INP-WealthPk

Ayesha Mudassar

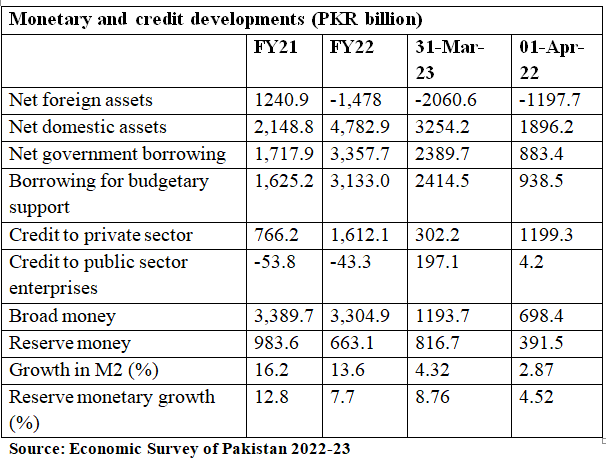

Broad money (M2) witnessed a growth of 4.3% during the first nine months (July-March) of the fiscal year 2022-23 compared to 2.9% during the same period of FY22, as per the Economic Survey of Pakistan 2022-23. This growth was driven by increase in net domestic assets (NDA), but was partially offset by contraction in net foreign assets (NFA).

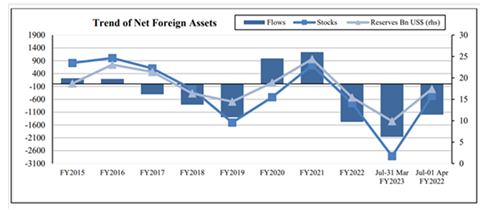

As per the survey, NFA declined by Rs2,060.6 billion during the period under review compared to decrease of Rs1,197.7 billion last year. Talking to WealthPK, Dr Sajid Amin Javed, Deputy Executive Director at Sustainable Development Policy Institute (SDPI), said this decline was observed on account of payment pressures due to high commodity prices and currency depreciation. In addition, the scheduled repayments of external debt increased the country’s gross financing requirements. “However, in the case of inadequate external inflows, these payments were partially financed by

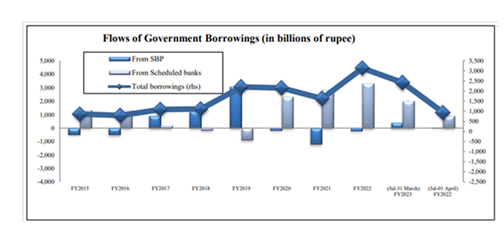

drawdown in the State Bank’s reserves,” he added. On the other hand, NDA increased by Rs3,254.2 billion during 9MFY23 compared to Rs1,896.2 billion during the same period of the previous year. Elaborating the reason of significant expansion in NDA, Dr Sajid said it was primarily due to higher budgetary borrowing. During the period under review, the government borrowing for budgetary support increased to Rs2,414.5 billion from Rs938.5 billion during the same period of the previous year. This increase in financing requirements elevated pressure on domestic banks due to insufficient external inflows. Resultantly, net government borrowing from banking system stood at Rs 2,389.7 billion compared to Rs883.4 billion during the same period of FY22.

Reserve money grew by 8.8% (Rs816.7 billion) during 9MFY23 compared to the growth of 4.5% (Rs391.5 billion) during the same period of FY22. This double increase came entirely from growth in NDA. A significant growth in NDA was offset by negative growth of NFA.

Credit: INP-WealthPk