INP-WealthPk

Ayesha Mudassar

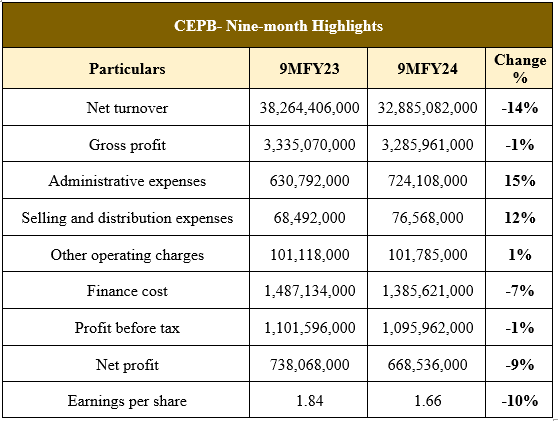

The Century Paper and Board Mills Limited (CEPB)’s earnings declined around 9% during the nine months ended March 31, 2024. The company reported a profit of Rs 668.5 million compared to Rs 738.06 million over the corresponding period of last fiscal year, reports WealthPk.

The company’s topline declined by 14% year-on-year (YoY) to Rs 32.8 billion compared to Rs 38.2 billion in 9MFY23. Driven by this sales reduction, the gross profit decreased by 1% YoY to Rs 3.2 billion in 9MFY24. High inflation has restrained the purchasing power of consumers, putting a dent in the demand for paper and paperboard products. Furthermore, the global recession has lowered the prices of similar products in the international market, which is encouraging local companies to import packaging material.On the expense side, the company observed a rise in administrative expenses by 15% YoY and selling &distribution expenses by 12% YoY to clock in at Rs 724.1 million and Rs 76.5 million, respectively, during the review period. In addition, other operating charges of CEPB increased by merely 1% YoY to 101.7 million. The company’s finance cost declined by 7% YoY and stood at Rs 1.3 billion compared to Rs 1.4 billion in 9MFY24.

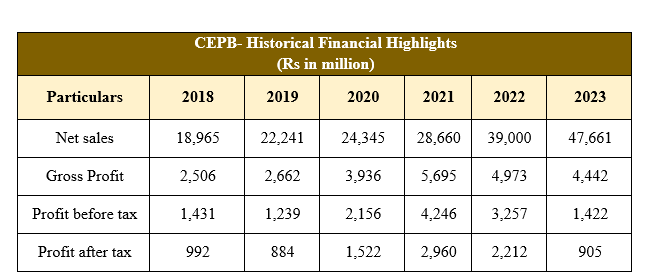

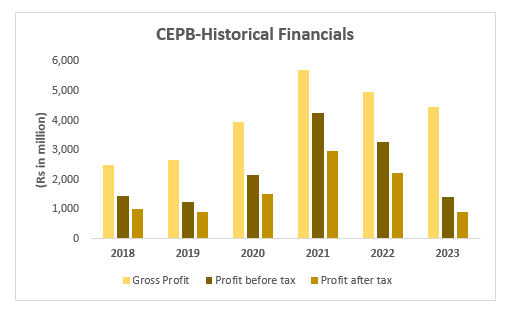

Historical Performance (2018-23)

The CEPB’s topline has been posting steady growth over the years; however, its bottom line slid thrice- in 2019, 2022, and 2023. In 2019, CEPB's topline grew by 17% on the back of improved prices, a better sales mix coupled with increased sales volume. The cost of sales grew by 19% year-on-year (YoY) in 2019 due to rupee depreciation and fuel price hikes. Moreover, the gross profit ticked up by 6% YoY in 2019. Higher debt coupled with monetary tightening culminated in a higher financial cost for the year and pushed down the bottom line by 11% YoY to clock in at Rs 884 million in 2019. During 2020, the company witnessed a marginal 9% YoY growth in its top line. Due to an improved sales mix and better prices, the gross profit posted an encouraging growth of 48% YoY.

The bottom line grew by 72% YoY in 2020 to clock in at Rs 1,522 million. The company’s EPS also grew to Rs 10.35 in the year. In 2021, the net sales magnified by 18% YoY on the back of an 8% YoY rise in sales volume. Consumers started focusing on packaged products and online shopping after COVID-19, thus increasing the demand for packaging products in 2021. The gross profit grew by 45% YoY in 2021 due to operational efficiency, optimal sourcing of raw materials, and low fuel cost. The finance costs shrank by 59% YoY in 2021 on the back of a low discount rate. The bottom line posted a stunning 94% YoY growth to clock in at Rs 2,960 million.

The year 2022 brought 36% YoY growth in CEPB's topline due to impressive growth posted by LSM which created demand for paper and paperboard products. However, high commodity prices due to commodity super cycle, Pak Rupee depreciation, and indigenous inflation jacked the cost of sales up by 48% YoY. This trimmed down the gross profit by 13% YoY in 2022. Furthermore, the net profit dropped by 25% in the year to clock in at Rs 2,212 million. During 2023, the CEPB's topline posted a 22% YoY growth. Elevated material and fuel costs led to a 27% rise in the cost of sales compared to the previous year. The company witnessed an 11% and 59% decline in gross and net profit, respectively.

Company Profile

The company uses the symbol of CEPB on the Pakistan Stock Exchange and is listed in the paper and board sector. With a market capitalization of Rs 11.8 billion, CEPB is the second largest firm in the paper and board sector. It was incorporated as a public limited company in 1984 and is primarily engaged in the manufacture and sale of paper.

Near-term Outlook

The prevailing local and global economic conditions have put a dent in the demand and supply of paper and paperboard products. However, CEPB is planning to tap the export market beyond Afghanistan to attain higher sales volume. Furthermore, the company also focuses on providing high-yielding products to improve margins and profitability.

Credit: INP-WealthPk