INP-WealthPk

Ayesha Mudassar

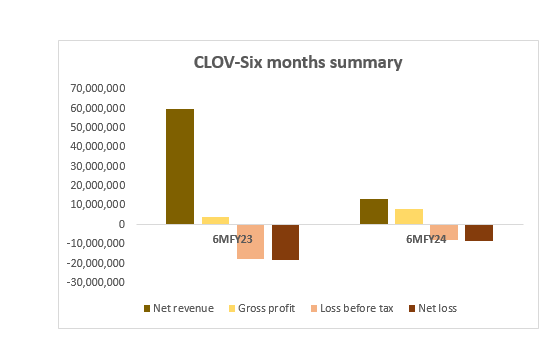

Clover Pakistan Limited (CLOV) managed to reduce its net loss and loss-before-tax by a significant 54% and 55%, respectively, in the first six months of the ongoing fiscal year (6MFY24) compared to the corresponding period of last year, reports WealthPK. The company posted a net loss of Rs8.2 million in 6MFY24 against Rs18.1 million over the same period last year.

The company’s net sales declined by 78% to Rs13.1 million during 6MFY24 from Rs59.7 million recorded in 6MFY23. The reduction in revenue is attributable to economic slowdown, which has retarded the growth of various segments of the company.

Performance over last four years (2020-23)

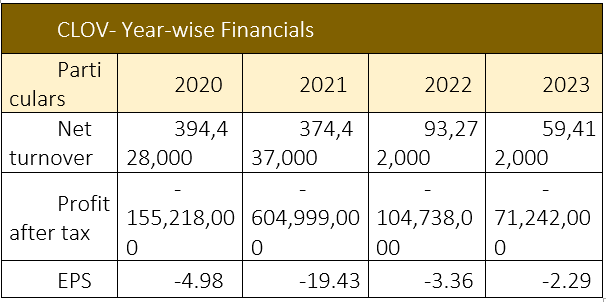

The CLOV’s top line slid over the years from 2020 to 2023, with the bottom line posting no positive figures after 2019. The company posted the highest net loss in 2021. In 2021, CLOV's revenue shrank by 5% year-on-year (YoY) as the company streamlined its business and trading activities during the year. The closure of two marts and declining sales of lubricants resulted in a gross loss of Rs24.07 million in the year. Furthermore, the net loss grew by 290% YoY in 2021 to clock in at Rs604.9 million with a loss per share of Rs19.43.

The year 2022 saw the greatest YoY decline of 75% in CLOV's top line due to a decline in the sales of industrial chemicals, equipment and lubricants. The significant slowdown was due to high inflation, currency depreciation as well as political uncertainty. Besides, the plunge in expenses trimmed the net loss by 82% YoY in 2022 to clock in at Rs104.7 million with a loss per share of Rs3.36. The top line continued to plunge in 2023 as CLOV's sales further shrank by 21% YoY due to the slowdown of the economy. Its operating expenses contracted by 64% YoY as fewer operations resulted in the rightsizing of its workforce as well as other business resources. Other income considerably grew by over 11 times in FY23 on account of high discount rate, which magnified the profit on deposit accounts.

Balance sheet analysis

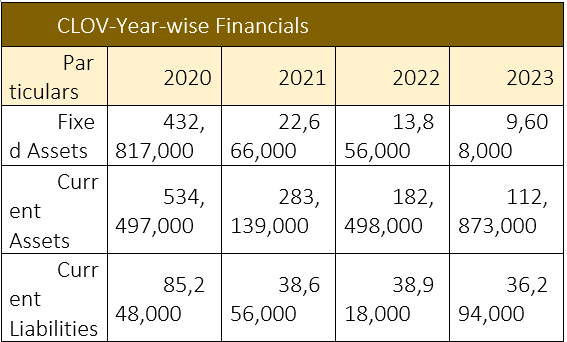

The analysis of the company’s financial position shows that total assets and current liabilities declined at a staggering rate over the years under review. However, the year 2022 witnessed the biggest contraction as non-current and current assets saw a decline of 94.8% and 47%, respectively. Furthermore, the current liabilities also declined from Rs85.2 million in 2020 to Rs38.6 million in 2023.

Overall, the trend indicates a decline in both fixed and current assets, which might raise concerns about the company's financial stability and operational efficiency. Nevertheless, the reduction in current liabilities signifies effective management of short-term obligations, potentially mitigating some of the risks associated with the decline in assets.

About the company

Clover Pakistan was incorporated in Pakistan as a publicly listed company in 1986. The company is engaged in the sale of consumer durables, food items, chemicals and lubricants as well as the trade of gantry equipment's air/oil filters and other car care products. In addition, the company sells, distributes and provides after-sale support for digital screens, gasoline dispensers, vending machines, and office automation equipment. The company was initially owned by Lakson Group, and in 2017 it was acquired by Fossil Energy (Private) Limited.

Future outlook

The economy’s slowdown, unprecedented inflation and discount rate, depreciation of rupee and uncertain political situation will continue to weigh on CLOV’s business activities. The company needs to undertake cost optimisation to minimise its losses amid lackluster demand.

Credit: INP-WealthPk