INP-WealthPk

Qudsia Bano

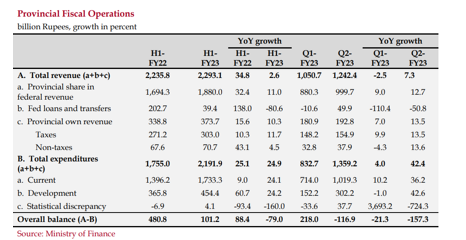

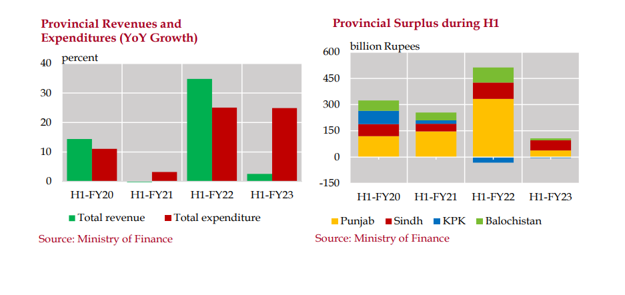

The fiscal health of the provincial governments in Pakistan took a significant hit in the first half of Fiscal Year 2023 (H1-FY23). The consolidated provincial surplus plummeted to Rs101.2 billion, representing a considerable drop from Rs480.8 billion recorded during the same period in the previous fiscal year, reports WealthPK. The deceleration in surplus can be primarily attributed to lower revenue generation in the first quarter of FY23, exacerbated by higher development and current expenditures incurred during the second quarter.

During the second quarter of FY23, the provinces faced another significant hurdle in the form of increased expenditures. Both development and current expenditures surged as provinces allocated more funds to various projects and ongoing operational costs. These higher expenses further eroded the provincial surplus, creating a challenging financial environment. Adding to these fiscal woes was the provinces' inability to meet the fiscal year target of achieving a surplus. The failure to reach this target raised concerns about their effectiveness in managing their finances. The shortfall in the surplus not only undermines the provinces' ability to fund critical development projects but also places them at the risk of struggling to meet their financial obligations.

The data paints a concerning picture of the provinces’ fiscal performance. By the end of H1-FY23, the surplus could only reach 13.5 percent of the fiscal year target, which, shockingly, translates to a mere 0.1 percent of the Gross Domestic Product (GDP). One of the most noticeable decelerations came from Punjab, the country's most populous province, where the surplus saw a significant decline. Balochistan and Sindh also followed suit, experiencing notable reductions in their respective provincial surpluses. In contrast, Khyber Pakhtunkhwa (KPK) faced a deficit of Rs5.4 billion during this period.

Talking to WealthPK, Dr. Uzma Zia, Senior Research Economist at the Pakistan Institute of Development Economics (PIDE), expressed her concern. She said, "The deceleration in provincial surpluses can be attributed to a combination of factors. First, the modest growth in overall provincial revenues, at just 2.6 percent, indicates a slowdown in both federal transfers to provinces and provincial own revenues. This slowdown in revenue generation is concerning, as it limits the provinces' fiscal maneuverability." She further commented on the significance of tax revenues. "The increase in tax revenues, particularly sales tax on services, has been a noteworthy contributor to provincial finances.

However, the reliance on certain tax categories can pose risks if they do not diversify their revenue sources. It's essential for provinces to continue exploring avenues for revenue growth, especially given the fiscal challenges they face," she said. Dr. Hamid Haroon, trade economist, and former consultant at the World Bank, said, "The provinces need to adopt a multifaceted approach. This includes not only expanding their revenue base and ensuring efficiency in tax collection but also exploring innovative fiscal policies and considering the long-term economic sustainability of their budgets. Collaborative efforts between provincial and federal authorities may be required to address these challenges effectively."

Credit: INP-WealthPk