INP-WealthPk

Qudsia Bano

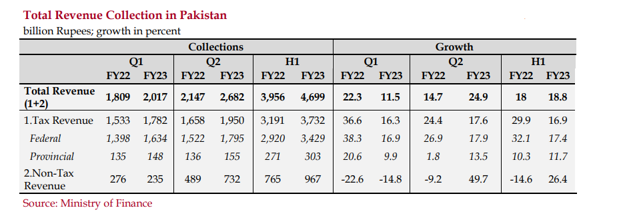

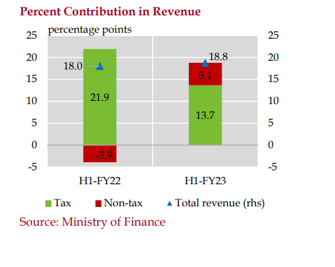

Pakistan's total revenue collection experienced an 18.8% increase in the first half of the financial year 2022-23, marking a slight uptick from the previous year's 18% growth, according to the recent data released by the ministry of finance. A deeper look into the figures reveals a dynamic landscape, with tax and non-tax revenue sources playing contrasting roles in driving this growth. In a quarterly analysis, it becomes evident that the acceleration of total revenue growth in the second quarter compared to the first quarter of FY23 was primarily fueled by the positive contribution of non-tax revenue.

This surge was propelled by markup payments, oil and gas royalties, and the transfer of the State Bank of Pakistan's surplus profit, including arrears from the previous year. Tax revenue, on the other hand, showed consistent growth across both quarters. Federal tax revenue collection received a boost from administrative and revenue mobilisation measures, inflation, and rising interest rates. However, it faced significant headwinds from a slowdown in imports, floods, and sluggish economic activity. Exchange rate depreciation somewhat mitigated the impact of declining imports.

A noteworthy development was the shift in revenue composition. Domestic direct taxes recorded a substantial 56.3% growth in 1HFY23, playing a pivotal role in driving overall tax revenue expansion, as opposed to the previous year when import-related taxes had been the key driver. This shift was influenced by import contraction, decreased demand, economic challenges, and legal disputes related to revenue-enhancing measures. Moreover, temporary exemptions on duties and taxes, extended under the umbrella of flood relief, further hampered tax collections. Notably, refunds issued in 1HFY23 were 18.1% higher than the same period last year, adding to the complexity of the revenue landscape.

Talking to WealthPK, Hamid Haroon, a former economist at the World Bank, said the 18.8% increase in total revenue collection was encouraging, signifying a positive economic trajectory. However, he added it was essential to acknowledge the dual nature of this growth, with tax and non-tax revenue sources playing contrasting roles. He said the notable positive shift in non-tax revenue, driven by markup payments, oil and gas royalties, and the State Bank of Pakistan's surplus profit, underscored the importance of diversifying revenue streams. “This diversification can enhance financial stability and reduce dependency on tax revenue, which is often subject to economic fluctuations,” he said.

Haroon said challenges loomed large in the form of economic slowdowns, floods and legal disputes surrounding revenue-enhancing measures. “The impact of these challenges on tax revenue underscores the need for resilient fiscal policies and proactive risk management. The temporary exemptions on duties and taxes, while serving as an essential relief mechanism during times of crisis, should be carefully evaluated for their long-term impact on revenue stability.” “Additionally, the higher-than-expected refunds issued in 1HFY23 call for improved tax administration and streamlined refund processes.

Efficient tax administration is crucial to ensure that taxpayers receive their refunds promptly while preventing potential revenue leakages,” he said. Looking ahead, he said Pakistan's fiscal policymakers should focus on enhancing revenue predictability, reducing economic vulnerabilities and promoting sustainable economic growth. “Diversifying revenue sources, strengthening tax collection mechanisms, and closely monitoring economic developments will be essential in achieving these objectives,” he added.

Credit: INP-WealthPk