INP-WealthPk

Ayesha Mudassar

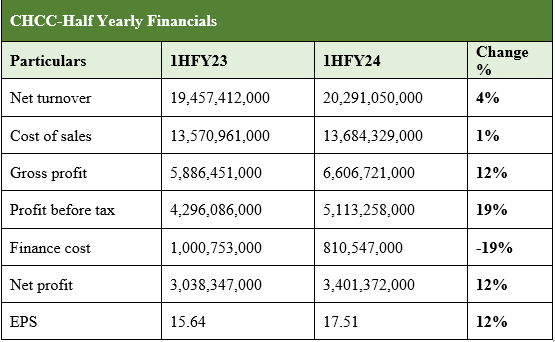

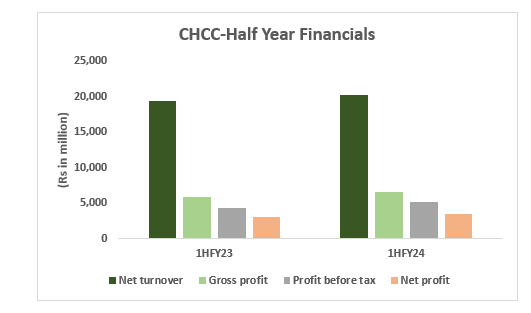

The net revenue of Cherat Cement Company Limited (CHCC) grew by 4%, gross profit by 12%, and net profit by 12% in the first half (July-December) of the ongoing fiscal year 2023 (1HFY24), compared to the corresponding period of the previous year, reports WealthPK. As per the Consolidated Interim Statement, the company posted revenue of Rs 20.2 billion and gross profit of Rs 6.6 billion in 1HFY24. The net profit stood at Rs 3.4 billion compared to Rs 3.0 billion in the corresponding period last year, resulting in an Earning per Share (EPS) of Rs 17.51 versus Rs 15.64 in the same period the previous year.

In comparison to 1HFY23, the company increased net turnover by 4% from Rs 19.4 billion to Rs 20.2 billion in 1HFY24. The improved sales were mainly due to upward adjustment in cement prices on account of higher input costs. Furthermore, the company's exports to Afghanistan enhanced during the period under review. Moreover, the cost of sales increased by 1%, which is mainly attributable to higher fuel, power, and packing material costs. However, the financial costs for the period experienced a 19% reduction, declining from Rs 1 billion to Rs 811 million. This was primarily due to lowering working capital requirements with better inventory management and principal repayment of long-term loans.

Six Years at a Glance

- Historical Operational Performance

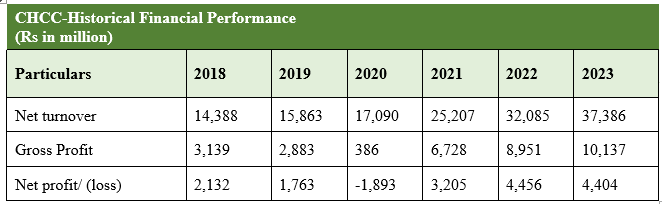

Cherat Cement has consistently witnessed a growing topline since FY18. However, the profit margins declined until FY20, then improved again in FY21.

During FY19, the company witnessed a rise of 10% in its net turnover on account of strong domestic and export demand as well as an increased production capacity during the year. Owing to the higher cost of production, the gross profit fell by 8%. Moreover, the net profit of CHCC plunged by 17% to clock in at Rs 1.7 billion. In FY20, revenue growth stood at 8% for the year, with a topline crossing Rs 17 billion. Due to a decline in selling price and a rise in input cost, the gross profit fell to Rs 386 million. With finance expenses growing massively, the company lost Rs 1.9 billion. During FY21, the company experienced the biggest rise in revenue by 47%.

This was on the back of a rise in demand that was largely due to the announcement of the construction package and greater allocation of funds under the Public Sector Development Programme (PSDP). The higher revenue led to greater profitability, as gross profit and net profit were recorded at Rs 6.7 and 3.3 billion, respectively. There has been a 17% rise in sales revenue in FY23. This increase was mainly due to adjustments in cement prices to counter higher input costs. Furthermore, increased finance cost and taxation provision led to a 1% decline in net profit which clocked in at Rs 4.4 billion for the year ended June 30, 2023.

- Historical Ratios (Profitability and Liquidity)

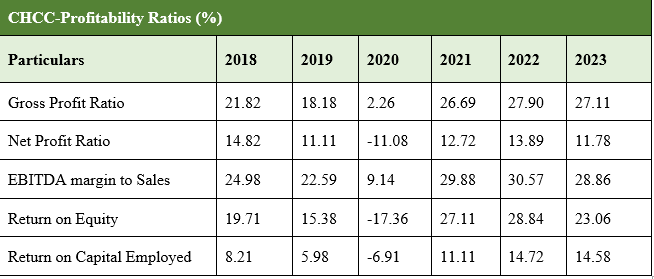

Profitability ratios provide insights into a company's ability to generate profits relative to its revenue, assets, equity, or other financial metrics. The company witnessed fluctuations in its net profit margin over the six years. In FY23, the net profit margin was 27.11% compared to the previous year's margin of 27.90%, which indicates a decrease in the company's revenue.

Similar to the net profit margin, the trend for EBITDA to sales shows fluctuations over the years, with a noticeable dip in 2020. During the years under consideration, both ROE and ROCE ratios decreased in the first three years, followed by an increase in 2021 and 2022, and then a slight decline in 2023. Liquidity ratios provide insights into a company's ability to meet its short-term obligations using its current assets. The current ratio has been declining over the years, from 1.72 in 2018 to 1.21 in 2023. A decrease in this ratio might indicate potential liquidity issues or inefficient use of assets to generate revenue.

Similar to the current ratio, the quick ratio has been declining over the years, illustrating a potential decrease in the company's ability to meet its short-term obligations with its most liquid assets. Furthermore, the cash-to-current liabilities ratio provides a specific insight into the company's ability to pay off its short-term liabilities using only its cash reserves. The trend shows fluctuations, but there is a significant decrease from 2020 to 2023, which demonstrates challenges in maintaining sufficient cash reserves to cover short-term obligations.

Company Description

Cherat Cement Company Limited, which operates as a subsidiary of the Ghulam Faruque Group, is one of the leading cement manufacturers in Pakistan, with a production capacity of 45,000 tonnes per day.

Credit: INP-WealthPk