INP-WealthPk

Shams ul Nisa

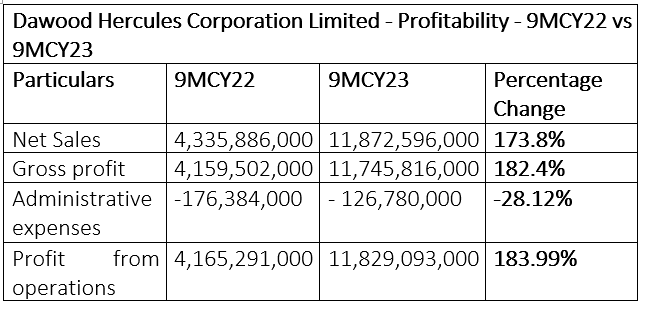

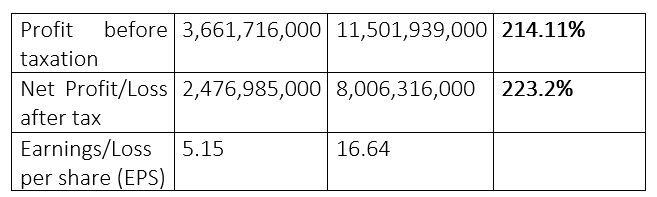

Dawood Hercules Corporation Limited (DHCL) – an investment and holding company – posted remarkable growth in net sales and profitability in the first nine months of the last calendar year 2023 compared to the corresponding period the year earlier. The company registered an impressive increase of 173.8% in its net sales during the period. According to its financials, the firm posted net sales of Rs11.8 billion in 9MCY23 compared to Rs4.33 billion in 9MCY22. During 9MCY23, DHCL's gross profit soared 182.4% to Rs11.7 billion from Rs4.15 billion in 9MCY22.

The company managed to reduce its administrative expenses by 28.12% during the period under review, indicating it opted for cost-effective strategies to ensure growth in financials.

The company posted Rs11.8 billion profit from operations for the period, which was 183.99% higher than Rs4.16 billion in 9MCY22. Similarly, the profit-before-tax expanded significantly by 214.11% to Rs11.5 billion in 9MCY23 from Rs3.66 billion in 9MCY22. The net profit jumped by 223.2% to Rs8.006 billion from Rs2.47 billion in 9MCY22. This surge translated into earnings per share of Rs16.64 in 9MCY23 against Rs5.15 in 9MCY22.

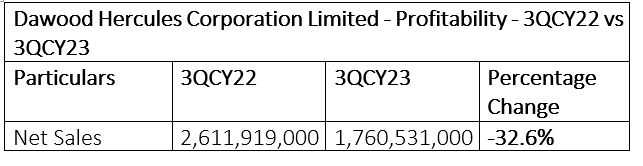

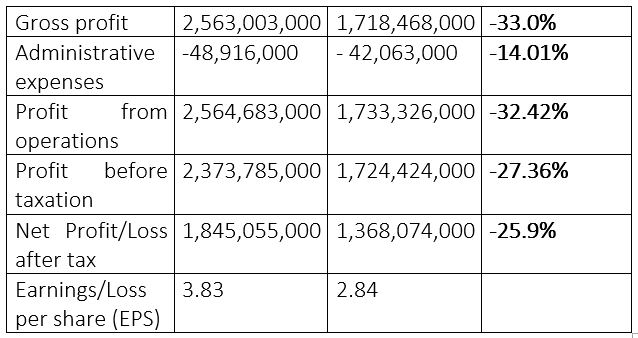

3QCY22 vs 3QCY23

The third quarter ended September 30, 2023, posted significant losses compared to the same period of the previous year. The company's net sales decreased 32.6% to Rs1.7 billion in 3QCY23 from Rs2.6 billion in 3QCY22. Gross profit stood at Rs1.7 billion, down from Rs2.5 billion in 3QCY22, posting a 33% decrease.

The administrative expenses fell by 14.01% to Rs42.06 million from Rs48.9 million in 3QCY22. DHCL's profit from operations and profit-before-tax decreased by 32.42% and 27.36%, respectively, in 3QCY23. The company's net profitability decreased 25.9% to Rs1.36 billion in 3QCY23 from Rs1.84 billion in 3QCY22. Hence, the earnings per share declined to Rs2.84 in 3QFY23 from Rs3.83 in 3QCY22.

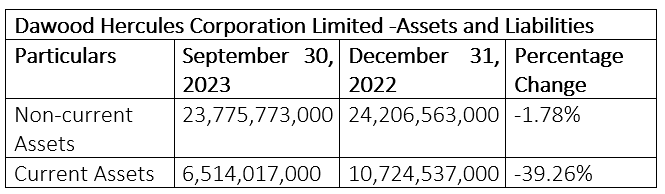

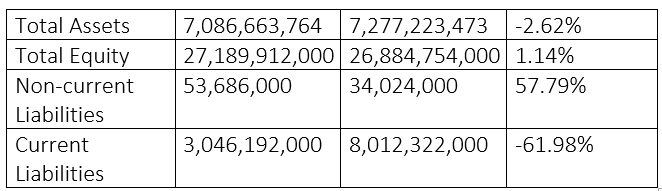

Assets and liabilities analysis

In comparison to December 31, 2022, Dawood Hercules Corporation Limited reported a decrease of 39.26% and 1.78%, respectively, in current and non-current assets on September 30, 2023. Consequently, the total assets inched down from Rs7.27 billion in December 2022 to Rs7.08 billion in September 2023, posting a decrease of 2.62%. The company's total equity in September 2023 stood at Rs27.18 billion compared to Rs26.88 billion at the end of December 2022, showcasing a marginal increase of 1.14%.

However, non-current liabilities experienced a significant surge of 57.79% in September 2023 from December 2022. The business successfully decreased its current liabilities from Rs8.01 billion in December 2022 to Rs3.04 billion in September 2023, posting a massive decline of 61.98%.

Credit: INP-WealthPk