aims to achieve economies of scale by improving raw material consumption, becoming the lowest-cost producer, and dominating the market through manufacturing excellence and international market development programmes.

Credit: INP-WealthPk