INP-WealthPk

Shams ul Nisa

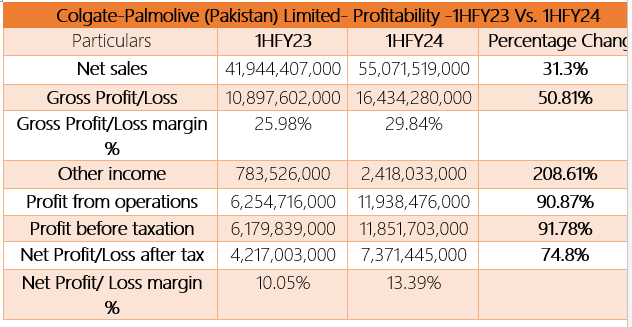

Colgate-Palmolive (Pakistan) Limited released its unconsolidated financial results for the first half of the Fiscal Year 2024, registering a magnificent jump in net sales by 31.3% and net profit by 74.8%, reports WealthPK. The positive result of net sales was attributable to the increase in the volume gains and favorable pack mix changes. The company’s results revealed a significant surge of 50.81% in gross profit, which stood at Rs16.4 billion in 1HFY24 as opposed to Rs10.89 billion in 1HFY23. The growth in net sales and gross revenue is translated to the hike in gross margin to 29.84% in 1HFY24 from 25.98% in the same period last year.

![]()

In 1HFY24, the company recorded a gain from other income, amounting to Rs2.41 billion, a 208.61% expansion. The profit from operations ballooned by 90.87% to Rs11.9 billion in 1HFY24 from Rs6.25 billion in 1HFY23. Similarly, the pre-tax profit grew 91.78% from Rs6.17 billion in 1HFY23 to Rs11.8 billion in 1HFY24. During the review period, the net profit margin and earnings per share also increased to 13.39% and Rs30.36, respectively. The rise in EPS is because of the reduction in commodity prices and relatively stable exchange rates.

Quarterly Analysis

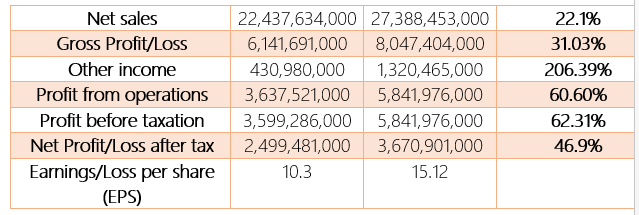

The quarterly analysis provides a similar trend, with net sales of Rs27.38 billion, and gross profit of Rs8.04 billion in 2QFY24. According to the financial results, other income climbed to Rs1.32 billion from Rs430.9 million in 2QFY23, a hefty growth of 206.39%. The company continues an upward swing of 60.60% in profit from operations, clocking in at Rs5.84 billion in 2QFY24. Similarly, the chemical company delivered an impressive performance with a robust growth of 62.31% in pre-tax profit and 46.9% in net profit in 2QFY24 compared to the same period last year. The EPS widened from Rs10.3 in 2QFY23 to Rs15.12 in 2QFY24.

![]()

Profitability Ratios Analysis

The company’s profitability analysis provides a detailed insight into profit generation to the costs incurred in the operations. A gross profit margin assesses how a company manages the costs of production. Overall, the gross margin ranged between 33% in 2018 and 29% in 2023, with the lowest margin of 26% recorded in 2022. On the other hand, the operating profit is the income earned from the core operations of the company. The chemical company observed an expansion in its operating profit from 15% in 2018 to 18% in 2023.

However, the net profit margin assesses the net income generated as a percentage of revenue. Over the years, the net margin remained stagnant, ranging between 9% and 11%. Starting from 11% in 2018, the net profit margin reduced to 10% in 2023.

Liquidity ratios analysis

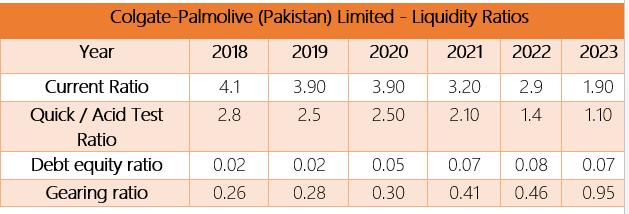

The current ratio measures the ability of a company to cover its short-term liabilities using its current assets. A current ratio greater than 1.2 is considered safe, and below 1 indicates a risk to cover short-term liabilities. The chemical company's current ratio of 4.1 in 2018 reflects a secure position. In the subsequent years, it kept on declining from 3.90 in 2019 to 1.90 in 2023, indicating a reduction in current assets compared to a rise in short-term liabilities. However, the ratio still reflects the safe position of the company.

The quick ratio measures the capacity of a company to pay its short-term liabilities with most liquid assets and without selling inventory. A quick ratio of less than 1 indicates lower quick assets to cover short-term liabilities. During the period 2018 to 2023, the company's quick ratio remained above 1, indicating higher quick assets by the company. However, the ratio followed a declining trend from 2.8 in 2018 to 1.10 in 2023. The debt-to-equity ratio calculates the ratio between total liability and shareholder equity.

The company’s debt-to-equity ratio remained below 1, reflecting a lower risk to cover liabilities. Similarly, the gearing ratio measures the amount of debt a company uses to fund its operation in proportion to equity. From 0.26 in 2018 to 0.95 the gearing ratio has increased but remained below 1, indicating less debt and low risk for investors.

Chemical sector analysis

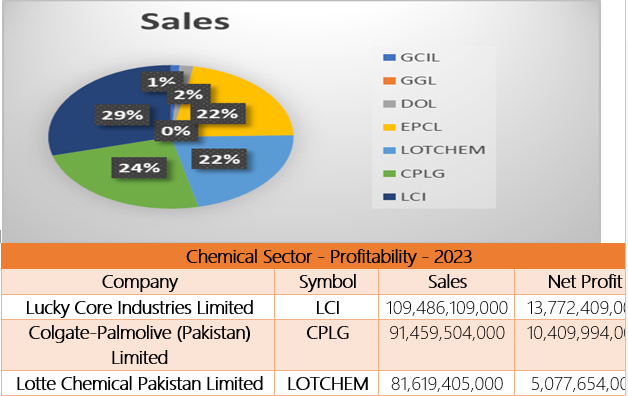

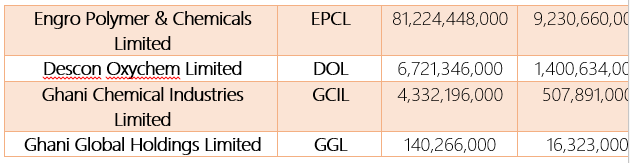

A thorough comparison of the companies in the chemical sector for 2023 is analyzed using sales and net profit. According to the sales for 2023, Lucky Core Industries Limited led the sector, covering 29% of total sales. The company was followed by Colgate-Palmolive (Pakistan) Limited with 24% sales and 22% by Lotte Chemical Pakistan Limited and Engro Polymer & Chemicals Limited each.

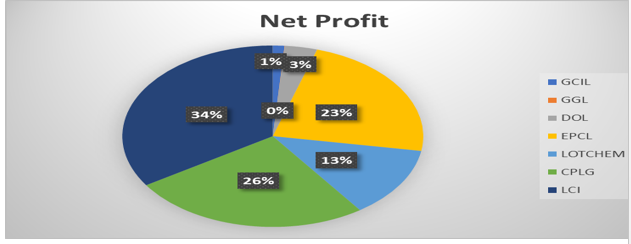

Similarly, Lucky Core Industries Limited led the chemical sector, covering 34% of net profit generation in 2023. Colgate-Palmolive (Pakistan) Limited secured the second position, with 26% net profit generation. However, Engro Polymer & Chemicals Limited managed 23%, and Lotte Chemical Pakistan Limited 13% of the total net profit generation within the chemical sector.

Company profile

Colgate-Palmolive (Pakistan) Limited was established as a public limited company in Pakistan on December 5, 1977. The primary activities of the company are the production and distribution of personal care, detergents, and related goods.

INPCredit: INP-WealthPk