INP-WealthPk

Ayesha Mudassar

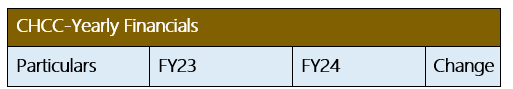

Cherat Cement Company Limited (CHCC) reported substantial growth in its financial performance for the fiscal year 2024, with the gross profit increasing by 17% and net profit rising by 25% compared to the

previous fiscal year, reports WealthPK.

According to the latest financial report, the company posted a total revenue of Rs38.4 billion and a gross profit of Rs11.8 billion in FY24. The net profit for the year reached Rs5.4 billion compared to Rs4.4 billion in FY23, resulting in an earning per share (EPS) of Rs28.31 from Rs22.16 in FY23.

Compared to FY23, Cherat Cement reported a moderate 3% increase in net turnover, rising from Rs37.3 billion to Rs38.4 billion in FY24. This growth in sales was primarily driven by adjustments in cement prices on account of higher input costs. Furthermore, the cost of sales declined by 2%, largely due to the initiatives aimed at enhancing the operational efficiency by optimizing the coal and power mix. In addition, the financial cost for the year experienced a 28% reduction, declining from Rs1.9 billion to Rs1.3 billion. This decline was primarily attributed to the lower working capital requirements and scheduled payments of long-term loans during the period.

Cashflow Summary

The net cash generated from operations for the fiscal year 2024 reached Rs13.1 billion, reflecting an increase of Rs3.2 billion compared to 2023. This growth was mainly driven by enhanced profitability and inventory liquidation. To support ongoing operations and ensure business continuity, the company continued its strategic investment in capital projects, resulting in net cash used in investing activities amounting to Rs1.7 billion in FY24. Moreover, financing cashflows totalled Rs8.8 billion, marking an increase of 34% from Rs6.5 billion reported in FY23.

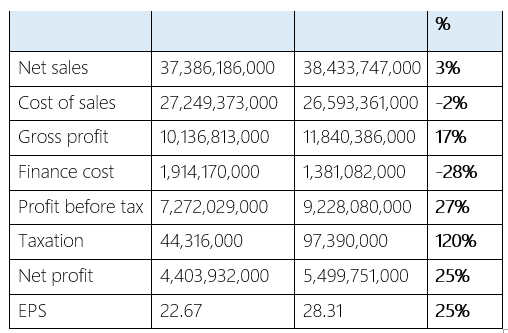

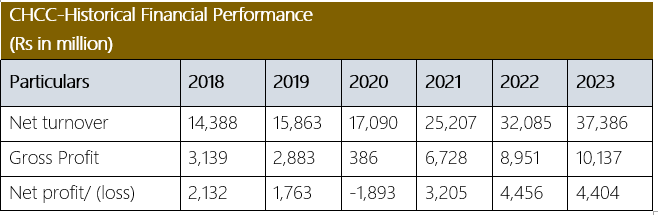

Performance over the last six years

Cherat Cement has experienced consistent topline growth since FY18, although profit margins declined until FY20 before rebounding in FY21.

In FY19, the company recorded a 10% increase in net turnover on account of a robust domestic and export demand as well as an expansion in the production capacity. Owing to higher production costs, the gross profit fell by 8% and net profit decreased by 17% during the year. In FY20, revenue growth reached 8%, with the top line surpassing Rs17 billion. Nonetheless, a decline in selling price and rising input cost resulted in a gross profit of Rs386 million. Additionally, the escalating finance expenses led to a loss of Rs1.8 billion for the year. FY21 marked a significant turnaround, with revenue rising by 47% due to increased demand following the announcement of a construction package and enhanced funding under the Public Sector Development Programme (PSDP). This increase in revenue translated into improved profitability, with the gross profit and net profit reaching Rs6.7 billion and Rs3.3 billion, respectively. In FY23, the company experienced a 17% rise in sales revenue. This growth was mainly due to the adjustments in the cement prices to counter the higher input costs. However, due to higher finance costs and taxes, the net profit dropped by 1% to Rs 4.4 billion for the year.

Company Profile

Cherat Cement Company Limited, which operates as a subsidiary of Ghulam Faruque Group, is one of the leading cement manufacturers in Pakistan, with a production capacity of 45,000 tonnes per day.

Credit: INP-WealthPk