INP-WealthPk

Shams ul Nisa

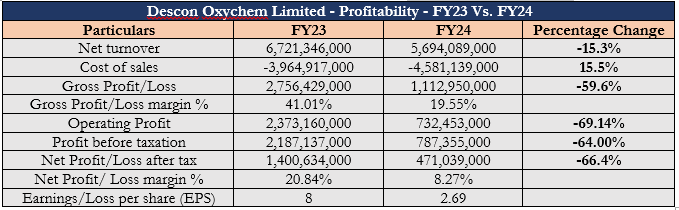

Descon Oxychem Limited's net turnover declined significantly by 15.3% to Rs5.69 billion, and net profit dropped by 66.4% during the fiscal year 2024, reports WealthPK.

The company attributed its profit decline to rising electricity costs and increased competition from dumped international products. The cost of sales surged by 15.5% to Rs4.58 billion, intensifying pressure on profitability. Consequently, the gross profit dropped by 59.6% to Rs1.11 billion, with the gross profit margin decreasing sharply from 41.01% in FY23 to 19.55% in FY24.

Similarly, the company’s operating profit fell by 69.14% to Rs732.45 million, and profit before taxation declined by 64% to Rs787.36 million in FY24, underscoring the adverse effects of shrinking revenue and rising costs. The net profit margin narrowed from 20.84% in FY23 to 8.27% in FY24, and earnings per share dropped from Rs8 to Rs2.69, reflecting reduced shareholder value and potentially affecting investor confidence.

Historical Trend

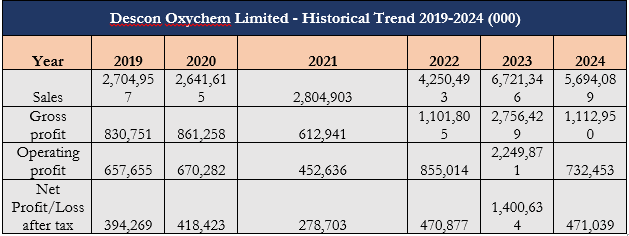

Descon Oxychem Limited experienced notable financial volatility from 2019 to 2024, with periods of strong growth followed by significant declines. The company’s sales increased from Rs2.70 billion in 2019 to Rs6.72 billion in 2023, indicating strong revenue growth. However, the sales dropped to Rs5.69 billion in 2024.

The gross profit followed a similar pattern, climbing from Rs830.75 million in 2019 to Rs2.76 billion in 2023, before falling sharply to Rs1.11 billion in 2024, likely due to rising costs or pricing challenges. Furthermore, the operating profit, which peaked at Rs2.25 billion in 2023, also decreased to Rs732.4 million in 2024, suggesting operational difficulties. The net profit rose from Rs394.27 million in 2019 to Rs1.40 billion in 2023, but dropped significantly to Rs471.04 million in 2024, highlighting challenges in sustaining profitability.

Profitability Ratios

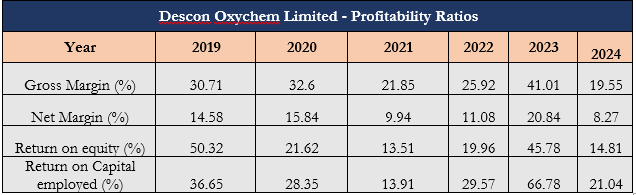

Descon Oxychem Limited's profitability ratios from 2019 to 2024 indicated significant fluctuations in financial performance. The gross margin showed notable instability, reaching a high of 41.01% in 2023 before dropping to 19.55% in 2024. Similarly, the net margin increased from 14.58% in 2019 to 20.84% in 2023, only to decrease to 8.27% in 2024.

The return on equity ratio fluctuated from 50.32% in 2019 to 14.81% by 2024, suggesting challenges in sustaining growth and profitability. The return on capital employed also dropped from 66.78% in 2023 to 21.04% in 2024, indicating that while the company generated substantial returns on its capital investments during strong performance periods, it struggled to maintain those returns amid declining sales and profitability.

Future Outlook

The company aims to control fixed costs, diversify market segments, and increase margins by entering diversified export markets. It is working on risk mitigation strategies and capitalizing on opportunities to maximize shareholder value by exploring profitable export markets and business segments. The company aims to maintain its top-notch position in safety, production efficiency, and market intelligence through continuous improvement and data-driven decision-making.

Company profile

The Company was incorporated as a private limited Company in 2004 and in 2028 it was converted into a public limited company. The Company primarily manufactures, procures, and sells hydrogen peroxide and related products. It began trial production in 2008 and began commercial production in 2009.

Credit: INP-WealthPk