INP-WealthPk

Shams ul Nisa

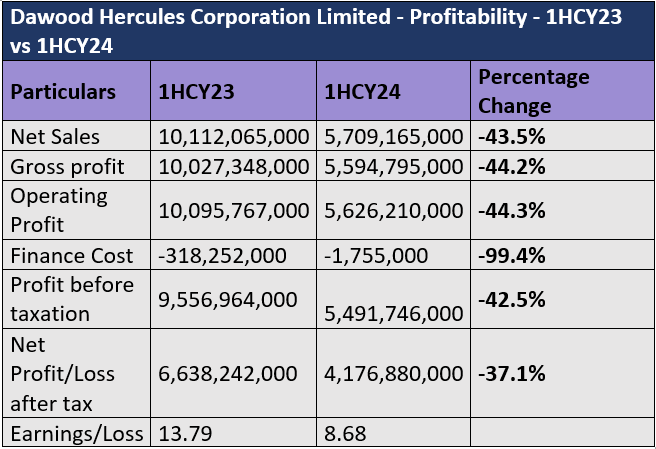

Dawood Hercules net sales plunged by 43.5%, gross profit by 44.2%, and operating profit by 44.3%, respectively, during the first half of the ongoing calendar year 2024 compared to the corresponding period of 2023, reports WealthPK.

The sales and profits declined despite a 99.4% decrease in finance costs. Similarly, the company’s profit-before-taxation fell by 42.5% and net profit by 37.1% in 1HCY24. This decline was driven by rising costs, mainly due to inflation and a reduction in profit from discontinued operations. As a result, the earnings per share fell from Rs13.79 in 1HCY23 to Rs8.68 in 1HCY24, potentially affecting investor sentiment and confidence in the company’s future prospects.

Analysis of income statement

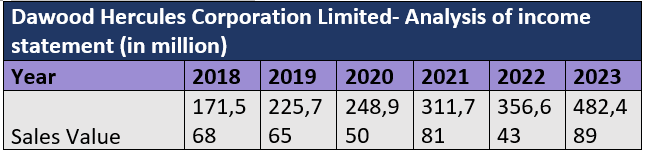

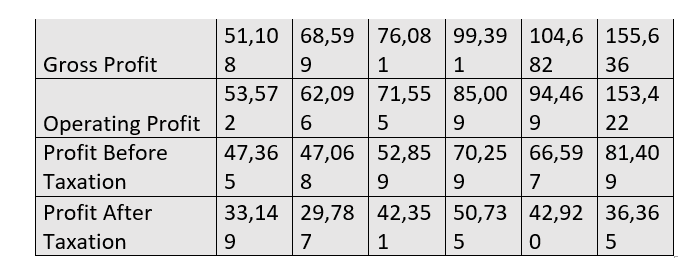

The company’s sales value has steadily risen from Rs171.5 billion in 2018 to Rs482.4 billion in 2023, marking an impressive growth of about 181% over five years. This substantial increase underscores the company’s capability to grow its market share and seize opportunities in demand for its products. The gross profit also surged 205% from Rs51.1 billion in 2018 to Rs155.6 billion in 2023. This improvement in gross profit indicates effective management of production costs in relation to sales over the years.

The operating profit exhibited a similar pattern, increasing from Rs53.5 billion in 2018 to Rs153.4 billion in 2023. This growth highlights the company’s operational efficiency and its ability to manage overhead costs while expanding production. The profit-before-taxation climbed to Rs81.4 billion in 2023 from Rs47.3 billion in 2018. The profit-after-tax peaked at Rs50.7 billion in 2021 but then slipped to Rs36.3 billion in 2023, indicating a decline of around 28%.

Statement of balance sheet

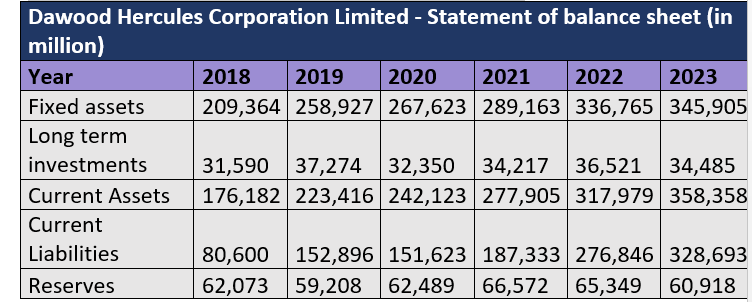

Dawood Hercules has shown a steady increase in fixed assets, which rose from Rs209.3 billion in 2018 to Rs345.9 billion in 2023. This growth of approximately 65% indicates the company's commitment to investing in its infrastructure and operational capacity, which is essential for supporting its expanding business activities. The long-term investments fluctuated in between and stood at Rs34.4 billion in 2023 compared to Rs31.5 billion in 2018. However, the current assets increased significantly, from Rs176.1 billion in 2018 to Rs358.3 billion in 2023, reflecting improved liquidity and the company’s ability to meet short-term obligations.

Similarly, the current liabilities grew from Rs80.6 billion in 2018 to Rs328.6 billion in 2023, suggesting that the company continued to bear short-term obligations as it expanded. The reserves fluctuated over the years, decreasing from Rs62 billion in 2018 to Rs60.9 billion in 2023. The company reported highest reserves of Rs66.5 billion in 2021.

Future outlook

The country is currently experiencing a sluggish economic growth due to stabilisation measures mandated under the IMF programme. Attempts are also being made to implement structural reforms to plug fiscal leakages. At the same time, thanks to easing in inflation, interest rates declined, enabling businesses to manage financial costs. This will also benefit equity markets as fixed-income investments will become less attractive.

Company profile

Dawood Hercules Corporation was incorporated in Pakistan on April 17, 1968 as a public limited company under the Companies Act, 1913 (now the Companies Act, 2017). The principal activity of the company is to manage investments, including in its subsidiaries and associated companies.

Credit: INP-WealthPk