INP-WealthPk

Ayesha Mudassar

The net revenue of Cnergyico Pakistan Limited (CNERGY) declined by 36.4% in the first quarter of the ongoing fiscal year (1QFY24), as compared to the corresponding period of the last year, reports WealthPK. Higher oil prices in the international market and massive rupee devaluation drastically blew up the company's working capital requirements, resulting in extraordinarily low refinery throughput in the quarter under review.

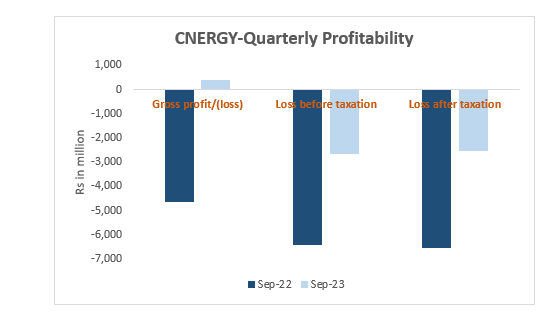

On a positive note, the company was able to record a gross profit of Rs 390.1 million in 1QFY24, against a gross loss of Rs 4,642 million during the same period last year as the company incurred huge inventory losses in 1QFY23 on account of severe flash flooding in the area surrounding its refinery. Furthermore, CNERGY was able to cut down its net loss by 61% in 1QFY24 to bring it down to Rs 2,543 million with a loss per share of Rs 0.46. On the expense side, selling and distribution costs inched down by 10% during the quarter due to lower sales volume. Finance costs surged by 91% in 1QFY24 on account of the high discount rate and increased short-term financing obtained during the year.

Six Years at a Glance (2018-2023)

Financial Performance

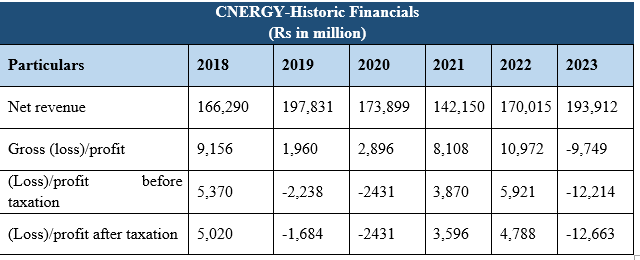

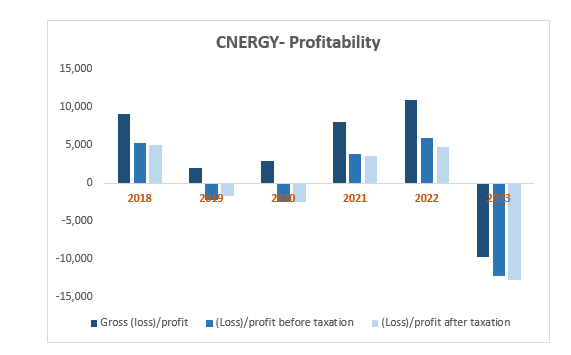

During the period under review, the company's net revenue slid twice, i.e. in 2020 and 2021. The profit margins, which drastically fell in 2019, showed an upsurge in the subsequent years to reach their optimum level in 2022. However, CNERGY's profit margin fell into the negative territory in 2023 again. In 2019, CNERGY's revenue grew by 18.9% year-on-year (YoY) which was merely the result of an upward revision in oil prices as well as the effect of currency depreciation. During the year, the company faced multiple challenges, including the drastic decline in the demand for furnace oil, abrupt changes in international oil prices, and rupee depreciation. All these factors resulted in a 78.6% and 188.9% YoY slump in the company's gross and net profit.

In 2020, the company's top line slipped by 12.1% year-on-year. Reduced oil prices in the international market, coupled with the company's proactive strategies regarding crude cargo, resulted in 47.7% improved gross profit. Moreover, the company's net loss magnified by 44.3% to clock in at Rs 2,431 million. CNERGY's net sales continued to decline in 2021. However, the setup of the fluid catalytic cracking unit and better inventory management have led to 179.9% higher gross profit in the year. Moreover, CNERGY was able to record a net profit of Rs 3,596 million in 2021.

After two successive years of top-line slide, CNERGY's net revenue recorded a 19.6% rebound in 2022. During the year, net profit enlarged by 33.1 % in 2022 to clock in at Rs 4,788 million. The refinery industry made immense profits due to the Russia-Ukraine conflict, which plunged international oil prices. In 2023, CNERGY's top line grew by 14.1% YoY. During the year, the company recorded a gross loss of Rs 9,749 million on account of sluggish economic activity in the country. A hike in administrative expenses and finance costs culminated in a net loss of Rs 12,663 million.

Ratio Analysis

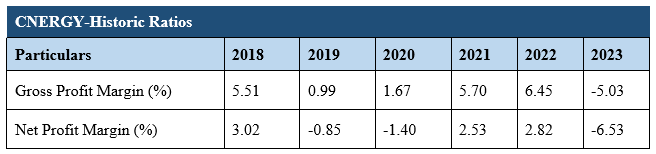

The CNERGY grappled with severe profitability challenges, as indicated by its deteriorating financial ratios. The gross profit margin, reflecting the efficiency of production and cost management, plunged to a concerning 5.03% in 2023, portraying potential inefficiencies or increased production costs.

Likewise, the net profit margin followed suit, recording a negative 6.53% in 2023. This signifies challenges in controlling overall expenses and achieving profitability.

Company Profile

Cnergyico Pakistan Limited (CNERGY) was incorporated in Pakistan as a public limited company in 1995. The company is engaged in the oil refinery and petroleum marketing business, with the latter being launched in 2007. CNERGY was previously known as Byco Petroleum Pakistan Limited.

Future Outlook

The recently announced brown field oil refinery policy, which aims to encourage existing refineries to upgrade, modernize and expand their facilities to minimize black products such as furnace oil and produce environment-friendly fuels as per Euro-V specifications. This is a positive step as it will attract foreign investment and will surely boost the company's throughput.

inpCredit: INP-WealthPk