INP-WealthPk

Hifsa Raja

The market will always have possibilities for long-term investment, but currently it is range-bound, which is not ideal for long-term investors, but good for those looking for short-term benefits through volume trading. This was stated by Hamza Anwaar, a market analyst and expert at Zahid Latif Khan Securities Private Limited.

In an exclusive interview with WealthPK, he said that political and economic unrest was affecting stock market sentiment. The main reason that the stock market is unable to perform is investors’ lack of confidence due to current circumstances. “So, we advise our clients to continually look for long-term investment opportunities in the market.”

WealthPK: What are the current market circumstances, and how they impact the economy?

Hamza Anwaar: As said earlier, political and economic turmoil have an impact on stock market sentiment. The stock market is impacted by key economic factors, including declining foreign exchange reserves, interest rate hikes and inflation.

WealthPK: What strategy should an investor adopt to book profits in the current situation?

Hamza Anwaar: Some industries are being hurt by interest rate hikes and imposition of super tax. The market is currently in a range-bound condition, which is not conducive for long-term investors, but short-term investors can benefit from volume trading.

WealthPK: If we look at the market, the trading volume is continuously decreasing. What are the main reasons behind it and how can we improve it?

Hamza Anwaar: Investor confidence is the key to performance of stock market. The stock market can’t perform when there is no confidence in investors. Whenever there is political instability, the stock market has always reacted negatively to it. Whenever there is economic or political turmoil in the country, investors will pull out their money from the market. The other reason behind continuously decreasing trading volumes is the high-interest rates to tame inflation.

WealthPK: How is your company attracting investors to the market? What kind of services is your company offering? How are you protecting your investors?

Hamza Anwaar: We never create attractions for investors. Our vision is to create awareness among them. The attraction for investors will always be there in the market. Different companies perform differently under stress conditions. So, our main goal is to make people financially literate. We also have initiated a programme called the financial literacy programme. Under this initiative, we target the people of universities and big financial institutes. We are giving them the knowledge that how we can make the capital market profitable.

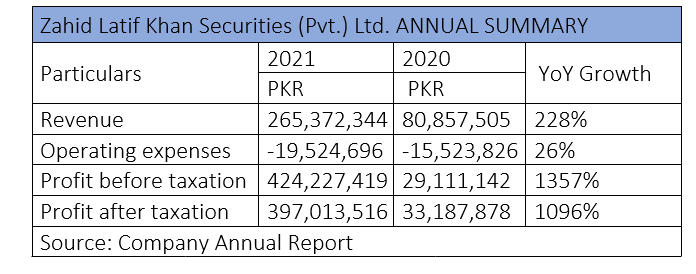

Performance of the company in FY21

During the fiscal year 2020-21, the company generated revenue of Rs265 million, which was a whopping 228% higher than the revenue of just Rs80 million in the fiscal 2019-20. In FY21, the company’s operating expenses stood at Rs19 million compared to Rs15 million in FY20.

In FY21, the company earned a profit of Rs424 million before taxation compared to only Rs29 million in FY20, showing a mind-boggling increase of 1357% year-on-year. Similarly, in FY21, the company’s net profit stood at Rs397 million compared to Rs33 million in FY20, again showing a massive 1096% growth year-on-year.

Zahid Latif Khan Securities (Pvt) Ltd is a progressive and leading service provider of premier brokerage and financial services in the Pakistan Stock Exchange. It is known for providing professional quality services to its valued corporate and retail clients. Established in 1999 as a proficient brokerage firm, Zahid Latif Khan Securities (Pvt) Ltd has laid an extensive network of branches across the country. The company became an active broker of the Pakistan Mercantile Exchange in 2010.

Credit: Independent News Pakistan-WealthPk