INP-WealthPk

Ayesha Mudassar

Pakistan is currently witnessing low growth, price hikes, massive rupee devaluation, widened fiscal deficits, falling investment, and high debt accumulation, says Vice-Chancellor Pakistan Institute of Development Economics Dr. Nadeem Ul Haque while talking to WealthPK. Nadeem said the economy is facing multiple challenges due to the Ukraine crisis, commodity super cycle, the aftermath of torrential rainfall, and implementation of harsh IMF conditionalities.

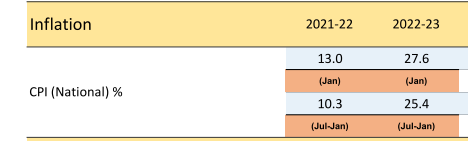

Inconsistent policies have further complicated the economic and financial outlook, he added. The World Bank has revised the country’s projected growth for the current fiscal year to be 2%. It was previously estimated at 4%. Pakistan has been observing decades-high inflation in the past few months. According to the statistics released by the Pakistan Bureau of Statistics (PBS), the annual inflation was recorded at 27.6% in January 2023 – the highest increase since May 1975.

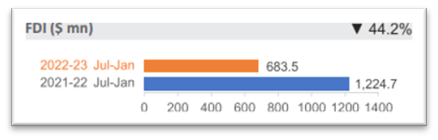

The Pakistani rupee, which was valued at 182 rupees against one US dollar in March 2022 ended in March 2023 at 283 rupees – a depreciation of 55%. The economic uncertainty in Pakistan has dented the investors’ confidence and huge funds are being withdrawn in the prevailing circumstances. As per the figure issued by the SBP, foreign investment (FDI) fell by 44.2% in Jul-Jan 2022-23 compared to the corresponding period of the last year.

The country’s total debt and liabilities have increased to over Rs60 trillion. The annual report of the Ministry of Finance states that the debt burden of every citizen alarmingly jumped by 21% to Rs216,708 by the end of Fiscal Year 21-22. The global financial outlook is also looking grim. Rapid deterioration of growth prospects, coupled with skyrocketing inflation and tightening financing conditions, has significantly complicated the economic picture.

Regarding measures to steer the country out of the current challenges, Ashfaque Hassan Khan, Dean National University of Science and Technology, told WealthPK that the only practical way is to adopt an aggressive yet selective import compression policy – cutting down nonessential imports. Moreover, a policy shift is required from ad-hoc projects to targeted subsidies.

Credit : Independent News Pakistan-WealthPk