INP-WealthPk

Qudsia Bano

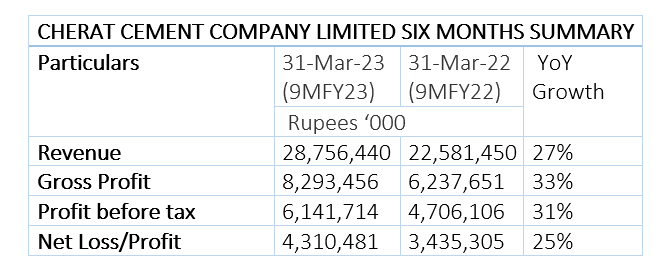

Cherat Cement Company Limited has released its nine-month summary for the period ending on March 31, 2023 (9MFY23), showing positive growth in revenue and profits compared to the same period of the previous year. According to the report available with WealthPK, the company's revenue increased 27% to Rs28.76 billion in 9MFY23 from Rs22.58 billion in 9MFY22. The gross profit also increased by 33% to Rs8.29 billion from Rs6.24 billion in the previous year.

Cherat Cement's profit-before-tax increased 31% to Rs6.14 billion in 9MFY23 from Rs4.71 billion in 9MFY22. The net profit increased 25% to Rs4.31 billion from Rs3.44 in 9MFY22. The company's management attributed the positive growth to the increase in demand for cement products in the market as well as the company's operational efficiency and cost management initiatives.

Cherat Cement Company Limited, which operates as a subsidiary of the Ghulam Faruque Group, is one of the leading cement manufacturers in Pakistan, with a production capacity of 4,500 tonnes per day. The company's stock is listed on the Pakistan Stock Exchange.

On April 27, the company’s Board of Directors approved the capital expenditure plan for the fiscal year ending June 30, 2023. According to a statement, the company plans to invest in various projects to improve its production capacity and efficiency. The board also announced the company's interim cash dividend of 15% or Rs1.50 per share for the ongoing financial year.

Third-quarter analysis of share price returns

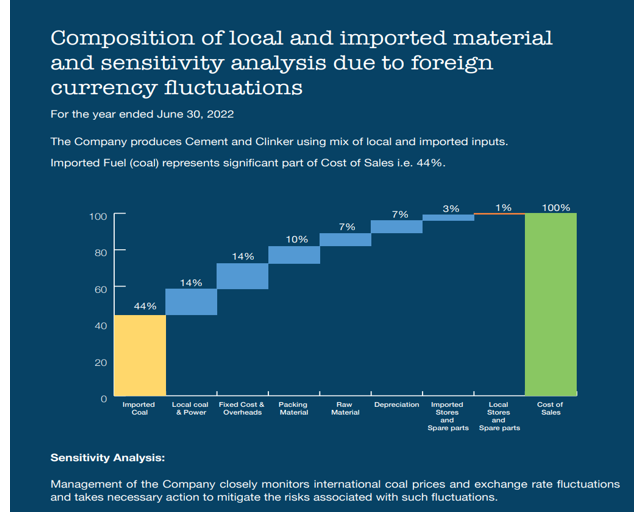

During the third quarter (January-March) of FY23, Cherat Cement’s share price saw an abnormal increase due to a corresponding rise in the company's revenues and earnings, primarily driven by an adjustment in cement prices. The adjustment was necessitated by a surge in fuel and electricity costs, resulting in a significant increase in production costs due to the steep rise in coal and electricity prices and the devaluation of the Pakistani rupee.

Imports and exports

The Ukraine crisis has resulted in a super-cycle of commodities that has driven up the cost of various fuels dramatically on a worldwide scale. The company's input costs have increased dramatically as a result. The unstable environment in neighbouring Afghanistan has caused a fall in the company's exports to its key markets.

However, the strategically located factory in Nowshera, which is near the Afghan border, as well as Cherat's strong brand recognition in Afghanistan have allowed the company to maintain its position as the country's leading cement exporter. The State Bank’s persistence with increasing the discount rate and import limitations in an effort to close the current account deficit have slowed down the economic activity. As a result, there is a trend toward decreasing local cement demand, which has had a negative impact on the company in 2022.

Introduction of new technology

In consultation with the IT steering committee, the board of directors has agreed to switch the company's on-premises SAP ERP solution to SAP S/4 HANA on the cloud. The company is currently going towards Success Factors on the cloud and SAP S/4 HANA.

Credit: Independent News Pakistan-WealthPk