INP-WealthPk

Hifsa Raja

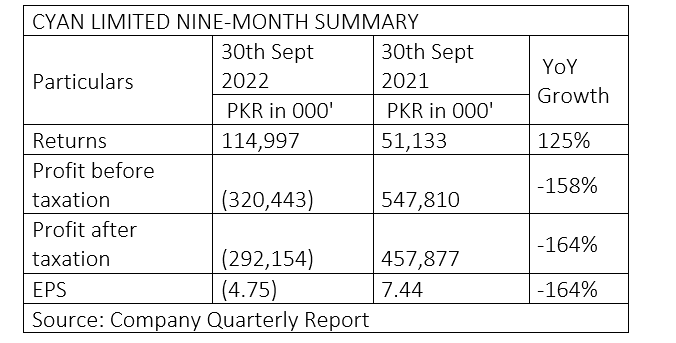

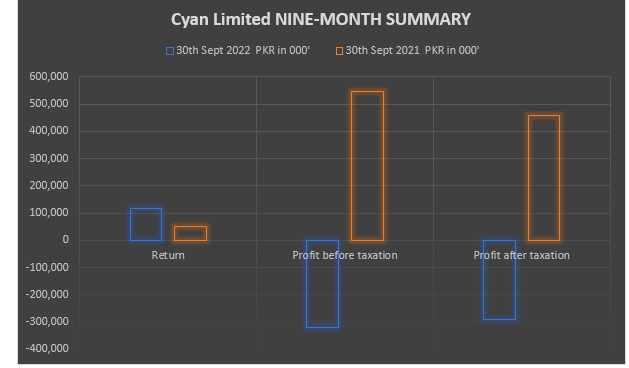

Cyan Limited’s returns increased 125% to Rs114 million in the first nine months of calendar year 2022 from Rs51 million over the corresponding period of 2021. However, the company suffered loss-before-taxation of Rs320 million in 9MCY22 compared to profit-before-taxation of Rs547 million over the corresponding period of CY21, showing a negative growth of 158%. Likewise, the firm’s net loss stood at Rs292 million in 9MCY22, which was 164% down from a net profit of Rs457 million over the corresponding period of CY21, reports WealthPK.

By the end of the third quarter of CY22, the company had plans to change its strategy to invest in high-yielding blue-chip firms with significant capacity for cash flow production. The company is rationalising its portfolio in order to minimise exposure from high beta securities and turn to dividend-paying value stocks. Additionally, the company is effectively controlling operating costs while optimising its leverage position.

The company is adjusting its investment portfolio strategy and rationalising bank leverage. The company may suffer further losses in the process, but once accomplished, it will have a low-beta portfolio that yields quite well.

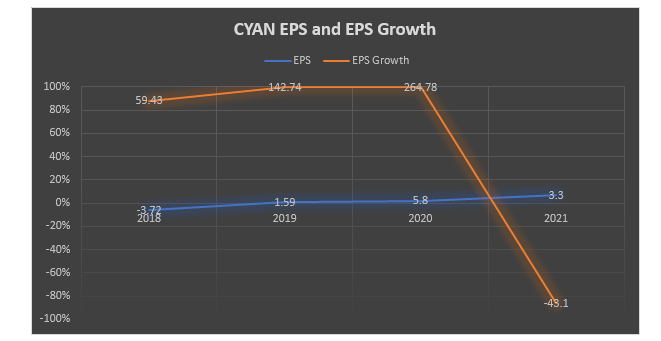

Earnings Growth Analysis

The earnings per share growth of the company remained strong from 2018 to 2020, but the growth trajectory plunged in 2021 due to political and economic uncertainties. Conversely, the earnings per share remained somewhat mixed from 2019 to 2021.

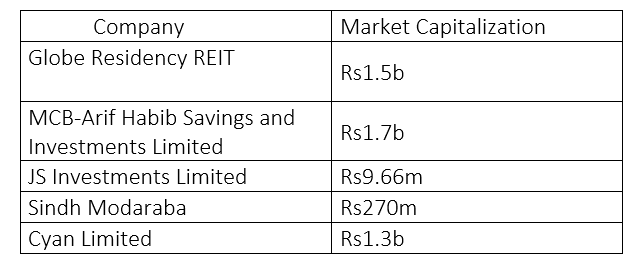

Industry Comparison

Globe Residency REIT, MCB-Arif Habib Savings and Investments Limited, JS Investments Limited and Sindh Modaraba are regarded as rivals of Cyan Limited. Investors use market capitalisation to determine the size of a firm, as it reflects the price investors are prepared to pay for a company's stock.

MCB-Arif Habib Savings and Investments Limited has the highest market capitalisation of Rs1.7 billion followed by Global Residency REIT's Rs1.5 billion. With a value of Rs1.3 billion, Cyan Limited has the third-largest market capitalisation among its rivals.

Profitability

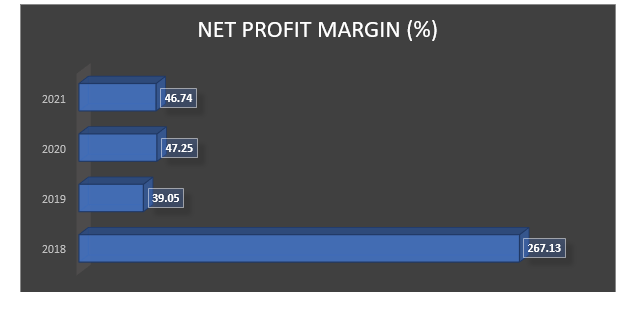

The net profit margin peaked at 267.13% in 2018 before plunging to 39.05% in 2019. The net profit margin stood at 47.25% and 46.74% in 2020 and 2021.

Company Profile

Cyan Limited was incorporated in Pakistan on April 23,1960 as a public limited company. The firm is a subsidiary of Dawood Corporation (Private) Limited. The company is engaged in making equity investments in companies with high growth potential.

Credit: Independent News Pakistan-WealthPk