INP-WealthPk

Ayesha Mudassar

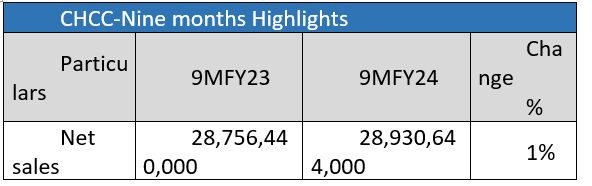

The gross and net profits of Cherat Cement Company Limited (CHCC) grew by 11% and 8%, respectively, during the first nine months of the ongoing fiscal year 2024 (9MFY24) compared to the corresponding period of the previous year, reports WealthPK. As per the company’s report, CHCC posted a revenue of Rs28.9 billion and a gross profit of Rs9.1 billion in 9MFY24. The net profit stood at Rs4.6 billion compared to Rs4.3 billion in the corresponding period last year, resulting in an earnings per share (EPS) of Rs23.91 versus Rs22.19 in the same period last year.

In comparison to 9MFY23, the company’s net turnover increased by a modest 1% from Rs28.7 billion to Rs28.9 billion in 9MFY24. The improved sales were mainly due to an upward adjustment in cement prices on account of higher input costs. Furthermore, the cost of sales declined by 3%, which was mainly attributable to measures taken to enhance operational efficiency by optimising the coal and power mix. In addition, the financial costs for the period experienced a 20% reduction, declining from Rs1.4 billion to Rs1.1 billion. This was primarily due to lower working capital requirements along with scheduled payments of long-term loans during the period.

Sectoral financials- 9MFY23 vs 9MFY24

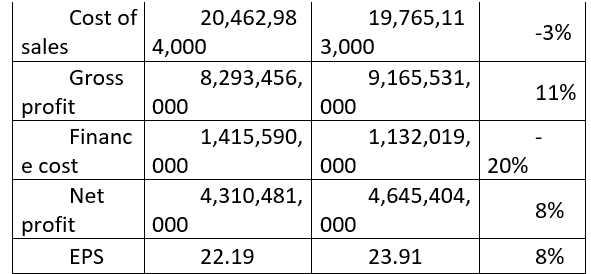

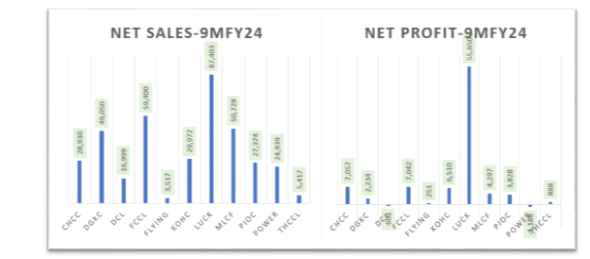

The cement sector recorded a 12% year-on-year (YoY) growth in net profits, which clocked in at Rs85.9 billion as against Rs76.9 billion in the same period of last fiscal year. Likewise, the sector’s gross profit grew by 24% during the nine months.

As per the results compiled by WealthPK from the income statements of the 11 PSX-listed cement companies, the sector saw an increase of 10% in its net sales, pushing them to Rs383.7 billion from Rs347.3 billion in 9MFY23. The cement sector’s main stakeholders include CHCC, DG Khan Cement Company Limited (DGKC), Dewan Cement Limited (DCL), Fauji Cement Company Limited (FCCL), Flying Cement Company Limited (FLYING), Kohat Cement Company Limited (KOHC), Lucky Cement Limited (LUCK), Maple Leaf Cement Factory Limited (MLCF), Pioneer Cement Limited (PIOC), Power Cement Limited (POWER), and Thatta Cement Company Limited (THCCL).

According to the Monthly Economic Update and Outlook for April 2024, the total cement dispatches (domestic and exports) stood at 34.5 million tonnes (MT), which is 2.6% higher than the 33.6 MT dispatches during the corresponding period of last year. The improved dispatches were mainly due to the sector's enhanced exports during the period under review. On the cost front, the cost of sales rose by 6% YoY, which stood at Rs277 billion in 9MFY24 compared to Rs261.5 billion in 9MFY23. Moreover, the sector paid a higher tax worth Rs25.3 billion against Rs17.6 billion in the corresponding period of last year, depicting a rise of 44% YoY. During 9MFY24, LUCK beat its peers by making the highest sales and net profit. The robust performance was due to the company's strong focus on cost optimisation, risk

management and innovation to deliver sustainable value to its stakeholders.

On the other hand, POWER and DCL underperformed with negative net profits, suggesting the higher expenses incurred over the nine months.

Challenges facing cement sector

The cement industry faces two simultaneous but divergent challenges: Pakistan’s per capita cement consumption stands at 182 kilogrammes, which is lower than its regional counterparts, indicating untapped market potential. Besides, the cement industry’s heavy reliance on coal, which accounts for 66% of its energy consumption, exposes it to the fluctuations of global coal prices and diverges from the global trend towards sustainable energy sources.

Company profile

Cherat Cement Company, which operates as a subsidiary of Ghulam Faruque Group, is one of the leading cement manufacturers in Pakistan, with a production capacity of 45,000 tonnes per day.

Credit: INP-WealthPk