INP-WealthPk

Uzair bin Farid

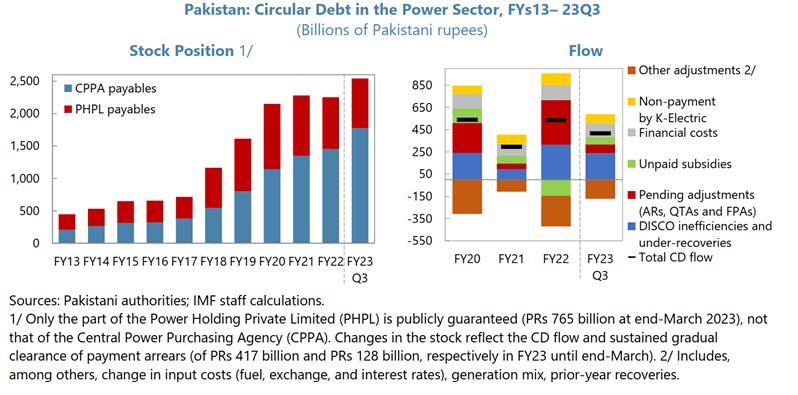

Circular debt in the power sector of Pakistan had reached a staggering value of Rs2.5 trillion by the end of March 2023. According to latest data published in a country report of Pakistan by the International Monetary Fund (IMF), Pakistan’s power sector continued to underperform during the fiscal year 2022-23 with circular debt now reaching to 3% of the gross domestic product (GDP). The primary reason for the increase in the circular debt was the ‘flow overruns’ of Rs387 billion in relation to the Circular Debt Management Plan (CDMP) from the start of fiscal year 2022-23. According to the IMF report, circular debt saw an increase in its volume mainly because there were ‘policy slippages’ on thepart of the government, and also very slow pace of progress with ‘structural cost-side reforms.’

There were a lot of unbudgeted and untargeted energy subsidies for producers and exporters, especially in the agriculture sector, in addition to deferred tariff adjustments for various residential consumers. Amid these volatile conditions of mounting circular debt, the government took emergency measures to limit the run-off from the mounting debt. Due to pressures on the liquidity front, rising costs of fuel inputs, and surging capacity charges to independent power producers (IPPs), the government took ‘socially-balanced’ measures starting from March 2023. The targeted measures by the government aimed to limit the budget subsidies for power sector to 1.1% of GDP, and the circular debt flow to 0.4% of GDP. These measures by the government will help permanently increase the base and level of the debt service surcharge and get rid of all the unbudgeted and untargeted subsidies.

Circular debt in the natural gas sector also does not present a rosy picture. The IMF estimates that the circular debt in the natural gas sector is almost equal to that ofthe power sector. The circular debt of the natural gas sector has increased mainly due to delayed biannual tariff adjustments, high operational losses, and unbudgeted subsidies that result in prices below cost-recovery. High operational losses include the losses from collection shortfalls and unaccounted for gas (UFG) losses. Uncovered subsidies, on the other hand, usually given to export and zero-rated industries, also add to the burden of thecircular debt. In order to avoid further losses in the natural gas sector, the government instituted a price hike per unit of, on average, 75% as suggested by the Oil and Gas Development Authority (OGRA), at the start of calendar year 2023. The government also instituted an updated tariff slab system to guarantee full cost recovery, affordability and efficiency.

Credit: INP-WealthPk