INP-WealthPk

Hifsa Raja

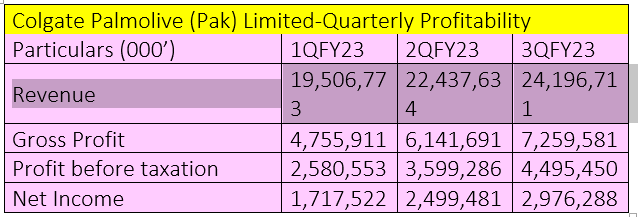

Colgate Palmolive (Pakistan) Limited, a renowned consumer goods maker, recently released its quarterly profitability report, showcasing a consistent upward trajectory in key financial metrics during the ongoing financial year 2022-23.

The company's revenue witnessed a significant rise over the three quarters (July-March), indicating robust sales performance.

In the first quarter (July-September) of FY23, Colgate Palmolive posted gross revenues of Rs19 billion, gross profit of Rs4.7 billion and net profit of Rs1.7 billion.

In the second quarter (October-December), the company posted gross revenue of Rs22 billion, gross profit of Rs6.1 billion and net income of Rs2.4 billion.

In the third quarter (January-March), the company posted gross revenue of Rs24 billion, gross profit of Rs7.2 billion and net profit of Rs2.9 billion, showing a steady growth in all the three segments quarter-on-quarter.

With these encouraging results, Colgate Palmolive is poised to continue its growth trajectory in the fourth quarter, leveraging its strong market presence and customer trust to further expand its market share.

The synchronised increase in sales and profit signifies a favourable outlook for the consumer goods maker, demonstrating the company's strong market presence, customer loyalty, and the ability to adapt to changing market dynamics. Stakeholders and investors can look forward to the company's continued success and its efforts to capitalise on emerging opportunities in the consumer goods industry.

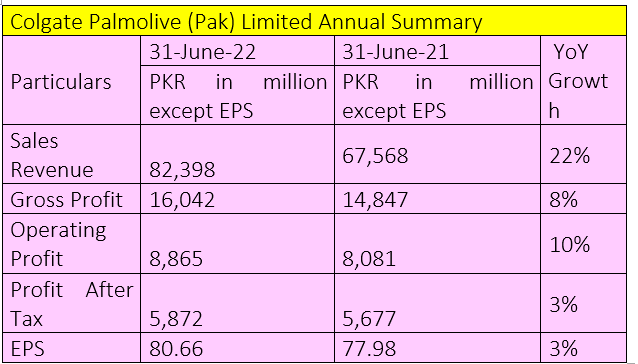

Performance in FY22

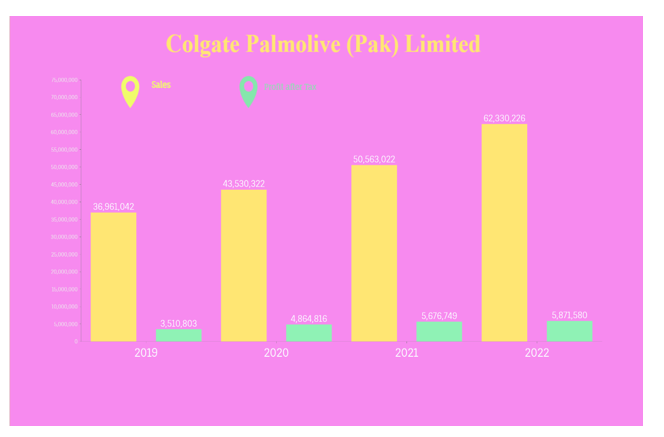

In fiscal year 2021-22, the company’s net sales surged 22% to Rs82 billion from Rs67 billion in FY21. The gross profit stood at Rs16 billion, up 8% from the previous year's Rs14 billion.

The company’s operating profit increased by 10% to Rs8.86 billion in FY22 from Rs8.08 billion in FY21. Moreover, the profit-after-tax increased by 3% to Rs5.8 billion in FY22 from Rs5.6 billion in FY21. The company’s EPS also increased with the same percentage.

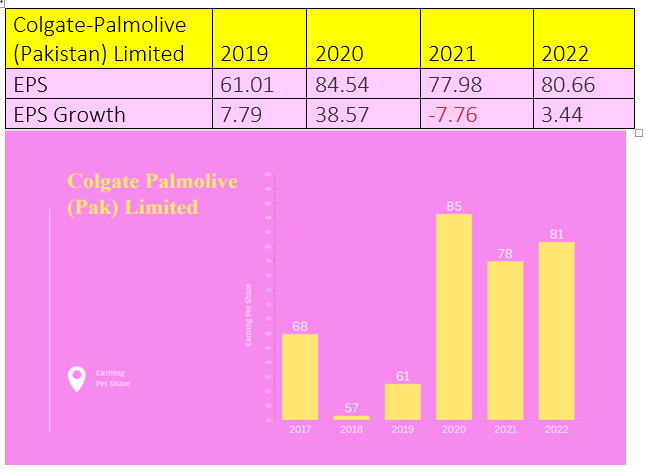

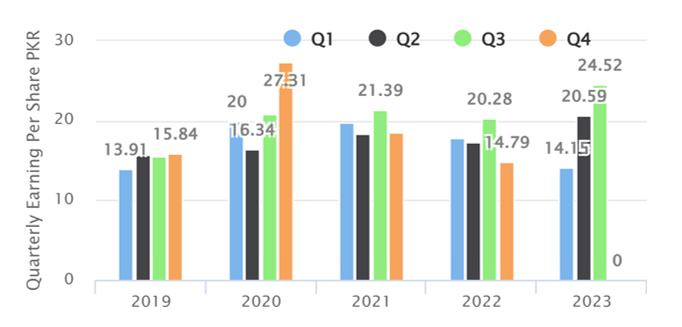

Earnings Per Share over the years

The EPS from 2019 till 2022 remained positive, demonstrating that the business was profitable. The EPS growth in 2020 was quite high at 38.57%. In 2021, the EPS growth was negative compared to the previous year. The EPS growth in 2022 was positive at 3.44%.

The EPS was all-time low in 2018 at Rs57, and all-time high in 2020 at Rs85.

In the latest financial update for the fiscal year 2022-23, the company's EPS showcased an increasing performance across the quarters. During the first quarter, the company reported a robust EPS of Rs14.15, indicating a promising start to the year. The EPS increased significantly in the second quarter, rising to Rs20.59. The EPS climbed even further in the third quarter, reaching Rs24.52.

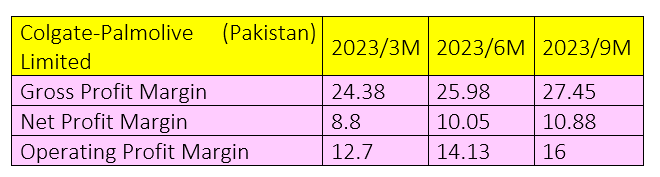

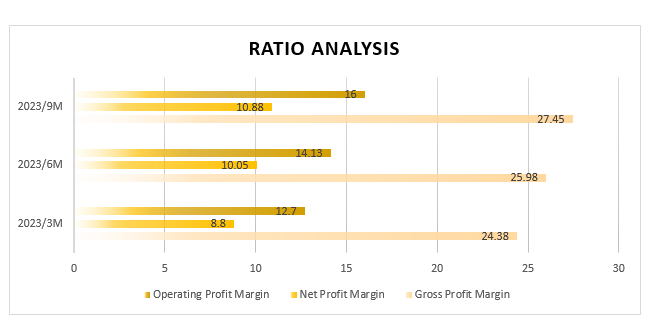

Ratio analysis

In the first quarter of FY23, the gross profit margin stood at 24.38%, net profit margin at 8.8% and operating profit margin at 12.7%.

In the second quarter, the gross, net, and operating profit margin further increased to 25.98%, to 10.05% and to 14.13%, respectively.

In the third quarter, the gross profit margin further increased to 27.45%, net profit margin to 10.88% and operating profit margin to 16%, respectively.

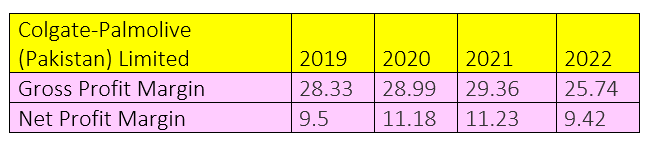

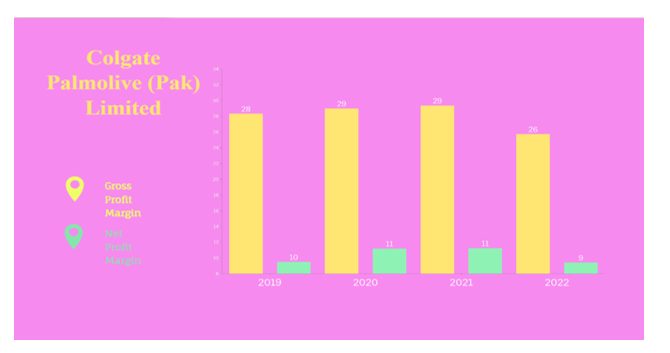

Profit margins over the years

In 2019 and 2020, the company’s gross profit margin stood at over 28%. However, it rose to 29.36% in 2021 before falling to 25.74% in 2022. In 2019, the net profit margin stood at 9.5%, and jumped to 11.18% in 2020. It moved further up to 11.23% in 2021 before falling to 9.42% in 2022.

Company profile

Colgate-Palmolive (Pakistan) Limited is engaged in the manufacture and sale of detergents, personal care and other related products. The company's principal classes of products are personal care, home care and others. Its products categories include oral care, personal care, surface care and fabric care. Its oral care products include toothpastes such as Colgate Maximum Cavity Protection, Colgate Total Advanced Health, Colgate Herbal, Colgate Sparkle and toothbrushes. Its personal care products include beauty soap, hand wash and shampoo under the brand Palmolive.

Credit : Independent News Pakistan-WealthPk