INP-WealthPk

Shams ul Nisa

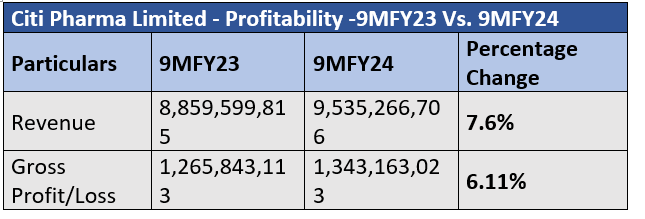

Citi Pharma Limited posted a 27.7% growth in net profit and a 7.6% increase in revenue during the first nine months of the financial year 2023-24 as compared to the corresponding period of FY23, reports WealthPK.

During the period, the company registered a net profit of Rs681.39 million, which was mainly driven by improved revenue from short-term investments, higher turnover, and tightly managed spending. The company witnessed a 6.11% rise in gross profit, which clocked in at Rs1.34 billion in 9MFY24. However, the gross profit margin slightly decreased to 14.09% in 9MFY24 from 14.29% in 9MFY23, suggesting a marginally higher cost of goods sold relative to revenue.

Furthermore, operating profit also saw a moderate expansion of 5.45%, indicating the company's effective control over operating expenses. The profit-before-taxation surged by 44.99% to Rs1.11 billion in 9MFY24, indicating better financial management by the company. Thus, the earnings per share increased from Rs2.33 in 9MFY23 to Rs2.98 in 9MFY24, showcasing enhanced shareholder value.

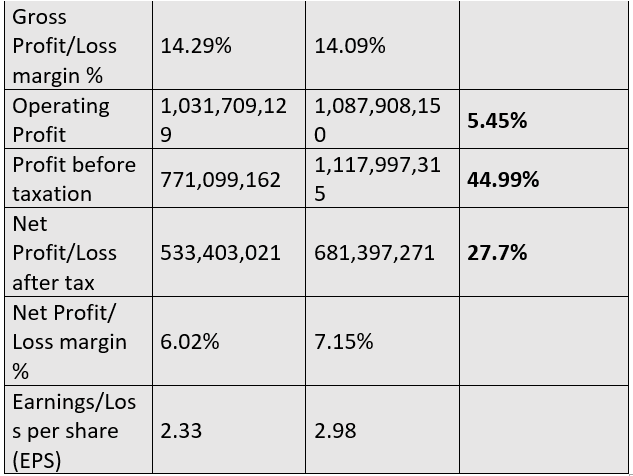

Profitability ratios analysis (2018-23)

The company's gross profit ratio ranged from 12.16% in 2023 to 13.94% in 2022, the highest percentage recorded during the period. The decline in 2023 suggests that the company's costs were higher than its revenue. Similarly, the net profit ratio experienced a slight decrease from 5.83% in 2018 to 5.31% in 2023. However, a notable decline to 1.07% was recorded in 2019. In 2022, the company's net profit ratio reached its highest point of 6.68%.

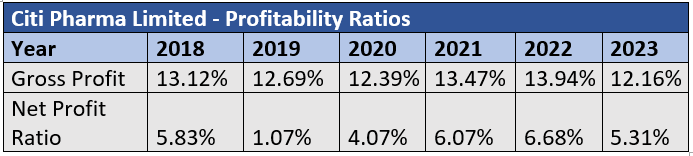

Liquidity ratios analysis

The company was in a stable position with regard to the liquidity or current ratio. The current ratio continued to rise from 1.152 in 2018 to 1.48 in 2023. In 2021, the company recorded the highest current ratio of 2.453. During the period, the debt-to-equity ratio dropped from 57% in 2018 to 29% in 2023, indicating improved debt management by the company.

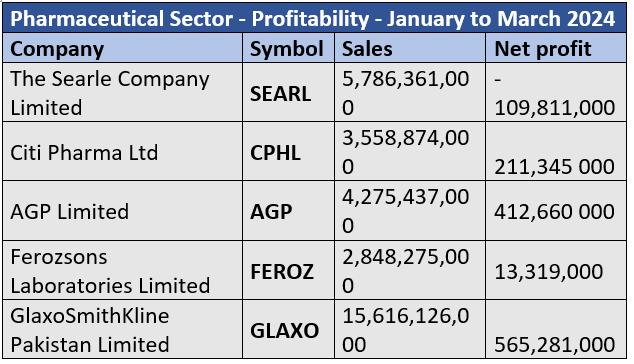

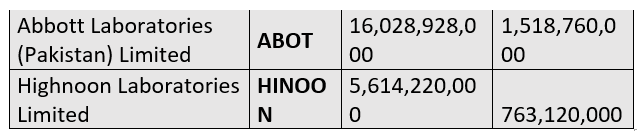

Pharmaceutical sector analysis

Companies in Pakistan's pharmaceutical industry displayed differing degrees of profitability during the January-March 2024 period. The best performer was Abbott Laboratories (Pakistan) Limited, posting sales of Rs16.02 billion and a net profit of Rs1.51 billion. Strong financial standing was also shown by GlaxoSmithKline Pakistan Limited, which had a net profit of Rs565.28 million and sales of Rs15.61 billion. Another strong performer was Highnoon Laboratories Limited, which had a Rs763.12 net profit. Furthermore, significant net profits were reported by AGP Limited and Citi Pharma Limited, whereas Ferozsons Laboratories Limited only made a meager Rs13.31 million in net profit. The Searle Company Limited disclosed a net loss of Rs109.81 million, suggesting that its financial performance was impacted by operational inefficiencies during the period.

Future outlook

The outlook for the remainder of financial year 2024-25 will be influenced by a number of domestic and foreign factors, such as global geopolitical tensions, interest rates, inflation, the rupee's parity with the dollar, and the country's political and economic stability. Maintaining the trust of investors and other stakeholders will require persistent work. The company hopes the government will take the necessary steps to guarantee political and economic stability in the country. The company's management always works to improve sales performance through a variety of strategic initiatives.

Company profile

Citi Pharma was incorporated in Pakistan as a private limited company on October 08, 2012 under the now-repealed Companies Ordinance, 1984. The principal activity of the company is the manufacturing and sale of pharmaceuticals, medical chemicals and botanical products.

Credit: INP-WealthPk