INP-WealthPk

Shams ul Nisa

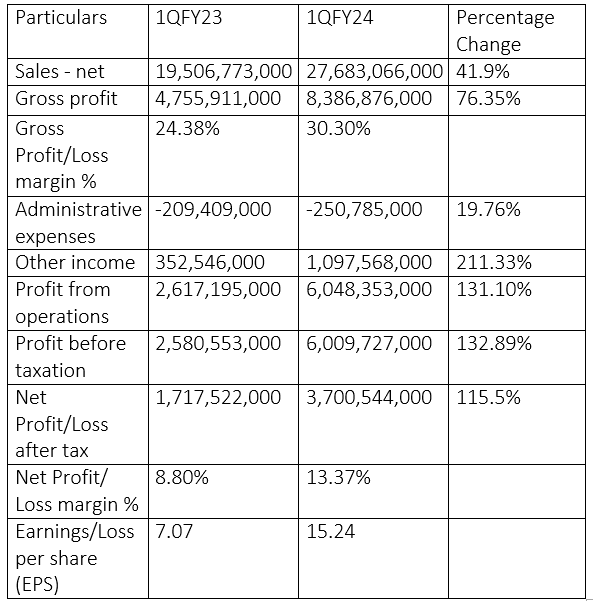

Colgate-Palmolive (Pakistan) Limited's net sales increased by 41.9% to Rs27.68 billion in the first quarter (July-September) of the ongoing fiscal year 2023-24 (1QFY24) from Rs19.5 billion in 1QFY23. The company attributed this increase to the beneficial pack mix improvements, volume increases and selling price adjustments. The company registered a gross profit of Rs8.38 billion in 1QFY24 compared to Rs4.75 billion in 1QFY23, indicating an impressive growth of 76.35%. Gross profit margin improved from 24.38% in 1QFY23 to 30.30% in 1QFY24 due to the lower material costs supported by improved internal cost reductions and a relatively steady exchange rate.

The company's primary business is producing and selling personal care products, detergents and associated goods. Administrative expenses rose by 19.76% to Rs250.78 million in 1QFY24. The company showcased impressive growth in other income, which ballooned 211.33% to Rs1.097 billion in 1QFY24 from Rs352.5 million in 1QFY23. The company posted Rs6.048 billion profit from operations in 1QFY24 against Rs2.617 billion in 1QFY23, reflecting a significant hike of 131.10%.

![]()

The company's profit-before-taxation jumped 132.89% to Rs6 billion in 1QFY24 from Rs2.58 billion in 1QFY23. Similarly, the net profit jumped to Rs3.7 billion during the period under review from Rs1.71 billion in 1QFY23, posting a remarkable 115.5% growth. The net profit margin settled at 13.37% in 1QFY24 against 8.80% in 1QFY23. Earnings per share of the company rose to Rs15.24 in 1QFY24 from Rs7.07 registered in the same period last year.

Equity and liabilities analysis

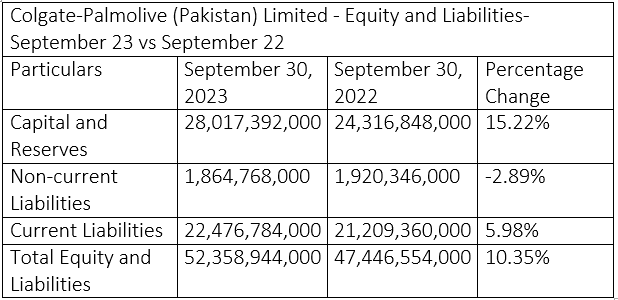

As of September 30, 2023, the company's capital and reserves stood at Rs28.01 billion compared to Rs24.31 billion on September 30, 2022, reflecting a growth of 15.22%. This signifies that the company accumulated additional capital during this period. Whereas, the non-current liabilities showed a decline of 2.89% from Rs1.92 billion on September 30, 2022, to Rs1.86 billion on September 30, 2023. This decline shows that the company paid its long-term obligations during this period.

The company's current liabilities grew by 5.98% to Rs22.47 billion on September 30, 2023 from Rs21.2 billion on September 30, 2022. This rise is more likely because of an increase in operational activities and investment of the company during this period. Colgate-Palmolive (Pakistan) Limited's total equity and liabilities grew by 10.35% during the period under consideration.

Assets analysis

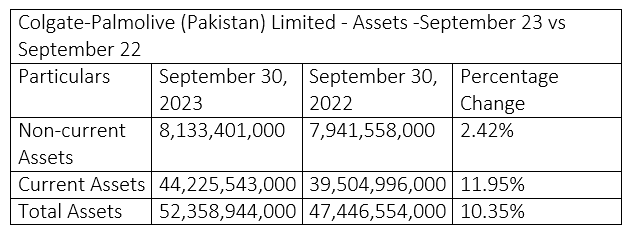

The company's better financial performance contributed to the increase in investment in long-term assets such as property, plant and equipment. The non-current assets rose from Rs7.94 billion on September 30, 2022, to Rs8.133 billion on September 30, 2023, posting a moderate growth of 2.42%. The current assets grew 11.95% from Rs39.5 billion on September 30, 2022, to Rs44.22 billion in June 2023. This shows the company improved its liquidity position by increasing investment in short-term assets such as cash, account receivables and inventory. The rise in current and non-current assets resulted in a growth of 10.35% in total assets, which rose from Rs47.44 billion on September 30, 2022, to Rs52.35 billion on September 30, 2023.

Credit: INP-WealthPk