INP-WealthPk

Shams ul Nisa

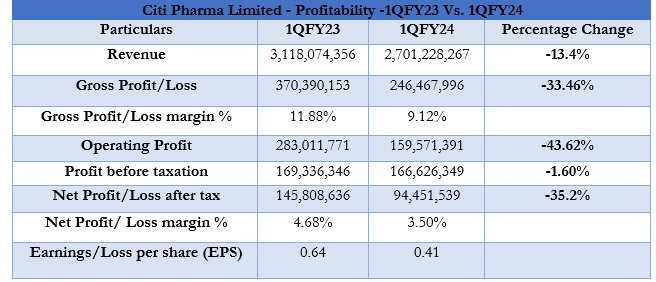

The Citi Pharma Limited reported revenue of Rs2.7 billion for the first quarter of 2024, 13.4% lower than Rs3.118 billion in the same quarter of the previous year, report WealthPK. The driving factors for this decline include the overall economic crisis in the country, which involves rising production costs, currency devaluation, import restrictions, escalating inflation, and soaring fuel prices. Going through the results, the pharmaceutical company’s gross profit reduced by 33.46% to Rs246.46 million in 1QFY24. As a result, the gross profit margin fell from 11.88% in 1QFY23 to 9.12% in 1QFY24. During the review period, the operating profit stood at Rs159.57 million as compared to Rs283.01 million in 1QFY23, representing a significant decrease of 43.62%.

Similarly, the profit before and after tax contracted by 1.6% and 35.2% respectively. At the end of the quarter, the company posted a profit before and after tax of Rs166.6 million and Rs94.45 million. As a result, the net profit margin collapsed from 4.68% in 1QFY23 to 3.50% in 1QFY24. The earnings per share also slide down to Rs0.41 during the review period from Rs0.64 in the same quarter of the preceding year.

Historical Trend

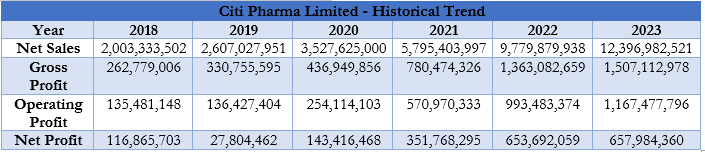

The historical trend analysis of the company revealed that the net sales displayed consistent growth over the years, from Rs2.003 billion in 2018 to Rs12.39 billion in 2023. The company observed a robust jump from Rs5.79 billion in 2021 to Rs9.77 billion in 2022, indicating higher sales over the year.

Similarly, the gross profit expanded gradually over the last years, ranging between Rs262.77 million in 2018 and Rs1.5 billion in 2023. This increase in gross profit indicates that the company is settling its costs more efficiently and generating higher profits.

In terms of the operating profit, the company witnessed a marginal increase from Rs135.48 million in 2018 to Rs136.4 million in 2019 but saw a more rapid increase in the subsequent years. Over the last six years, the highest operating profit of Rs1.16 billion was observed in 2023. The higher operating profit reflects that the company has strengthened its core operations to improve revenue.

Starting from a net profit of Rs116.8 million in 2018, the company suffered a substantial decline to Rs27.8 million in 2019. However, by improving operational performance, the company tracked back on increasing profit in the following years, reaching Rs657.98 million in 2023.

Profitability Ratios Analysis

![]()

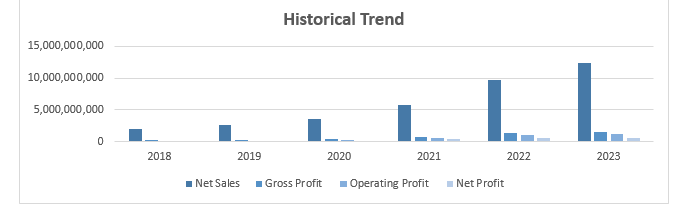

The gross profit ratio remained almost stagnant over the last six years. It declined from 13.12% in 2018 to 12.16% in 2023. The company witnessed the highest gross profit ratio of 13.94% in 2022 and the lowest of 12.16% in 2023. This decline implies higher costs than revenue generation by the company during the review period. Likewise, the net profit ratio declined marginally from 5.83% in 2018 to 5.31% in 2023, but a significant dip to 1.07% was registered in 2019. The company recorded the highest net profit ratio of 6.68% in 2022.

Liquidity Ratios Analysis

![]()

In the case of the liquidity ratio, the company is in a stable position as the current ratio kept on improving from 1.152 in 2018 to 1.48 in 2023. The company registered the highest current ratio of 2.453 in 2021. The debt-to-equity ratio has decreased over time from 57% in 2018 to 29% in 2023, reflecting better management of debt by the company during the period.

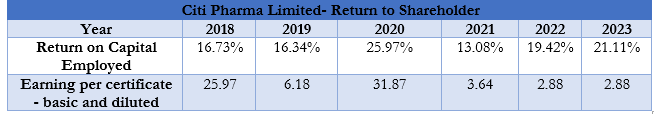

Return to Shareholder Analysis

The return to shareholders analysis provides a deeper insight to investors. Starting from a 16.73% return on capital employed in 2018, it slipped slightly to 16.34% in 2019 but jumped to the highest of 25.97% in 2020. In 2021, the company failed to sustain the return on capital as it declined to 13.08% in 2021. However, in the subsequent 2022 and 2023, the company managed to increase return on capital to 19.42% and 21.11%. The earnings per share stood at Rs25.97 in 2018, which fell to Rs2.88 in 2023. The company recorded the highest earning per share of Rs31.87 in 2020.

Future outlook

The pharmaceutical sector is experiencing increased expenses due to currency devaluation and modifying prices according to increased inflation to keep the company viable. The company is always optimistic about the economic recovery of the country. The company aims to allocate resources more efficiently by making investments in human capital and fostering a compassionate culture that encourages innovation, teamwork, and creativity.

INP: Credit: INP-WealthPk