INP-WealthPk

Shams ul Nisa

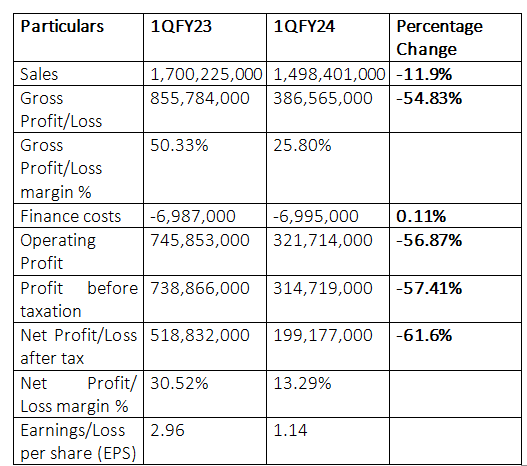

Descon Oxychem Limited faced a decline of 11.9% in sales and a huge 61.6% dip in net profitability during the first quarter of the ongoing fiscal year 2023-24 (1QFY24). The company registered sales of Rs1.49 billion in 1QFY24 compared to Rs1.7 billion in the same period last year. The company attributed this decline in sales to the increase in costs of sales due to high raw material costs linked with the Ukraine crisis and global inflation. The company generated a net profit of Rs199.17 million in 1QFY24 compared to Rs518.8 million recorded in 1QFY23. The company encountered difficulties in implementing its product pricing plan since the supply of the product in the local marketplaces exceeded the demand because of the worldwide economic downturn. During 1QFY24, the gross profit plunged by 54.83% to Rs386.56 million from Rs855.78 million in 1QFY23. The company produced higher volumes after expanding its capacity in 2020 to enter new markets and categories. The company’s gross profit margin plunged to 25.80% in 1QFY24 from 50.33% registered in the same period last year.

![]()

The finance costs went up by 0.11% to Rs6.99 million in the period under review from Rs6.98 million posted in 1QFY23. Conversely, the operating profit fell 56.87% to Rs321.7 million in 1QFY24 from Rs745.8 million in 1QFY23. During 1QFY24, the profit-before-tax clocked in at Rs314.7 million, 57.41% lower than Rs738.86 million in 1QFY23. The decline in sales and increased costs of the company resulted in a lower net profit margin of 13.29% in 1QFY24 against 30.52% in the same period last year. The earnings per share clocked in at Rs1.14 in 1QFY24 compared to Rs2.96 in 1QFY23.

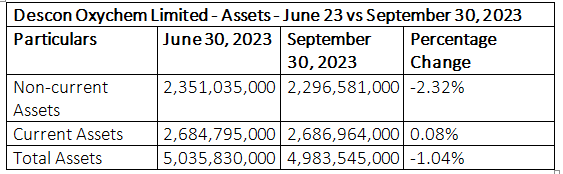

Assets analysis

As of September 2023, the company’s non-current assets totalled Rs2.29 billion compared to Rs2.35.8 million in June 2023, posting a negative growth of 2.32%. This reduction is due to currency depreciation during the period.Descon Oxychem Limited experienced a slight increase of 0.08% in current assets, which increased from Rs2.684 billion in June 2023 to Rs2.686 billion in September 2023. This shows that the company experienced a minute rise in short-term assets during this period. The decrease in non-current offsets and the increase in current assets resulted in an overall decline of 1.04% in total assets.

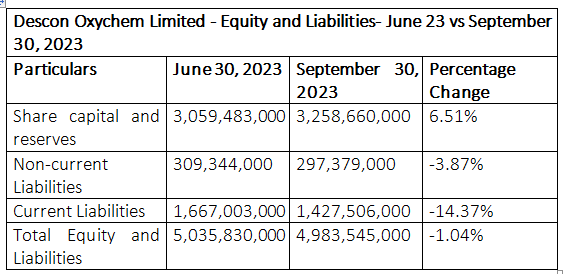

Equity and liabilities analysis

The company’s share capital and reserves went up by 6.51% to Rs3.258 billion in September 2023. Its non-current liabilities stood at Rs297.37 million in September 2023 compared to Rs309.34 million in June 2023, constituting a decline of 3.87%. This reduction indicated that the company paid off its long-term obligations. Similarly, the company’s current liabilities and total equity and liabilities reduced by 14.37% and 1.04%, respectively, reflecting a decline in borrowing.

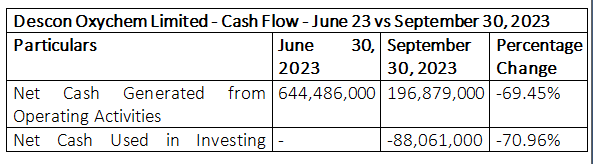

Cash flow analysis

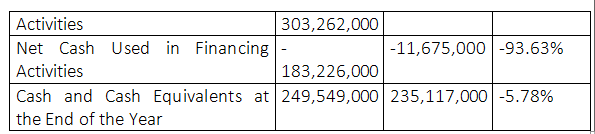

The company’s cash used for operating activities contracted significantly from Rs644.48 million in June 2023 to Rs196.87 million in September 2023. In September 2023, the company used Rs88.06 million cash in investing activities compared to Rs303.26 million in June 2023. Likewise, the company's net cash used in financing activities and cash and cash equivalents at end of the year plunged by 93.63% and by 5.78%, respectively, in September 2023. The company attributed this reduction in the cash flow from operations to the decline in profitability during the period under review.

Credit: INP-WealthPk