INP-WealthPk

Ayesha Mudassar

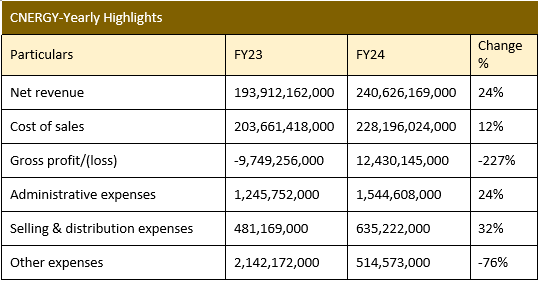

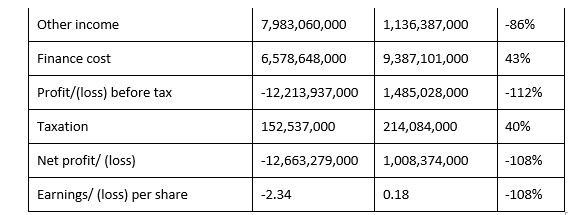

Cnergyico Pakistan Limited (CNERGY) announced a net profit of Rs1 billion for the last fiscal year 2023-24, marking a remarkable recovery from a net loss of Rs12.6 billion in the earlier fiscal (FY23), according to WealthPK.

The company’s revenue rose 24% year-on-year (YoY) to Rs240.6 billion from Rs193.9 billion in FY23. Correspondingly, the cost of sales grew by 12% YoY, totalling Rs228.1 billion compared to Rs203.6 billion in FY23. This resulted in a gross profit of Rs12.4 billion in FY24, a significant improvement from the previous year’s gross losses.

On the expense side, the company experienced increased selling and distribution expenses, which rose by 32% YoY to R635.2 million. Administrative costs increased by 24% YoY. However, other operating expenses for CNERGY declined by 76% YoY to Rs514.5 million from Rs2.1 billion in FY23. The company’s finance costs inflated by 43% YoY and stood at Rs9.3 billion, up from Rs6.5 billion in FY23. In terms of taxation, the company paid a higher tax worth Rs214 million against Rs152 million in FY23, depicting a rise of 40% YoY. The country’s economic environment has remained challenging, marked by rising operational costs, high inflation, and fluctuating refining margins. However, the company effectively mitigated these issues by implementing appropriate policies and robust risk management strategies.

Pattern of shareholding

As of June 30, 2024, CNERGY had 5.4 billion shares, which were held by 26,610 shareholders. Associated companies, undertakings, and related parties owned the majority stake of 73.4% in the company, followed by the general public, which held 20.9% of the total shares. Around 1% of CNERGY's shares were held by Modarabas and mutual funds. The remaining shares are distributed among other categories of shareholders.

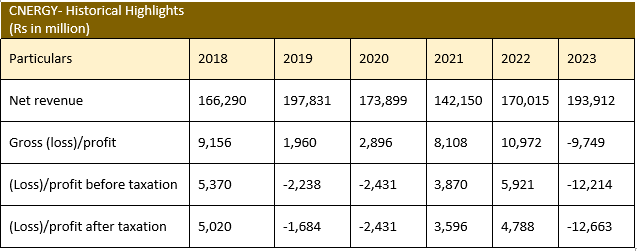

Financial performance over past six years

Over the past six years, the company's net revenue declined twice i.e. in 2020 and 2021. In contrast, CNERGY recorded a net profit only in 2021 and 2022. After experiencing a significant decrease in profit margins in 2019, these margins improved in the subsequent years and peaked in 2022. Nevertheless, CNERGY's profit margin turned negative in 2023.

In 2019, the company achieved a 19% year-on-year (YoY) increase in revenue, primarily driven by rising oil prices and the impact of currency depreciation. During the year, ENERGY faced numerous challenges, including a drastic decline in the demand for furnace oil, abrupt fluctuations in international oil prices, and continued rupee depreciation. These factors resulted in a decline of 79% in gross profit and 134% in net profit. In 2020, the company's revenue decreased by 12% YoY. However, lower international oil prices and proactive strategies related to crude cargo management resulted in a 48% improvement in gross profit. Despite this, the company experienced a 44% increase in net loss. CNERGY's net sales continued to decline in 2021.

However, the installation of a fluid catalytic cracking unit and enhanced inventory management led to a 180% higher gross profit for the year. As a result, CNERGY was able to shed net losses and record a net profit of Rs3.5 billion in 2021. After two consecutive years of declining net revenue, CNERGY's top line recorded a 20% rebound in 2022. During the year, net profit expanded by 33% to Rs4.7 billion. The refinery sector benefited significantly from the Russia-Ukraine crisis, which caused a notable drop in international oil prices. In 2023, CNERGY's top line grew by 14% YoY. Nevertheless, the company recorded a gross loss of Rs9.7 billion on account of sluggish economic activity in the country. A hike in administrative expenses and finance costs culminated in a net loss of Rs12.6 billion.

Company profile

CNERGY was incorporated in Pakistan as a public limited company in 1995. The company is engaged in oil refinery and petroleum marketing business with the latter segment being launched in 2007. CNERGY was previously known as Byco Petroleum Pakistan Limited.

Credit: INP-WealthPk