INP-WealthPk

Hifsa Raja

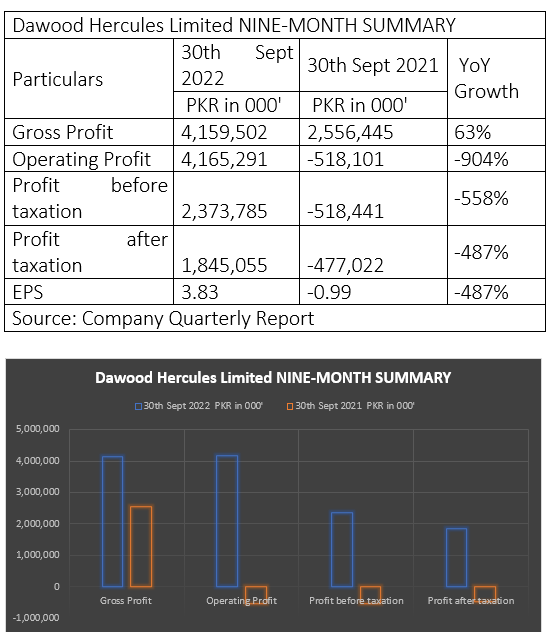

Dawood Hercules Corporation Limited’s gross profit increased 63% to Rs4.1 billion in the first nine months of the calendar year 2022 (9MCY22) from Rs2.55 billion over the corresponding period of the previous year. The company’s operating profit increased by mammoth 904% to Rs4.1 billion in 9MCY22 from an operating loss of Rs518 million in 9MCY21. The profit-before taxation jumped 558% to Rs2.3 billion from a loss-before tax of Rs518 million in 9MCY21. The profit-after taxation also leapt 487% to Rs1.8 billion in 9MCY22 from a post-tax loss of Rs477 million in 9MCY21, reports WealthPK.

Earnings Growth Analysis

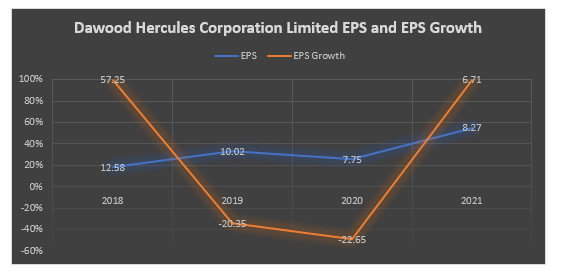

The company's ability to grow its earnings can be attributed to its operational efficiency and effective cost management. The growth trajectory of Dawood Hercules Corporation Limited is poised to continue. The business is making investments in the energy sector, and it intends to grow its portfolio of power plants to boost its capacity for generating electricity.

Additionally, it is making investments in sustainable energy sources like wind and solar energy. Moreover, the government's focus on boosting Pakistani farm output is anticipated to promote the company's fertiliser business through higher demand. Through its joint venture with Mitsubishi Corporation, which is dedicated to creating new enterprises in Pakistan, the company is also pursuing prospects in the industrial sector.

Dawood Hercules Corporation Limited has shown strong historical earnings growth and has a positive outlook for future growth. Its diversified portfolio of businesses and ongoing investments in its core segments bode well for its future earnings growth.

Industry Comparison

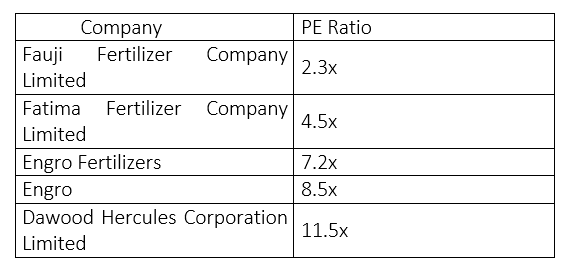

Fauji Fertilizers, Fatima Fertilizers, Engro Fertilizers, and Engro have all been regarded as rivals of Dawood Hercules.

The price-to-earnings ratio of Dawood Hercules is higher than that of its peers, which means it is expensive for investors based on its price-to-earnings ratio (11x) compared to its peers’ average of (5.6x). This suggests investors will pay a higher price for each rupee of earnings than its peers.

Profitability

The company's net profit margin has seen steady improvement over the past five years. In 2021, Dawood Hercules Corporation’s net profit margin was 5.7%, up from 3.8% in 2017. This can be attributed to the company's cost management initiatives, operational efficiencies, and lower effective tax rate. The company’s focus on its energy segment, which has higher profit margins, has also contributed to the improvement in its net profit margin.

Company Profile

Dawood Hercules Corporation was incorporated in Pakistan on April 17, 1968, as a public limited company under the Companies Act, 1913 (now the Companies Act, 2017). The principal activity of the company is to manage investments, including in its subsidiaries and associated companies.

Credit: Independent News Pakistan-WealthPk